Optimism in the electronics market is surging, according to ECIA, bolstering data from a national manufacturing index that reached a 37-year high in March.

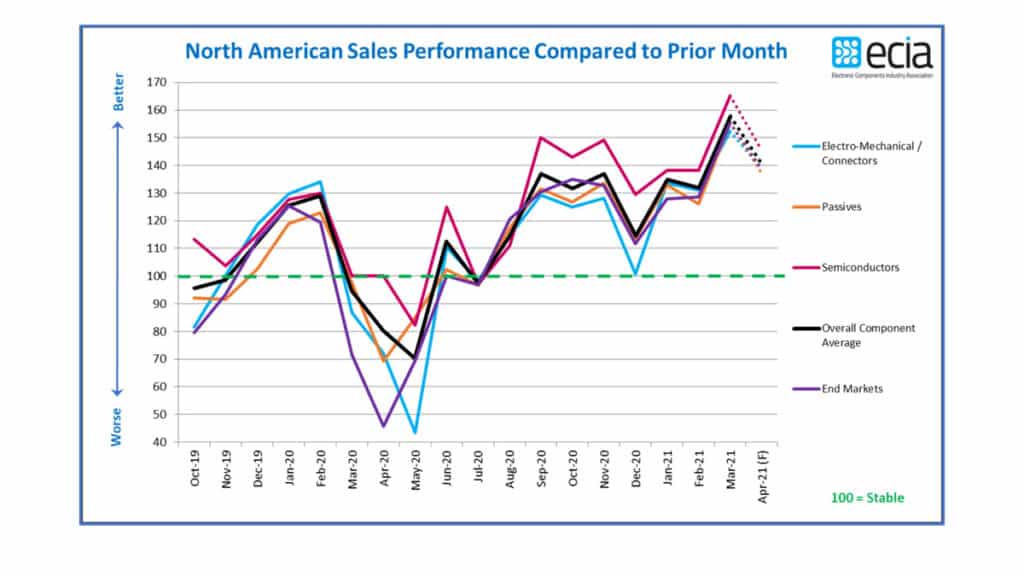

The ECIA’s Electronic Component Sales Trend (ECST) monthly survey, which assesses month-to-month sales growth sentiment, leapt up between 26 and 27 points in component and end-market measures from February to March.

The overall component average soared to 158 points in March compared to 132 points in February. This market performance far outpaces the expectations looking toward March from February and continues a strong surge in the index that started in January, according to the association.

“The ECST index reflects the incredible market strength as it is propelled by multiple powerful forces,” said the report. “First, the market continues to exhibit cyclical behavior and the upward trend in the cycle that started in late Q3 of 2019 actually overcame the negative effects of the pandemic in the quarter-over-quarter and annual revenue growth. On top of this, pent-up demand has been unleashed in a market that was reshaped and redefined by the changes in social and purchasing behavior due to the pandemic. Finally, new technologies are gaining traction in this re-energized market and stimulating strong levels of excitement for adopting and accessing products built on the foundation of these new technologies.”

The ECIA also notes a number of headwinds, which the Institute for Supply Management outlined in its March PMI report. Manufacturing capacity has been unable to keep up with demand as illustrated by a semiconductor shortage which began in January. An unexpectedly strong Q4 uptick in automotive and consumer electronics demand has strained MPU and MCU supplies. Fab capacity for the foreseeable future has already been booked, which has largely left automotive manufacturers bereft of the chips they need.

“When you have most markets increasing for various reasons, that is when problems arise, especially when you have factories whose capacities – they are saying they are at 100 percent – in some instances are working with Covid restrictions and social distancing between employees and factory workers on the line itself,” said Graham Maggs, vice president, EMEA marketing, for Mouser Electronics. “The industry is seeing one of the largest challenges in the 45-50 years I have been around in electronics and education. I expect we will see, for the rest of the year, a number of challenges.”

Supply chain and employment restraints also continue to dog manufacturing. Port congestion, weather-related factory shutdowns and high employee turnover are challenging production. Scarce supplies are also raising prices.

“As participants in the electronics component supply chain know all too well, the jump in product demand has far outpaced the surge capacity of the supply base,” said ECIA. “As a result, lead times have extended to such a degree that many companies are struggling to access adequate and timely supply to support demand from their customers. This effect is amplified by the bullwhip effect as increased demand in the end market is amplified up the supply chain as companies work to restock inventory and prepare for future growth.”

ISM reported March backlog hit record-tying highs and customer inventory reach a record-tying low, positive indicators for future production. Demand, said ISM survey chair Tim Fiore, would have challenged manufacturers under any circumstances. Electronics was one of four market sectors leading March’s surging PMI.

The U.S. PMI hit 64.7 percent in March, an increase of 3.9 percentage points from February’s reading of 60.8 percent. New orders – a leading indicator of demand – reached 68 percent, up 3.2 percent from the prior month. Of the 18 manufacturing industries polled by ISM, 17 reported growth in March, led by textiles, electrical equipment, machinery and electronics products.

ISM manufacturing panelists in March expressed eight positive comments for every cautious comment, compared to a 5-to-1 ratio in February.

Any number above 50 indicates expansion; any number below 50 indicates contraction.

The ECST survey also measures the increase in lead times which validates other lead time measures published by ECIA. There is strong upward lead time pressure which is also manifest in strong increasing price pressure. The ISM listed electronic components as in short supply and increasing in price in its March report.

“Late-winter storms in unexpected [areas] of the U.S. had our organization exercising business-continuity plans on a much more aggressive scale than anticipated,” an electronics executive told the ISM. “While the storms slowed our supply chain down, we did what we could to meet orders, even though few were short.”