TTI MarketEYE published Dennis Zogbi Paumanok’s analysis that presents quarterly market forecast and outlook for passive components, updated to include recent financial reporting and forecasts by major vendors of passive components and coupled with a myriad of primary sources. The result is a much more robust outlook, and we expect by June that the worst will have passed and the global markets for passive components will resume their growth.

GDP Outlook: Impact on High-Tech

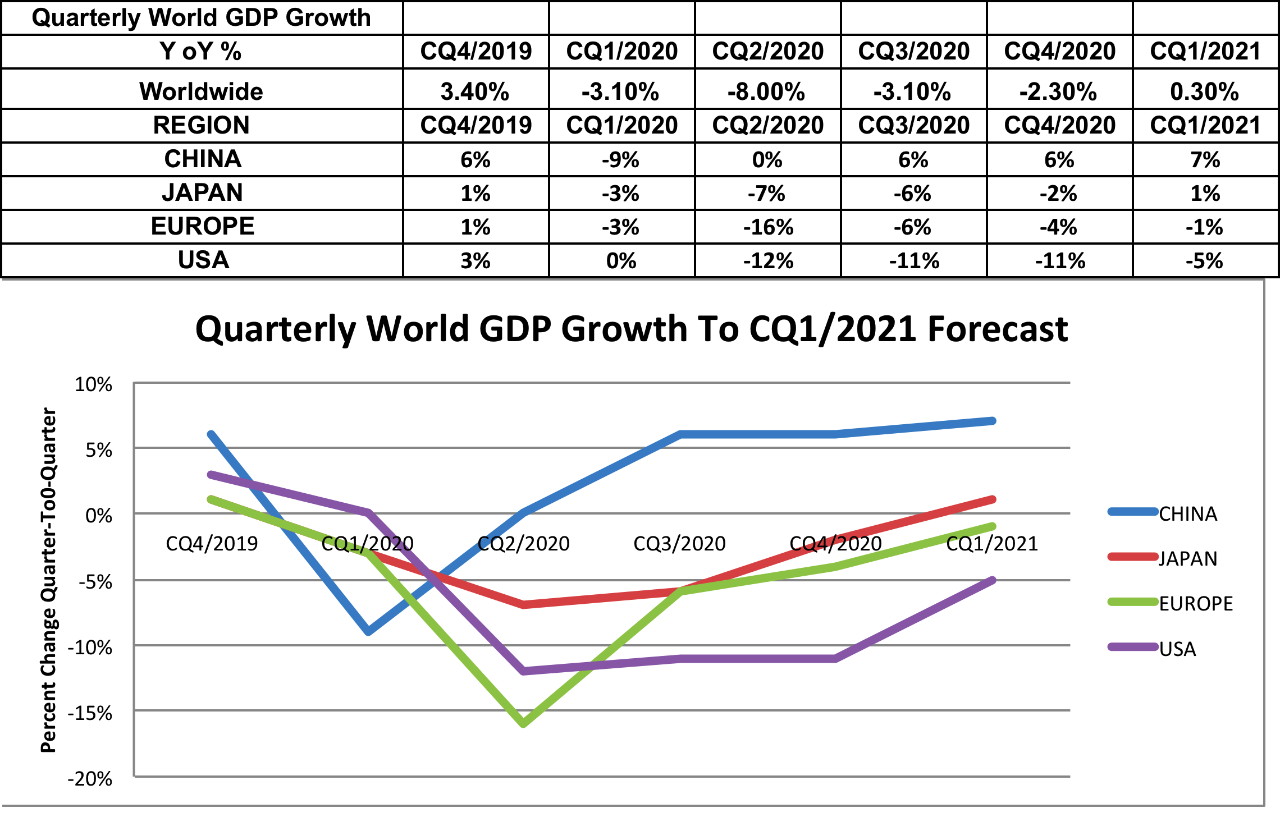

The following GDP forecast by world region suggests a tough road ahead for the U.S. and European economies. Asian regions will grow out of the situation at a faster rate than other regions, but the overall outlook for near-term GDP is challenging (see Figure 1).

Figure 1: Quarterly GDP Forecast by World Region and Quarter, 2020-2021 (click to full-view)

Focused Impact on Passive Component Markets

However, a deeper dive into the impact this is having on the high-tech economy suggests that component markets, especially the capacitors market, have been insulated from the fallout of the global pandemic to date.

The outlook for consumption remains bleak with respect to end-product sales; however, within specific segments of end-use markets there are churn opportunities that are already impacting the passive components supply chain.

The overall capacitance signature of specific segments of the market has been enough to keep prices stable and volumes growing. This is creating a safe haven amidst other end-use segments which are facing brand-ending events.

For specific components, such as high-capacitance MLCCs and tantalum capacitors (which are consumed globally but are localized with respect to production), we started to see regional shortages in May 2020.

MLCCs: Insulated from the Pandemic

Due to multiple unique economic conditions in FY 2021, high-capacitance BME MLCCs are expected to remain unchanged at their elevated levels throughout the year due to uncommon rates of churn in key end-markets.

In particular, Murata has noted that their sales would drop 12 percent in the June quarter but then rebound strongly for each consecutive quarter, suggesting a V-shaped Recovery. TDK recently forecasted that 5G handset production would increase 775 percent in FY 2021, with each new model phone having 30 percent more MLCCs to support the camera modules and the antenna.

This impacted Samsung MLCC sales in the March quarter, with MLCC sales increasing a substantial 10 percent in value quarter-to-quarter to support the requirements of their strategic customer.

Meanwhile, pandemic-related demand and increased the consumption in some industries, including personal computers. This was not planned, and therefore demand for the larger case size chips consumed in notebooks, desktops and servers increased; these parts had largely made way for new capacity in handsets.

These factors are resulting in a shortage of components that is being compounded by regional production capabilities: no high-capacitance BME MLCC are produced in the Americas or Europe, so all must be imported from Japan, Korea, Philippines, Singapore, Thailand or Taiwan.

Figure 2: MLCC Lead Time Trends, May 2013 to May 2020 (May) by Month (click to full-view)

Impact on the Tantalum Capacitor Market

Tantalum capacitor lead times are also spiking, which has raised concerns about the supply chain as the majority of raw materials are sourced from Central Africa where shutdowns of mining operations due to pandemic remains a concern.

However, tantalum is responding to the unexpected demand from the computer market segment due to the new “work-at home” trend (see Figure 3).

Figure 3: Tantalum Lead Time Trends, May 2013 – May 2020 (May), by Month (click to full-view)

Impact on Vendor Financials in the March 2020 Quarter

Recent financial reporting by major passive component manufacturers reveals that passive component sales were not being impacted as harshly as other market segments (such as commercial real estate and travel), with specific segments of the capacitor markets growing in the March quarter.

The June quarterly outlook for FY 2021 suggests it will be the low point for the components market, after which demand will grow quarter to quarter to satisfy churn in key growth sub-segments – 5G handsets, xEv automobiles, computers, HDD Nearline storage and gaming.

Shifts in Vendor Positions

The passive component market did not experience the usual quarterly downturn in March 2020 that historically follows the December 2020 quarter; this was pandemic-related. Meanwhile, the shift in the work paradigm from office to home on a global basis has created new demand for computers – an area which has been largely a challenging business for the past 36 months, with constant erosion in all product lines other than server-based systems.

In March 2020, the computer market (especially the notebook computer market which, is central to Taiwan ROC) suddenly increased in demand as the work-at-home model was being supported by demand in the notebook and tablet segment. The desktop segment also looks promising (1 to 5 percent growth instead of a 6 percent decline) compared to handsets. Gaming electronics demand also increased for console and handheld designs.

Fossil-fuel automotive turned weak during the quarter, and it was expected that production of automobiles would decline substantially which would have a major impact on component supply. (Some companies had tuned their sales to as much as 50 percent in auto as a result of growth in automotive electronics in 2017, 2018 and 2019.)

The downturn in demand in FY 2021 is expected to be significant and will also have an impact on all fossil-fuel-related electronics. The markets that return post-pandemic in automotive will begin to focus more on the 48-volt power supply for electric transport. Meanwhile, in the near term, FY 2021 production of xEV should rise 11 percent.

Quarter-to-Quarter Outlook

The June 2020 quarterly outlook calls for the global passive components market to decline by 12 percent in value, representing the worst quarter as the global economy emerges from the pandemic. However, expect the market to grow by the next two consecutive quarters.

A 10-percent decline in unit sales of handsets will have a large impact on the unit sales of passive components, especially MLCCs and thick film chip resistors. However, the shift created by the pandemic is happening while a major frequency shift to 5G handsets is underway, and this is already having an impact on MLCC sales.

Readers should note that it was the module business that declined sharply in the March 2020 quarter, but MLCC sales remained stable in unit sales and pricing, with one major vendor having a remarkable quarter as it supplied key 5G related MLCCs to a “strategic customer.”

The prevailing theory is that phone demand will decline due to lost employment globally, but a major churn will occur at the top end of the supply chain, creating some value stability in overall passive component sales – especially MLCCs for 5G handsets.

More people working and schooling from home has had, and will continue to have, a positive impact on notebook computers.

Expect Shift and Churn Within Key Markets

While sales to the automotive segment are expected to decline by 15 percent in value in FY 2021, the xEv market will grow 11 percent, from 4.4 million units to 4.9 million units – and the xEv is passive-component intensive.

Huge growth is expected in 5G handsets in FY 2021. Overall, the markets will decline from 1,365 million units to 1,250 million handsets and have a negative impact on overall component sales; however, expect a 775 percent increase in 5G phones from 43 million units in FY 2020 to 376 million phones in FY 2021.

The 5G phone has 30 percent more passive components than the previous smartphone models, most in the form of MLCC consumption in the camera and antenna. Please note that the March 2020 reporting of Samsung EMCO of a 10.7 percent quarter-to-quarter increase in MLCC sales to a strategic customer was in MLCCs designed for 5G handsets. This type of quarter-to-quarter increase in value may be evident in passive component vendor sales to other major handset brands in the 5G segment in the coming quarters.

Hard disk drive sales are expected to decline by 14 percent to 265 million units; however, within that model there is growth of 10 percent expected in “nearline” designs to 62 million units, and these too are passive-component intensive, with both high-cap MLCCs and tantalum chips consumed therein.

Value growth in computer markets will benefit more expensive capacitor, resistor and inductor parts, and will have a positive impact on western passive-component manufacturers who offer low-ESR chips and computer-grade X7R and X5R performance in MLCCs.

Also, stay-at-home and work-at-home orders are creating new optimism and expectations of increased sales of gaming systems for FY 2021, especially handheld designs from Japan. These game consoles and high-end visual designs are tantalum-chip and MLCC intensive.

Ultimately, the overall sales of passive components in FY 2021 will be down for the year, but expect certain profit centers – especially in high-capacitance BME MLCCs, molded low-ESR tantalum chips, X&Y suppression capacitors, thick-film chip resistors and ceramic-chip inductors – to keep sales in the overall market up.