source: ECN article

by Markus Bilger, Viavi Solutions. There’s no doubt that technology innovation is disrupting the automotive industry. The concept of turning your car into a robot that provides you with ultimate convenience on the road, while dramatically improving safety, is appealing and exciting. As cars become more automated, they also provide opportunities for a variety of companies to access a range of untapped data, creating new revenue-generating opportunities.

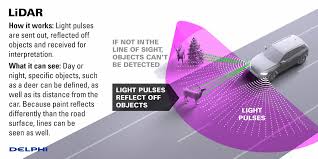

The merging of LIDAR (Light Detection and Ranging) technology into a specialized sensor suite within autonomous vehicles (AVs) promises to make cars more intelligent. LIDAR has already proven its accuracy and reliability across several hundreds of thousands of implementations in consumer electronics applications for 3D depth sensing over the past several years.

Reality Check: It’s a Complex Transition!

AVs of the future will be a significant driver of LIDAR over the long term. But the day when we are all whizzing around in AVs, whether it be through private ownership or a variety of transportation-as-a-service (TaaS) offerings, is still a long way out.

Five levels have been established on the path to AVs, with Level 1 including basic driver-assist systems already offered today, such as automatic steering or accelerating. Level 5 represents full autonomy – imagine no longer needing a steering wheel because the car performs like a human driver.

Most car makers and their tier 1 suppliers are focused on achieving Level 4 capabilities, where cars can be fully autonomous in most situations. Estimates vary on when this will happen, some say starting in 2020, others believe there will be more significant pickup by 2030.

Lots of technology advances and regulatory, infrastructure and behavioral changes will be needed before widespread adoption can take place. It’s an incredibly complex transition and cars will need to process decisions exactly the way humans do (including both rational and irrational behavior) for full autonomy.

LIDAR for Active Driver Safety Systems

The transition to AVs will be a gradual one, first with the implementation of more active safety systems that hand more authority to the car over time. These systems will also drive LIDAR innovation and adoption in the near term.

The European New Car Assessment Programme (Euro NCAP) is driving a lot of the changes to make car systems safer. Tier 1 auto suppliers have definite timelines in place to introduce LIDAR as part of this program over the next several years.

These safety applications will primarily use shorter distance LIDAR to enable cars to recognize a pedestrian or cyclist, ranging from about 10 – 50 meters away. In high risk situations, the car’s system will prompt the driver to take action or will automatically make the car brake to avoid a potential accident.

Two LIDAR units on the front sides of the car will analyze objects across a 360-degree view. They could be physically integrated into a fender design or into car headlights as LIDAR applications become smaller in size for better aesthetics.

There will also be more in-cabin innovation using LIDAR. Sensors will look at your physical location and adjust your airbag as necessary, based on how far you sit behind the wheel. The same goes for seatbelt tightness.

The Transition to Autonomous Vehicles

Over time, developmental phases of AVs will become a significant driver of LIDAR innovation. Contrary to many headlines about startups and tech companies spearheading the AV revolution, traditional automakers and their tier 1 suppliers are driving most of the transition to AVs. Recent data from Navigant Research shows many of these players in the “Leader” and “Contender” quadrants.

What makes it so tough for new entrants? Every traditional tier 1 supplier working on AV is already embedded in an intricate supply chain that has strict requirements. Traditional players don’t want to end up in a court room defending why they didn’t use a particular approach that could have prevented an accident or fatality. Tech companies and startups aren’t in the business of building cars, where safety remains a bigger priority over innovation.

Criteria for Joining the Inner Circle of Tier 1 Automotive Suppliers

Four major requirements are essential for becoming a key vendor to tier 1 suppliers:

- History of proven, robust technology. Since active passenger safety systems and AVs are new, tier 1 suppliers are looking for a proven track record of technology based on its success in other markets.

- Staying power and credibility as a supplier. Tier 1 suppliers want other vendors to guarantee they can be a key supplier for 10 years into the future.

- High volume manufacturing that consistently meets stringent quality standards. Car systems require “six nines,” or 99.9999 percent reliability, for driver and passenger safety.

- Multiple production sites for redundancy. Having multiple sites across different regions is something most startups can’t offer.

In terms of LIDAR systems, there are very few vendors who meet the criteria. It’s all about meeting stringent quality requirements, proven deployments and technology expertise that spans over several decades across other markets.

Because some startups and tech companies don’t have these capabilities and haven’t established proven reputations with automakers, they are willing to take bigger risks and

partner with less credible suppliers. While mass-producing cars isn’t in their DNA, automakers are likely to continue engaging in partnerships or acquiring some of the companies that are complimentary to their AV strategy.

Sensor Suite at the Heart of AV Decision Centers

For AVs to intelligently sense the environment around them, LIDAR systems will be combined via sensor data fusion with a suite of complimentary technology that also include RADAR (Radio Detection and Ranging) and cameras. Each technology offers particular performance benefits to ensure safety, helping cars make well-informed decisions on the path to full autonomy:

- LIDAR – Provides depth resolution across 360 degrees and can work at both short and very long ranges (10M – 300M) in both light and dark. However, it has some challenges in rain and fog.

- RADAR – Can see well in different types of weather but only across a narrow field of view.

- Cameras – Can see color and spatial resolution, interpreting important contextual information like the human eye, but have difficulty seeing in the dark.

Current designs for this sensor suite are bulky and unattractive, sitting on top of the car for access to a 360-degree view. The trunks of these cars are also filled with computers and aren’t practical for everyday use. As adoption and volume drive down costs, the size of the sensor suite will also be reduced to the equivalent of a computer mouse. At that point, smaller sensor suites can be more elegantly integrated into the four corners of a car. More subtle car designs will be essential for personal ownership or “first class” levels of TaaS.

Unfolding of the AV Evolution

Higher levels of AV adoption could initially take place in areas where the cost burden isn’t placed on individual owners. AV costs will decline over time as volumes go up and technology price tags go down, while maintaining the same level of performance:

- Ride Sharing. Privately-owned cars are currently used only about 4 percent of the time. AVs that offer TaaS could increase car use to 50 percent. This will save valuable real estate in parking lots, reduce environmental pollution and improve safety. Ride sharing companies and taxis could offer tiered levels of AV services to passengers.

- Trucking. Because trucking companies no longer need to pay drivers for AVs, they could invest that budget into AV technology. AVs will also increase utilization of trucks for more revenue.

- Individual Ownership. There could be some individual ownership of AVs by early adopters that can afford to pay the premium.

From a regional perspective, there are likely to be different adoption models across various geographies and urban areas. First deployments could happen on tech campuses in the West. Perhaps cities in Asia, where crowding and environmental pressures are high, could mandate use of electric and autonomous ride-sharing vehicles. Down the road, smart lanes could be implemented in urban areas specifically designed for AV use, separate from active driver lanes.

Pros and Cons of AVs

Once all sensor data can be integrated in a meaningful manner, cars will turn into supercomputers that open up a new world of opportunities. A few of the positives include:

- Dynamic mapping. Enormous amounts of mapping data fed to the cloud from AVs will constantly update digital mapping applications, helping to reflect immediate changes in the environment, such as construction blockages. This will ease congestion along affected routes.

- Easier insurance litigation. Insurance companies could know exactly where a car is located and what it did at any given point and time to quickly resolve disputes.

- Personalized/direct advertising. Brands could promote nearby products and services to you along your route.

At the same time, data security and privacy, job displacement and the future viability of automotive business models are major issues that will need to be addressed throughout the transition.

Whatever advances occur over the next several years, LIDAR technology will continue to play a critical role in the AV evolution. As an essential element to the highly-sophisticated sensor suite in AVs, it will facilitate the AV’s ability to adapt under a variety of circumstances on the quest to perform at human driver levels.

featured image source: Delphi