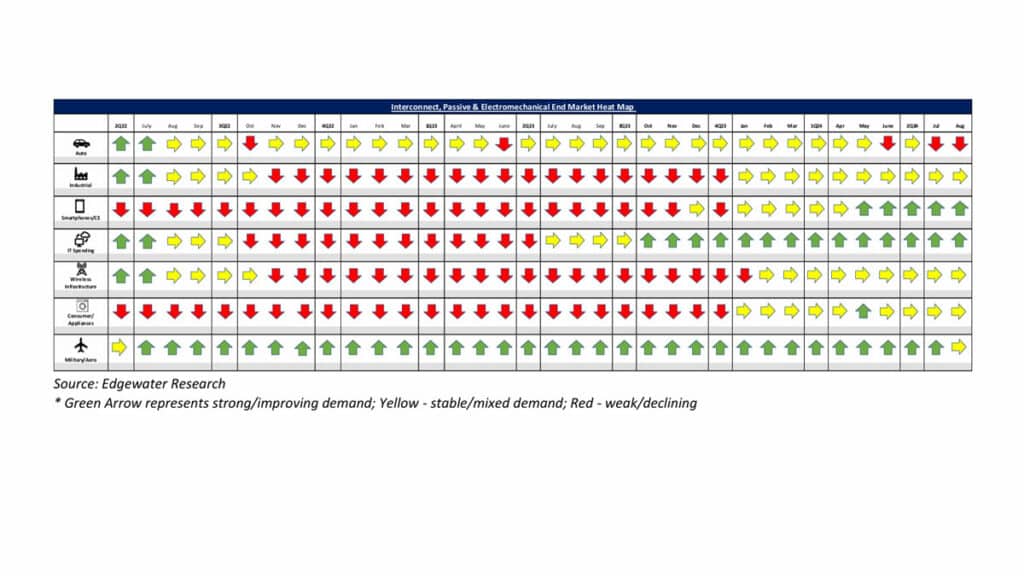

September 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

Diverging Trends in September & Pace of Recovery Still Slow, Auto Weaker & CE/IT Datacom Remain Strong

What’s Changed/What’s New?

1. 3Q B2B seen tracking to 1, down Q/Q on moderating orders in Jul, mixed Aug, and minor uptick in Sep. Visibility remains limited.

2. 2H Auto reads incrementally softer on further production cuts with Europe worse, followed by Americas and Asia. China demand seen moderating from both foreign and local OEMs.

3. iPhone connector demand tracking ahead of seasonality into early 4Q on higher complexity/increased content.

4. Mil/Aero demand feedback more mixed in 2H with signs of moderating growth tied to program lumpiness.

Top 2 Channel Comments:

• Core industrial demand for connectors remains weak, with customers still reporting six months of inventory to digest. This echoes the feedback from January, suggesting either they had even more excess inventory then or that demand has significantly slowed since.

• Public distis have started purchasing more interconnect products, but we see them focusing on breadth rather than volume. Distis are finding alternative areas in the market where they can buy low MLQ (min level quantity) before they go and order direct with suppliers.

Other Key Takeaways:

5. Connector disti inventory seen as healthy but disti orders noted as still slow; distis focused on improving breadth rather than volume.

6. Europe demand seen diverging, continuing to soften in 3Q on weak end-demand and ongoing inventory headwinds. N.A. mixed with stability in Industrial/channel but softening in Auto. Asia relatively best on AI and consumer seasonality offset by Auto moderation.

7. IT datacom datapoints stabilizing; demand still viewed growing double digits seq in 3Q and 2H on improvement in traditional IT demand from both hyperscalers and enterprise, acceleration in Hopper orders and ongoing ramp-up of AI ASIC projects.

8. Auto 2025 outlook noted as conservative with suppliers planning around flattish global light vehicle production (LVP).

9. Industrial reads mixed with pockets of improvement in instrumentation and continued strength from semi cap (outside of Americas). Europe industrial seen as weakening further.

10. Core Industrial demand (FA, Ind Equip.) still weak with destocking projected for another 6 months, implying softness into early 1H.

11. Recovery in Industrial/Auto/channel firmly pushed out to 2025 on lack of order recovery. Recovery expectations centered on 1H25.

12. 3Q Consumer ex-Apple seen improving but remaining well below peak on weak consumption. 4Q demand projected down seasonally.

13. TE’s TS President exit met with a surprise, with initial supply chain read being cautious, though views on his successor are positive.

Conclusion:

IP&E fundamentals remain mixed through September, continuing to show regional and end-market variability. The most notable trend in September was the clear slowdown in the automotive sector in the West, which was at least partially offset by seasonal growth in consumer electronics and strength in IT Datacom.

The recovery pace remains slower than initially expected, primarily due to extended inventory burn and higher supply chain levels. With low backlogs, limited visibility, and an uncertain economic outlook, we remain cautiously optimistic about the recovery. We believe the IP&E industry is well-positioned heading into 2025 and are confident that its fundamentals are closer to a true recovery compared to semis.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research