Strong demand and allocation continue to drive European semiconductor and passive components distribution (DMASS) in first quarter of 2022.

DMASS reports Q1 growth of 43.5% in semiconductors and 35.7% in interconnect, passive and electromechanical components. Shortages continue, but order situation becomes lighter. War impact limited but poses a risk for near-term future.

On the back of a strong 2021, a huge order book and ongoing shortages in key components, European components distribution again reported significant growth in its first calendar year quarter. According to DMASS Ltd., semiconductor sales, as reported by members, grew by 43.5% to a new record 3.13 Billion Euro. IP&E (Interconnect, Passive and Electromechanical) components grew by an equally impressive 35.7% to 1.62 Billion Euro. In total, the market grew by 40.8% to 4.75 Billion Euro.

Hermann Reiter, chairman of DMASS: “First of all, let us welcome a group of new members from the manufacturing and distribution side of the business, who bring our membership to nearly 40 leading companies, representing well over 80% of total European components distribution. In the course of 33 years of existence, DMASS Ltd. has grown continuously in representation and recognition for its great market coverage.”

In terms of last quarter’s results, Reiter stated: “A combined growth of 40% across all components is outstanding, but at the same time a clear sign of unprecedented times. The challenges of a post-CoVID recovery are now accompanied by the uncertainties of the Russian war against Ukraine and its ramifications for the entire planet. The human catastrophe of this war dwarfs every other concern, may it be unclear market expectations or supply chain disruptions. We hope that a just peace will be achieved soon.”

Semiconductors:

From a regional view, DMASS reported a similar picture on semiconductor growth as in the last quarter, a huge spread and an astounding strength of the major countries. Germany, for example, grew by 45.4% to 867 Million Euro, Italy by 45.6% to 310 Million Euro, the UK by 47.8% to 213 Million Euro, France by a staggering 54.8% to 210 Million Euro, Eastern Europe instead “only” by 34.5% to 540 Million Euro and the Nordic countries by 46% to 240 Million Euro.

At product and product group level, the situation was a bit more diverse. While Memories and Other Logic (ASSPs etc.) grew significantly over-proportionally and MOS Micro slightly faster than average, most other product groups grew below average, although still in the 20s and 30s. Analog, for example, grew by 42% to 886 Million Euro, MOS Micro by 44.8% to 621 Million Euro, Power by 36.5% to 375 Million Euro, Memories by 71.8% to 328 Million Euro, Opto by 26.1% to 260 Million Euro, Other Logic by 64.7% to 172 Million Euro, overtaking Programmable Logic (33.5% to 165 Million Euro). Finally Discretes went up 41.9% to 188 Million Euro and Sensors (incl. Actuators) by 34.9% to 88 Million Euro.

Interconnect, Passive and Electromechanical Components:

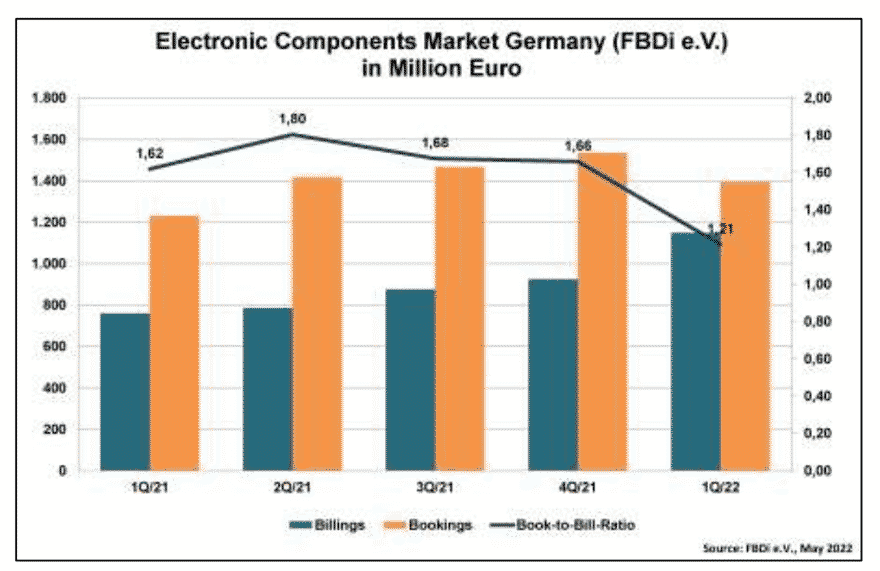

Interconnect, Passive and Electromechanical (IP&E) components again showed parallels to semis, but total sales “only” grew in the 30s. Last quarter’s 1.62 Billion Euro of total sales split as follows: Germany grew by 39.5% to 418 Million Euro, Italy by 40.5% to 191 Million Euro, the UK by 31.4% to 147 Million, France by 31.9% to 143 Million Euro and Eastern Europe by 30.5% to 207 Million Euro. On the product side, Passives grew by 36.4% to 670 Million Euro, Electromechanical products (including connectors) by 34.6% to 852 Million Euro and Power Supplies by 40.4% to 93 Million Euro.

Chairman Hermann Reiter: “We can certainly be very satisfied with the financial results in the first quarter, although some of the growth is exchange rate as well as price-driven. However, we are definitely not happy with the continuing difficult supply situation, where we cannot serve customers in the way we want. While we all hope that the situation gets better towards the end of the summer, the current uncertainties make any prediction impossible. The terrible war continues, economic growth expectations have been cut across the board, supply chains are disrupted by lockdowns in Asia, inflation is rising, energy supply is becoming unaffordable and customer confidence is sinking. We can only hope that this is all 2022 has in store for us. In the long run, we are convinced that technology will still make a huge difference to the world and distribution will be the way to go.”