North American electronic component sales downturn accelerates at the end of 2022 according to ECIA November 2022 survey results.

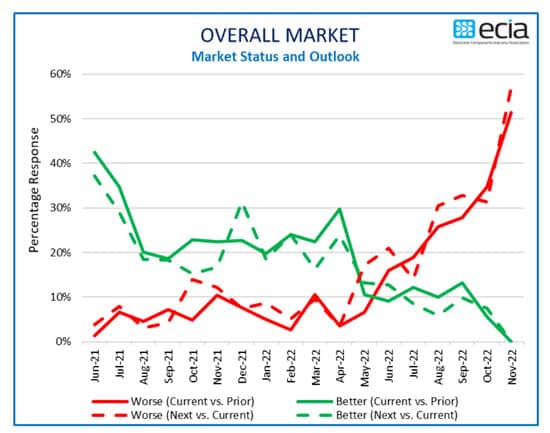

The overall electronic component average sales sentiment collapsed below the previous lowest level hit during the initial months of the pandemic shutdowns in May 2020, 2.5 years ago. The average sales sentiment fell to 58.1 in November 2022 and is projected to continue its free-fall to 50.4 in December.

By contrast, the lowest index measurement in the early stages of the pandemic was 69.4. In addition, the average electronic component index was measured below 100, indicating declining month-to-month sales, for four months during the pandemic shutdowns. The current index has come in below 100 for six months through November in the current downturn and shows no signs of improvement in December and Q1 2023.

Electro-Mechanical/Connectors and Passive Components are leading the charge down as they are projected to fall to 45.5 and 47.1 respectively in December. Semiconductors only fare marginally better at 58.8 in December. The slight rebound in Semiconductors projected for December could be a head fake as Semiconductors were projected to see a slight rebound between October and November also but then fell by 14.7 points in November.

The Overall End-Market index typically tracks slightly below the component index. This trend continues into November and December with the gap widening as the End-Market index drops to 48.6 in November and 43.1 in the December outlook. The end-market pessimism is reinforced by 0% of survey respondents seeing improvement in the end-market in both November and December.

Every end market measure is strongly negative in November and worsening in December with the exception of Avionics/Military/Space. The Avionics/Military/Space market segment eeks out a slightly positive result in November but then falls negative in December. The strongest level of pessimism for Electro-Mechanical and Passive Components is reported by Distributors in November. However, Manufacturer Representatives report the strongest negative sentiment in these markets by a wide margin in December. Distributors and Manufacturers are significantly less bearish in the Semiconductor segment compared to Manufacturer Representatives and also in comparison to their assessment of Passives and Electro-Mechanical components. Bottom line, the Americas electronic components markets are in a deep period of sales declines at this point in the market cycle.

The reported product lead time trends saw a large jump in decreasing lead times as the overall percentage jumped from 28% in October to 46% in November. At the same time, those still reporting increases dropped from 11% to 2% overall in November. In Semiconductors there were no reports of increasing lead times in November. This is especially good news given the extremely extended lead times for Semiconductors. Hopefully, this will allow a rebalancing of the supply chain and an ability to manage inventory levels overall.