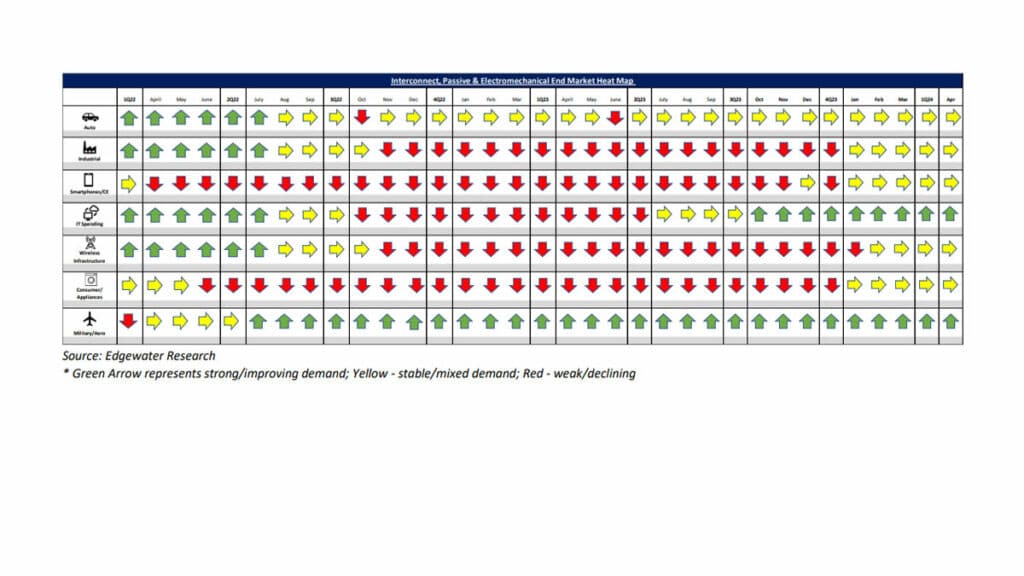

May 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

2Q Demand Signals Still Mixed by Improving, 2H Outlook Better on AI/Military, Broader Visibility Remains Elusive

What’s Changed/What’s New?

1. 2Q demand reads mixed QTD with incremental strength in AI, Mil/Aero, stable Auto, and mixed Industrial. Sell-through trend seen upticking in N.A., but down ticking vs. expectations in Europe and Asia. Overall 2Q shipments seen tracking in-line.

2. Aggregate orders seen upticking M/M though the trend still mixed by geo and end market; feedback of B2Bs returning to 1 also up M/M. Green shoots in orders consistent M/M, primarily in N.A. distribution implying disti/Industrial destocking in late innings.

3. CY24 AI outlook again revised higher to >3x increase Y/Y on growing expedite requests and stronger 2H forecasts.

4. Looking into CY25, AI revenue growth for the interconnect industry is expected to remain high, driven by increases in the number and content of interconnect applications driven by the launch of Nvidia GB200 NVL systems. We estimate interconnect and cable assembly content per system ranges from $45K to $75K, and the annual TAM reaches up to $2 billion, assuming 40,000 systems shipped in 2025.

Top 4 Channel Comments:

• Our 1Q IP&E B2B was 1.05x. We saw good bookings continue into April but May stepped down. We are trying to figure out why. It doesn’t look like it will be a linear progression as customers continue to struggle with uneven inventory.

• YTD distribution bookings have been stronger than direct bookings. It seems that distributor POA is bottoming out with some replenishment demand starting to come in, though we still have work to do on direct inventory and demand.

• TE says it sees signs of green shoots in Industrial/disti, particularly in N.A., but the improvement is still sporadic and unpredictable.

• AI connector outlook continues to increase every month. Projecting CY24 sales to be up more than 3x vs. previous of 2-3x. Demand is relentless; hyperscalers are asking us for 3x increase in shipments this year and next.

Other Key Takeaways:

5. Auto demand seen tracking in-line with 2Q/CY24 forecasts with an improvement in China EV and ICE demand in the West offsetting weaker EV demand Q/Q. Orders for connectors and sensors seen improving Q/Q on demand for 2H model year 2025 production.

6. Tesla demand noted down Q/Q on order pushouts. Tesla production forecast noted as cut to 1.8M at the end of 1Q, from 2M prior; some suppliers planning for production demand as low as 1.6M-1.7M. Volume production of low-cost Tesla EV projected in 2H25.

7. Industrial demand more mixed vs. March, with continued green shoots of demand but a lack of predictable improvement.

8. Consumer demand showing initial signs of improvement with an uptick in distribution and direct orders tied to PCs, gaming, and stronger-than-typical Jun/July demand pull for iPhones.

Conclusion

Overall demand signals are mixed midway point through 2Q, though shipments are viewed as tracking in line with target levels.

By market, strength and upside continue to be noted from AI and Military, which are projected to continue at least through year-end. Forecasts in AI continue to increase, with the industry calling for greater than 3x growth in 2024 compared to 2-3x previously. Concerns remain about a potential air pocket or bubble within AI, though current market data suggests that is not an immediate concern.

Outside of AI, the market shows signs of bottoming, with green shoots noted across multiple end markets. Inventory levels are improving but are still expected to remain a slight headwind through the year. With continued upside in AI, strength in Mil/Aero, and bottoming patterns across virtually all other markets, we remain comfortable with our view that 1Q24 likely marked the bottom of the cycle, and we remain cautiously optimistic about continued improvements through the remainder of 2024 and into 2025.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research