ECIA’s Electronic Component Sales Trend Sentiment (ECST) for August 2023 sustains improving trend; Q4 outlook sets stage for Q1 2024 growth.

The August sales sentiment for overall electronic component markets improved by 7.3 points over July to reach 90.3. This continues a trend of improving results that began in June. The outlook for September calls for the index to maintain this upward trend reaching 94.9. Even though these scores are below the threshold of 100 that divides growing from declining sales sentiment, they are the best scores since February 2023 and an increase of 22.5 points from May 2023.

The sentiment score for August came in 4.4 points below expectations from the July survey. Electro-Mechanical / Connector results failed to meet the lofty expectations for August and improved only slightly over the July score. On the other hand, Semiconductors beat expectations by 6.8 points. Improving scores are seen in all three component categories between July and August.

Passive Components and Electro-Mechanical / Connector Components both report expectations of continued strong improvement in September reaching 95.5 and 93.2, respectively. Semiconductor expectations for September remain essentially flat at 95.7, the best of all three. Hopefully, if the industry can sustain recent improvements, it is possible that sales sentiment for all categories could top 100 sometime in Q4 which would signal the potential for return to broad-based growth at the beginning of 2024.

A significant gap in reported sales sentiment between manufacturers and manufacturer representatives has continued. Product sales sentiment of manufacturers has come in between 8.1 and 9.9 points higher than the overall average between July and September. On the opposite end, manufacturer representative scores are between 8.0 and 16.2 points below the overall average. This difference emerged in April. While distributor scores are relatively close to the overall average, the difference in sentiment reveals a highly divergent view of the world with Manufacturers much more positive compared to the others. This renewed divergence in outlook is a possible indicator that the distribution channel is still resolving inventory imbalances while manufacturers benefit from direct sales that are more in line with end market demand.

The overall end-market index was relatively stable between May and August. The outlook for the market index predicted a major jump of 15.2 points for August in the July survey. This did not materialize in August results. Now the jump has been pushed out to September with a leap of 16.5 points predicted. Hope springs eternal!! This optimistic outlook is seen across all end markets with every market reporting improving sales sentiment looking toward September. The biggest improvements are expected in Consumer, Industrial, Medical, and Compute Electronics. Avionics/Military/Space, Medical, Automotive, and Industrial Electronics are all predicted to cross above the 100 threshold in September.

The results reported in the Quarterly ECST survey support movement toward a stage where renewed quarter-to-quarter growth can begin in early 2024. Reported sentiment for balanced sales between Q2 and Q3 was 44%. Declining sales sentiment was 16 points higher than improving sentiment in this same time.

In the Q4 outlook, improving and declining sentiment are nearly equal with improving sentiment only 2 points below declining sentiment. This is a push out of a quarter for improved sales sentiment from the Q2 survey. Sales sentiment equilibrium is now expected in Q4. Let’s hope this expectation becomes a reality!

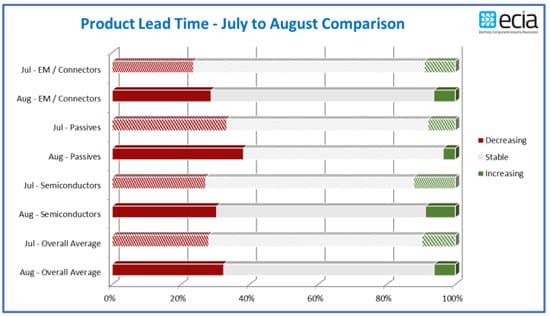

Strong improvement in lead times was reported in the August survey. Every category saw a notable jump in reports of declining lead times with corresponding reports of reductions in increasing lead times. Only Memory ICs and Analog/Linear ICs reported overall increases in lead times while Connector lead times were mainly stable. These reports of an improving lead time environment are encouraging as the industry continues to work out excess inventory in the channel.