North American ECIA’s Electronic Component Sales Trend Sentiment ECST achieves broad-based positive traction in August 2024 and Q3 Sentiment Surveys.

Positive market sentiment expressed by participants in the electronic components supply chain improved in the August measurement as it reached 108.4 in the index and is sustained in the September outlook with a 107.9 score.

This is an encouraging upward trend following a June measurement that fell below the 100 threshold and caused concern regarding market health. Building on the good news from the most recent ECST survey, all three major component segments realized scores above the 100 threshold in both the August measurement and the September outlook.

The actual index score for August came in below the projected score from the July survey. However, while the survey often projects a stronger improvement than is achieved, any level of continued upward improvement in the market is a valuable indicator of continued positive market momentum. This month-to-month positive market trend is projected to continue through the fourth quarter and the end of the year based on the results measured in the Q3 ECST survey.

Semiconductors and Electro-Mechanical components saw strongly positive scores in August with Semiconductors improving by 5.5 points to reach 111.8 and Electro-Mechanical growing by 2.8 points to a score of 108.6. Passive components experienced the greatest improvement in August with a 6.5-point improvement that moved it out of negative sentiment territory up to a positive score of 104.7. The September ECST scores show improving sentiment for Electro-Mechanical and Passive components.

Semiconductor market expectations in September slip from the August results but still sustain an overall positive market expectation at 103.0. Every product sub-category achieves a score of 100 or above in both August and the September forecast. This encouraging August/September momentum is projected

to continue through Q4 and the end of 2024 based on the most recent results reported in the Q3 2024 ECST survey. The Q4 outlook in the new quarterly survey shows 35% of participants projecting growth in Q3 with 10% expecting growth of between 3% and 5%. The sales sentiment measured in the Q3 survey

is lower than the enthusiastic expectations from the Q2 survey but still strongly positive.

In a notable reversal of roles, Manufacturers have become the most conservative group in their sales sentiment with overall scores in negative territory below 100 in both August and September. This group has typically been the most optimistic in their views in prior surveys. Sales sentiment expressed by

Distributors leads all three groups and comes in strongly positive in July, August, and the September forecast. Manufacturer Representatives also report solidly positive sentiment in the July to September period.

In a hopeful result, the index score for the overall end-market for electronic components was able to sustain a score of 100 in August and did not fall to 95.5 as had been projected in the July ECST survey. It is projected to improve to 110.8 in September and come back into alignment with the sentiment measured in the product index.

Avionics/Military/Space scores strengthened back to their prominent levels in August and the September outlook. Medical Electronics is the only other segment to deliver an index score above 100 in August. The encouraging news is that all but two market segments are projected to deliver positive sales sentiment in September. Only Computers and Consumer Electronics score below 100 in the September forecast. However, both are above 95. A return to a general sentiment of optimism is an encouraging development in the most recent ECST surveys.

The results reported in the Q3 2024 ECST survey are much more modest compared to the enthusiasm expressed in the Q2 survey. However, the sentiment is solidly positive, and that positive sentiment continues through the fourth quarter outlook. The strongest net positive score is measured in Semiconductors with 36% projecting sales growth and only 14% seeing declining sales, a net positive measure of 23% in Q3. Looking toward Q4 Semiconductors see net positive growth expectations from 17% of survey participants.

Electro-Mechanical components report similarly positive sales sentiment with 34% reporting growth expectations and only 21% seeing declining sales in Q3. This net positive score of 13% improves to 17% in Q4. Passive component results come in at a more modest score of net 8% with positive growth expectations in Q3 but then jump to 17% net positive growth reports for the Q4 outlook. This latest quarterly survey result continues the expectation coming into 2024 that growth for the year would be driven by second half performance. It is encouraging that positive sales expectations have been sustained all the way to the Q3 survey conducted in August.

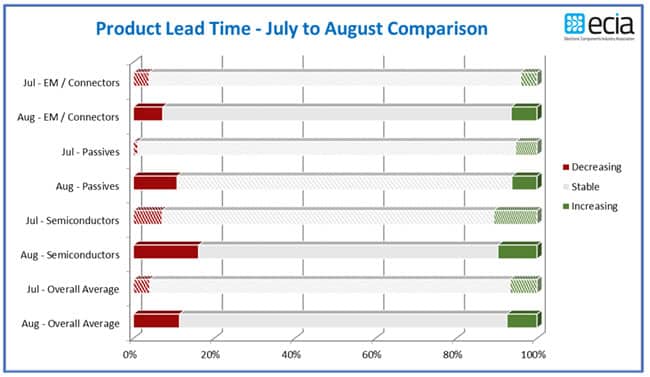

The level of lead time stability reported in August slipped as the average of those reporting stable lead times dipped from 89% to 81%. Semiconductors and Passive components both saw a notable increase in the percent reporting decreasing lead times. All three segments saw increases in reports of decreased

lead times. Increasing lead time reports were essentially unchanged between July and August.