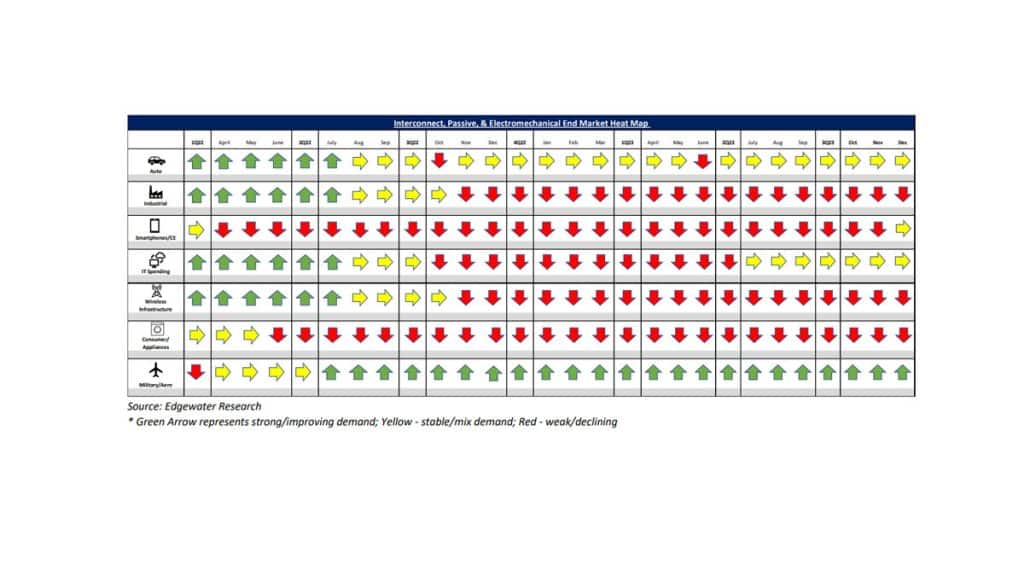

December 2023 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Asia feedback upticks on signs of inventory normalization; China demand stable to up but outlook into 2024 still muted.

2. Europe feedback downticks on inventory and end-demand across Industrial/Auto. 1Q outlook well below sub-seasonal.

3. Auto tempered modestly M/M, more stable vs. semis. Concerns tied to inventory in the West (UAW) and EV program fallouts.

4. AI connector feedback noisier vs recent work on volatility in deployment schedules and concerns of over-shipping end consumption.

Top 4 Channel Comments:

• Asia is showing signs of life in 4Q. Both bookings and shipments have flipped positive Y/Y. Sequentially shipments have been flattish for the past 4 months while bookings are upticking. Still hesitant to call it a recovery, but we see the improvement including in China.

• IP&E demand continues to downtick in Europe through 4Q. End customer demand seems off target. B2B is down Q/Q and continues to go in the wrong direction. Distis in Europe are swimming in inventory, and we see more requests for returns.

• Auto outlook in Europe is more tempered vs 3 months ago. Demand is okay at best. Outlook for content growth remains good for both EV and ICE but volume projections are cloudier. We see a clear fallout from some EV programs from VW and with some tier 2s.

• The AI market is extremely volatile. Customers are asking us to put capacity and ramp up, but by the time we do, plans have changed. When Telsa Dojo first fired up their machine back in October it tripped the power grid. That caused the volume to be cut in half initially, which was followed by another halving last week. Telsa said it will just move to the next-generation design due to performance tradeoffs and other changes that address some of the power issues.

Other Key Takeaways:

5. 2024 outlooks still muted at LSD growth and tied to 2H recovery expectations with disti demand underperforming direct.

6. China Auto mixed with upside in 4Q but concerns of pull-ins driving sub-seasonal 1Q; Easing EV incentives and cautious consumer spending creating uncertainty for EV production growth in 2024. China OEM seen continuing to take share from freight Auto in 4Q.

7. Industrial still seen weak across geos; inventory headwind seen persisting potentially through 2024 on recent forecast cuts to EMS.

8. Comm Transport/Traditional IT/Telco feedback still weak and little changed with inventory digestion projected to persist into 1H24.

9. Connector inventory broadly seen as still elevated but better relative to semis and passives. Digestion still seen through 1H24.

10. Connector pricing noted as stable for existing products but Amphenol, TE seen as more price-flexible for new designs.

Conclusion

IP&E fundamentals are showing signs of stabilization exiting 2023, with some signs of inventory bottoming in the Asia/Pacific region, while inventory in Americas/EMEA remains a headwind. By end market, little is changed M/M, with feedback in Automotive mixed, Aerospace and Defense strong, and Industrial and Telco continuing to draw down inventory levels. We are encouraged that inventory levels appear cleaner in IP&E relative to semiconductors and except for some pockets in passives the pricing environment remains benign. As fundamentals continue to show signs of bottoming, we are growing increasingly optimistic that the inventory digestion will likely come to an end in 1H24 allowing industry to return to shipping to end consumption.

Full report available from:

Dennis Reed, Sr. Research Analyst, Edgewater Research