Electronic component sales expectations for March and April 2022 have softened compared with previous months, according to the ECIA, as global economic concerns and inflationary pressures increase.

Actual overall sales sentiment for March fell by nearly 16 points from the February measure to come in at 113.6. The declining trend in expectations continues in the April outlook as the index falls another 7.1 points to 106.5. While still reflecting expectations for positive market growth these are measurements that are in the same weaker range as the index reports for September through January.

It appears that the February reading was only a temporary surge in optimism. The good news is that the index is still positive – but just barely.

Hopefully, the electronic component markets can overcome the headwinds they are facing and continue to exhibit resilience and relative stability in an unstable environment.

Sentiment across all major component categories moved in the same direction and by a similar magnitude in March. The Electro-Mechanical components index only drops by a point in April compared to much stronger drops in the other categories. As a result, the Electro-Mechanical index outlook for April comes in strongest at over 111.

Passive components come in at the lowest of the categories in April at slightly above 102. The decline in the index was seen in every subcategory for both March and April. Following a strong jump in February, Inductors suffered the most significant slump in March followed by Connectors and Capacitors.

Still, on the bright side none of the component subcategories dropped below 100 – the threshold been assessment/expectation of growth or decline. The overall end-market index moves in the same general direction as the component index for March and April. However, there are significant differences in strength among individual market segments.

Computers continued to measure below 100 in March and was joined by Consumer Electronics and Telecom Mobile Phones in the sub-100 group for March. While Computers and Consumer Electronics recover above 100 in April, Mobile Phones continues in its slump registering the lowest mark among all market segments at just above 80. The overall index measures for components and end-markets are in close alignment in their index scores for March and April at 111.8 to 113. 6 in March 106.8 to 106.5 respectively in April.

Looking at the bright side, the component sales sentiment in the index has shown its relative strength as it has now registered above 100 for 20 straight months dating back to August 2020. In the March assessment a major gap opened up between the Distributor assessment and the views of the Manufacturers and Manufacturer Representatives. Among component subcategories the Distributor index ranges between 123 and 160 for March as it improved substantially from the February assessment.

Both Manufacturers and Manufacturer Representatives saw dramatic drops in the March assessment compared to February. While all Manufacturer assessments of component subcategories sustained at 100 or above in March, Manufacturer Representatives only rated three categories at 100 and one category above 100. This is a major divergence in views between these groups compared to a much more uniform perspective in February.

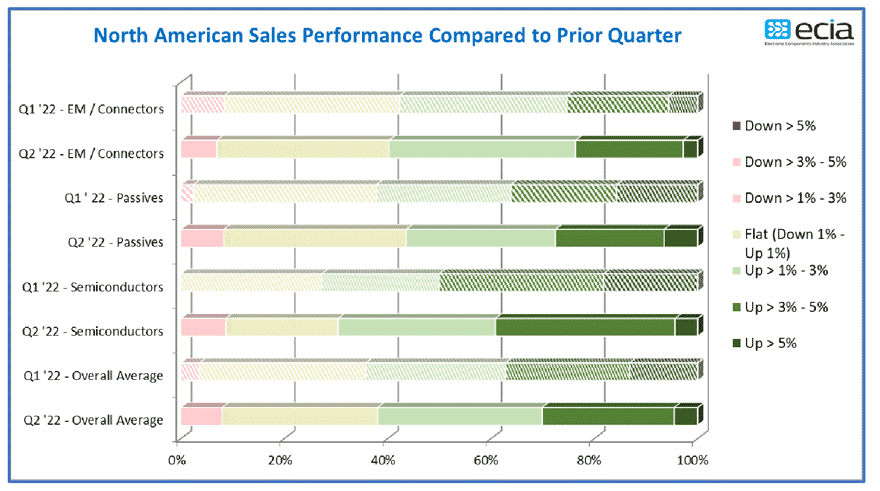

Certainly, there are many impacts being felt ranging from the war on Ukraine by Russia to the continued upward trend in the inflation measurements. It appears that many respondents in the most recent index were feeling the pressure of these forces. The results of the Quarterly ECST were presented last month and are shared again in the report for this month. This index presents a strong positive picture for both Q1 and Q2 2022. The overall average of the total number of respondents expecting growth in Q1 2022 is 64% and only dips slightly to 62% in Q2.

However, the mix of expectations for growth in the different tiers shows a shift to lower growth expectations in Q2 compared to Q1. Bottom line is that there is solid expectation for growth through the first half of 2022 with growth slowing in the later months. Once again, Semiconductors measure the highest level of optimism with at least 70% expecting growth in both Q1 and Q2.

In a continuation of the pattern from prior months, the March survey shows Mobile Phones, Computers, and Consumer Electronics all registered weak sales sentiment scores of less than 100 in March. While Computers and Consumer Electronics recover above 100 in the April outlook, Mobile Phones continue their slump in both March and April at slightly above 80.

While softness in these areas early in the year reflects a typical seasonal pattern for these markets it is concerning that Mobile Phones comes in so

low. Avionics/Military/Aerospace was the bright spot in both months among end-markets reaching nearly 129. Other markets – Automotive Electronics, Industrial Electronics, Medical Electronics, and Telecom Networks come in between 112 and 120 in March and April.

Concerns related to the economy continue to grow as inflationary pressures continue to increase and consumer confidence takes a strong hit. The talk of shortages in even the food supply with potential famine in some areas of the world opens up a much greater level of concern about global health – not just economically but physically and emotionally.

These forces weigh heavily and will be difficult to overcome. While recognized sales for 2022 should be solid with order books full, it will be important to keep an eye on orders in the longer term. With no end in sight to elevated supply chain challenges, manufacturers and retailers continue to face an extremely risky and uncertain future. Common projections for resolving the major supply chain challenges still stretch out into early to mid-2023.

Unfortunately, the latest ECST survey results see another jump in increased lead time expectations in March following a February increase. The jump in lead time pressure for Semiconductors and Electro-Mechanical/Connectors is much greater. After a brief glimmer of hope in prior surveys, it appears lead time challenges will continue to confront the supply chain for the foreseeable future.