This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides a quick update on capacitor lead-times in October 2025.

Current Status of Capacitor Lead Times

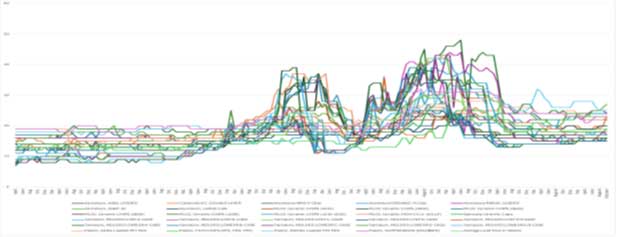

If you are procuring capacitors in 2025, you are facing one of the toughest situations in the history of the electronics industry. The average lead time across all capacitor technologies has reached 19.07 weeks (October 2025), marking a 46% increase compared to the pre-pandemic era.

Overview by Dielectric

- Most active trends: Aluminum electrolytic and plastic film capacitors.

- Stable segments: Tantalum capacitors and ceramic MLCC.

| Metric | October 2025 | Pre-pandemic (2012–2019) | Change |

|---|---|---|---|

| Average lead time | 19 weeks | 13 weeks | +46% |

Lead Time Severity Breakdown

- Most distressed (25–27 weeks):

- Aluminum Snap-In: 27 weeks (rapid rise)

- Plastic PET radial: 25 weeks (consistent)

- High activity (20–24 weeks):

- Al SMD V-Chip: 24 weeks

- Al Organic H-Chip: 23 weeks

- Film chips (PEN, PET, PPS): 23 weeks

- Plastic snubber (X/Y): 23 weeks

- Al axial: 22 weeks

- Al radial: 22 weeks

- Higher, but manageable (<20 weeks):

- All MLCC sizes: 15–17 weeks

- All tantalum sizes: 15–17 weeks

Key Factors Affecting Lead Times

- Artificial Intelligence & Data Centers:

Every AI server uses 5,000–10,000 MLCC and 300–600 aluminum polymer capacitors. Hyperscale data centers (AWS, Azure, Google) drive demand. - Electric Vehicle Revolution:

EVs use 10,000–22,000 capacitors versus 2,000–3,000 in standard vehicles. EV production: 18M units in 2025, projected 45M units by 2030. - Renewable Energy:

Growth in solar and wind installations (annual growth 20–30%). EV charging stations contain capacitors worth $400–800 per station. - Industrialization & Electrification:

Motors, automation, robotics, electric drives are replacing hydraulics. Demand for film and MLCC capacitors is rising.

Why Manufacturing Capacity Is Insufficient

- Long investment cycles: New MLCC/tantalum factory needs 18–36 months from decision to production.

- Technological barriers: Advanced capacitors (polymer aluminum, high-CV MLCC, low-ESR tantalum) are limited to few manufacturers.

- Raw material constraints: Tantalum: legislation/conflict minerals; MLCC ceramics: rare elements; aluminum/plastics: new market requirements.

Outlook for 2026–2027 (Paumanok Base Case, 50% probability)

- AI/HPC and EV demand will continue to grow.

- Added manufacturing capacity will be deployed in 2026–2027.

- Lead times are expected to stabilize at around 19 weeks (Q4 2025 – Q2 2026), rising slightly to 20 weeks in Q4 2026, up to 22 weeks by 2027.

- Lead times will remain 45–50% above pre-pandemic levels through 2027.

Source: Paumanok Publications, Inc., TTI, Inc., Dennis M. Zogbi