Denis Zogbi from Paumanok Inc. published on TTI Market Eye blog article that analyzes worldwide capacitor consumption in power electronics applications by dielectric, including aluminum, film and ceramic types, as well as a description of the circuit applications in which these capacitors are consumed, and sheds light on the fragmented segments that make up the industrial power markets globally in 2020.

Power capacitors constitute about 20 percent of the global capacitor market for 2020 and includes multiple products and dielectrics, with plastic film, ceramic and aluminum capacitors key technologies consumed in electrical power circuits for filtering and pulse discharge circuits.

For the purposes of this article, we are including all products that would qualify as “power capacitors” regardless of region. The primary areas of consumption for capacitors in the industrial segment are in power transmission and distribution; motors and drives, renewable energy, lighting, power supplies and the myriad of fragmented capacitor specific markets in power electronics that require power smoothing, power factor correction, circuit protection or burst power.

Paumanok also extends its definition of power capacitors here to include white goods, lasers, railguns, traction, furnaces, broadcast transmitters, radar, welding and external defibrillators that have industrial-grade capacitor requirements.

Capacitor Types and Market Share, 2020

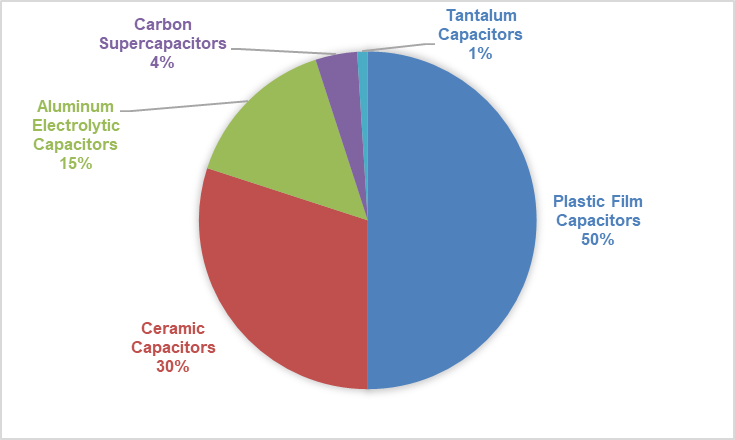

The types of capacitors that are used in the industrial end-use market segment include primarily plastic film capacitors, ceramic capacitors; aluminum electrolytic capacitors; but also to a lesser extent carbon supercapacitors and tantalum capacitors as is shown in the chart below.

In the industrial end-use market segment, the types of capacitors employed include:

- Plastic film capacitors, which make up 50 percent of the value of consumption for capacitors in the industrial segment and includes almost 100 percent of all applications for plastic film capacitors;

- Ceramic capacitors, especially large case size ceramic capacitors and uniquely packaged ceramic capacitors, which account for 30 percent of the industrial capacitor market (High Voltage Single Layer and Multilayered Chips, Axial, Radial and Slug Type);

- Aluminum capacitors, which represent about 15 percent of consumption value for all industrial capacitors (snap mount, screw terminal and motor start);

- Double-layer carbon supercapacitors (large can screw terminal) and tantalum capacitors (molded SMD chips) round out the requirements with the remaining 5 percent of consumption value for 2020.

Power Markets’ Financial and Market Status

Industrial end-use market segments – especially power transmission and distribution, motors and drives, and lighting – have taken on a greater degree of importance over the past ten years. Worldwide government regulations regarding power and lighting efficiency, as well as concerns over energy dependence, are increasing demand for the industrial-grade capacitors required for power smoothing and power factor correction via added capacitance.

Plastic Film Capacitors for Power Electronics

The plastic film capacitor market comprises about half of the market value for all industrial-grade capacitors. This market is further divided into AC plastic film capacitors for electrical systems and DC film capacitors for electronic systems.

The plastic film capacitor market is also determined by its dielectric. In this instance, polypropylene (PP) film is used for AC electrical capacitors and polyethylene terapthalate (PET) is used for 5 mm PCB-mounted smoothing capacitors. Plastic film capacitors are electrostatic designs and therefore have high voltage handling capabilities, but at low capacitance values.

The benefit of film is the self-healing nature of the plastic dielectric, which works well because the capacitor is constantly subjected to the rigors of high-voltage stress on the circuit. Therefore, plastic film capacitors are used for power factor correction, signal smoothing and burst power in a myriad of markets throughout the power electronics supply chain, especially lighting and power conversion.

Ceramic Capacitors for Power Electronics

Ceramic capacitors are also electrostatic and are also used in power electronics and account for 30 percent of the global industrial capacitor market. The industrial-grade ceramic capacitor market includes single-layer disc ceramic capacitors; high voltage “doorknob” capacitors; multilayered axial and multilayered radial capacitors (legacy designs); and, making up the bulk of the market, high voltage ceramic chip capacitors to 5 kV for PCB applications.

Ceramics have lower production costs compared to film capacitors, and have made significant inroads into the line voltage segment of the market because they have lower pricing and robust performance. Ceramic capacitors also offer high-voltage, low-capacitance designs in the same manner as film capacitors. Ceramics cost less to produce because their feedstock materials (barium carbonate and titanium dioxide) are available in abundance, and these materials have extremely low and stable pricing.

Aluminum Capacitors for Power Electronics

Large can and snap-mount aluminum capacitors are also used in power electronic applications, and will account for about 15 percent of global industrial capacitor revenues for 2020.

The primary applications for aluminum capacitors in industrial environments include their required use as key components in industrial motors and drives, and as filtering capacitors for DC link circuits. Aluminum capacitors are generally limited to 500 volts per capacitor, but have extremely high capacitance values that are by-products of their wet-electrolytic design.

Carbon Supercapacitors for Power Electronics

Double layer carbon super capacitors account for about 4 percent of the Industrial capacitor market by dielectric and are used for actuated power applications in industrial environments, motor start, energy storage and as battery load leveling in trucks and busses and are one of the fastest growth segments of the industrial capacitor market by dielectric. EDLC supercapacitors are also used in data server farms for solid-state disc drive protection; in windmills for adjustment of the blades; as braking energy recoup and track switching in electric rail systems.

Tantalum Capacitors for Industrial Electronics

Tantalum capacitors account for only 1 percent of the industrial capacitor market by dielectric. Large case size molded chips and molded axial and radial tantalum capacitors, as well as hermetically sealed tantalum capacitors can be found in industrial environments where the combination of high capacitance in a small case size is the circuit requirement. Therefore, we see tantalum capacitor applications in switchboard apparatus and in motor controllers as well as for applications in DC/DC converter “bricks.”

Industrial Circuit Applications for Capacitors

Here are the various levels of the supply chain for capacitors in the power electronics end-use market segment this year:

Power Transmission and Distribution

AC film capacitors used for power transmission and distribution applications are generally employed in circuits from between 3 kilovolts and 745+ kV. Distribution class capacitors are generally pole-mounted in series and parallel to achieve voltage requirements from 3 to 15 kV, while transmission class capacitors are rack-mounted in both series and parallel to be used in power transmission systems to 745 kilovolts, or even higher (some capacitor banks are rated to 100,000 volts).

Power transmission and distribution capacitors are large markets globally, requiring power utility and government investment for growth. Today we see retrofit markets in the West and new construction of power transmission and distribution grids in emerging economies.

There is also significant interest in the emerging markets for “micro-grid” technology which is designed for campus environments. The major vendors of power transmission and distribution equipment sell capacitors as part of larger turnkey projects; therefore, companies such as General Electric, Cooper Power Systems and ABB have captive access to their own polypropylene capacitor lines in-house.

The renewable energy portion of the market is more open and diverse, with more opportunities for merchant vendors to sell capacitors to manufacturers of inverters who are not under the auspices of major power transmission and distribution turnkey projects.

Motors and Drives

The motor run capacitor market has traditionally grown in accordance with new home building globally, which drives sales of large home appliances, such as air conditioning equipment and refrigerators (motor run capacitors are consumed in the split capacitor motors found in refrigerator and air conditioner motors).

The market for large home appliances and HVAC systems is driven primarily by new home sales, but aftermarket sales are also influenced by a quest for improved energy efficiency. The motor run capacitor business has been showing signs of improvement in response to the global movement to make white good appliance motors more efficient because they are responsible for a large portion of global electricity consumption.

Clear market opportunities exist for industrial capacitors used in industrial motor drives, especially variable frequency drives that have proven that they provide the greatest level of power efficiency in industrial environments. Both AC plastic film capacitors and large can aluminum electrolytic capacitors are positively affected by this growth market. Large can aluminum electrolytic capacitors are consumed in industrial motor drives.

These are generally high capacitance, high voltage, high ripple current and long-life aluminum electrolytic designs with rated voltages from 10 to 500 volts, with capacitance values from 84 to 100,000 microfarads. AC plastic film capacitors used in industrial drives can handle thousands of volts per cell, but at extremely low capacitance, generally in the 1-microfarad range. Both are used primarily for smoothing the signal and are considered primary components for system efficiency, and are therefore of great importance and the subject of continual research and development.

Capacitors for Renewable Energy

Based on primary research conducted for this article, Paumanok has determined that there are three primary types of capacitors being consumed in renewable energy systems. Readers should note that there are similarities between the circuits found in solar and wind renewable energy systems, primarily in the inverter and the DC link circuits that expand the overall market for capacitors consumed in this segment.

Since long-term growth is expected for both wind and solar technology, the opportunity for capacitors is significant and should not go overlooked, especially by manufacturers of plastic film capacitors, aluminum electrolytic capacitors and double-layer carbon supercapacitors.

Suppression and Protection Capacitors

Plastic film capacitors are also used as IGBT semiconductor snubbing capacitors, which are used for the circuit protection of the power semiconductor. Low-inductance snubber capacitors are connected in parallel with GTO thyristors to limit the rate of rise of their repetitive reverse voltage. The voltage values are derived from their repetitive peak offstate voltage of the GTO thyristor. These capacitors are abruptly charged and discharged, whereby the peak value of the current reaches extremely high values. Extremely low inductance is important to the proper operation of snubber capacitors. The channel of capacitor distribution here is usually in accordance with the sale of the semiconductor. It remains a good growth market for specialty manufacturers of snubber capacitors.

In addition to snubber technology, there are two main types of plastic film and ceramic chip interference suppression capacitors, which are the X versions and the Y versions. These designations are the result of standards set by various international governing agencies mentioned in the introduction.

In short, X capacitors are line-to-line capacitors used to suppress radio frequency interference in electrical systems; and the Y capacitors are line-to-ground capacitors used to suppress radio frequency interference in electrical systems. There are great markets for interference suppression capacitors in smoke detectors, power supplies, lighting ballasts and thermostats, all important anchor areas for the Internet of Everything; so this as well is considered a growth segment of the market going forward.

Power Supplies, Adapters and DC/DC Converters

Switch mode power supplies and DC-to-DC converter “brick modules” require capacitor smoothing for their input filters (usually plastic film or ceramic) and output filters (almost always aluminum electrolytic capacitors, but sometimes tantalum).

This is an enormous global market because every electrical device usually requires a power supply of some type. Every television set or home theater accessory, and every power adapter and transformer, requires capacitors.

The greatest market value is in the output filtering process because of the required combination of voltage and capacitance. This is a narrow area for aluminum capacitor manufacturers to compete in, but it represents a significant portion of the overall aluminum capacitor market on a global scale.

In 2020, we see a significant amount of activity in making power supplies, adapters and converters smaller and more efficient, and capacitors are an important part of that equation. The power supply manufacturers who purchase both aluminum and plastic film capacitors are so critical to the larger capacitor market that competition among the relatively few major manufacturers in power supplies makes the market aggressive and competitive.

Capacitors in Lighting Applications

Both AC and DC film capacitors count lighting as a major end-use market segment, and this has been true for decades.

AC film capacitors have been historically consumed in two separate markets in the lighting ballast industry: the PFC magnetic ballast business and the high-intensity discharge lighting business. DC film capacitor markets are heavily invested in ballasts of all types, including electronic ballasts and LED drivers. Capacitors are used in lighting for signal smoothing, interference suppression and (in some instances) burst power. Plastic film, ceramic or aluminum components may be used, and in many instances a combination of all three dielectrics is used in a single ballast.

Hidden Gems: Fragmented Sub-Markets for Capacitors

Pulse capacitors are DC circuit capacitors that absorb or supply strong current surges. They are charged sporadically and briefly discharged in relation to the charge time, or vice versa. Discharge capacitors are subjected to high loads, high field strength, and larg peak currents because of the fast discharge and require advanced technical knowledge to build.

Pulse capacitors find their niche in various forms of research and development, both for high-temperature electronics and for generating strong magnetic fields, high-energy light flashes and high pulses of electrical energy.

This list of applications for pulse capacitors shows the varying end markets for this fragmented capacitor sub-markets, with various granular sub-segments of larger markets:

- Lasers (industrial and medical)

- Defibrillator (external only)

- X-Ray machines (pulsed)

- Ultrasonics (pulse welders, cleaners)

- Airport runway strobes

- Pulse forming networks for radar

- Water purification

- Railgun power

- Missile power-up

- Food sterilization

- Marx generators

- Television and radio transmitters

Power transmission and distribution capacitors – all OPP film-based products – are the largest segment, and are almost exclusively turnkey in nature; followed by the motor and drive markets where capacitors are used for starting and running various types of motor and drive assemblies, but with the permanent split capacitor motor design used for compressors as a large runner for power capacitors consumed in HVAC and refrigeration. Power supplies and lighting ballasts are also capacitor intensive for smoothing input and output signals. DC link circuits for renewable energy and the broad category of pulse discharge capacitors consumed in a specialty electrical segment for defibrillators, pulse radars and igniters.

Summary and Conclusions

The power end-use market segment for capacitors is a broad product and end-use category that includes multiple levels of fragmented supporting markets. Plastic film capacitors are the primary dielectric consumed in this space, but specialty packaged and designed ceramic capacitors and large can aluminum capacitors also have considerable market share and represent large dollar values within the power end-use segment.

The overall trend in the market remains positive because of government regulations and goals from around the world regarding not only electricity generation, but also efficiency improvements in multiple power-hungry devices.

Capacitors play an important role in this transition, and will continue to do so for the foreseeable future. These trends suggest a slow but steady growth market over time, with significant opportunities in even the most granular sub-segments of the power industry for more efficient delivery of power to the global population.