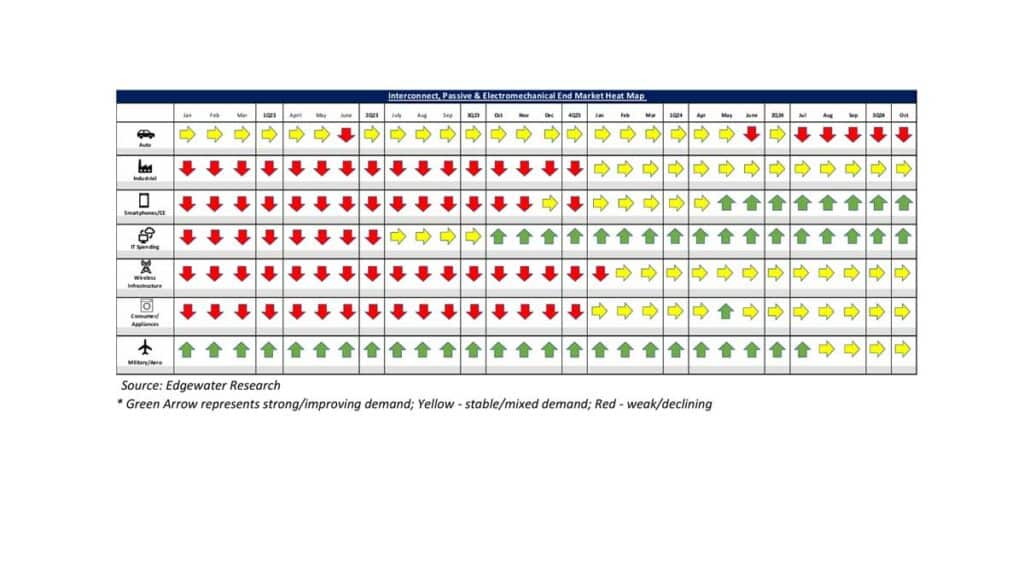

November 2024 collection of news summaries, survey results, and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

IT Outlook Suggests Further Upside, Other Markets Still Muted into 1H25

What’s Changed/What’s New?

1. Aggregate order trends viewed as remaining mixed with B2B hovering around 1 depending on supplier, end market mix. 4Q demand seen tracking in-line; aggregate 1Q outlook is mixed with strength in IT datacom, offset by sub-seasonality tied to Europe weakness.

2. 2025 IT datacom outlooks trending stronger, forecasting +40% growth on improved visibility, CSP demand despite marginal delays for some projects. 4Q24 and 1Q25 each projected up HSD/LDD Q/Q on initial ramp of new programs (NVL/CSP).

3. Industrial demand viewed as little changed, projected to hover along the bottom through 1H with continued digestion in some markets and regions (Europe), offset by stable demand in Asia and pockets of improving visibility via backlog orders in N.A.

4. Auto demand softness seen persisting through 1Q on further production cuts in the West and increasing new program delays.

Top 3 Channel Comments:

• Nvidia is testing with adding retimers to the PCB in order to overcome the PCB’s insertion loss and improve the signal integrity which could allow them to move to a PCB backplane in Rubin from cabled-one in Blackwell.

• The most visibility on Industrial we get is 5-8 weeks. China demand is stable or growing slightly but the West is still challenged. Rockwell continues to say that it has 6 months of inventory to work through. Rockwell has been telling us that for more than a year.

• We’ve begun engaging with customers about potential backlog orders for 2025. While no firm orders have materialized yet, the fact that these discussions are happening is a change and a signal that customer inventory levels are stabilizing.

Other Key Takeaways:

5. 2025 Auto production forecasted down LSD-MSD in Europe and flattish in N.A, implying muted connector demand for the year.

6. China Auto still strong with YE ramp-up driving 4Q strength. 2025 demand projected up, though EV mix seen shifting to PHEV from BEVs.

7. 2025 Nvidia NVL units forecast still 50-65K, with connector suppliers planning around the lower end. NVL mix unclear, though directionally shifting to NVL72. NVL connector/cable still projected to ramp-up in 1Q with high-volume shipments in 2Q.

8. Connector/cable content on Rubin still TBD. Nvidia seen testing PCB-based backplanes with more retimers as potential replacement of the cabled one. Backplane connectors expected to upgrade to 448G, potentially initially priced 25-30% above Blackwell’s 224G.

9. Mil/Aero reads mixed for a 2nd month with feedback of flattening backlogs underpinning 2025 outlook of LSD-MSD growth.

10. Green shoots still seen in connector orders from distis on normalized inventory; replenishment still muted on lack of POS recovery.

Conclusion:

IP&E fundamentals continue to bifurcate, with near-term upside in IT Datacom on AI strength and continuation of muted trends across the broader market. The outlook for 2025 remains robust for IT Datacom, with forecasts being raised to 40% new platform introductions and CSP demand. Outside of IT Datacom, the pace of the recovery remains unclear for 2025. The Industrial markets continue to work through stubbornly high inventory, with inventory likely to remain a headwind through early 2025. The Automotive outlook is more muted, with inventory levels still elevated and continued moderation in end demand outlook, in particular in the West. In aggregate, IP&E fundamentals have clearly bottomed in 2024, but the near-term outlook is mixed by end market supporting our mid-single digit Y/Y growth estimate for the industry in 2025.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research