This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides an overview of year-to-date lead-times for capacitors, resistors and inductors.

Overview

Capacitor, resistor, and inductor lead times remained relatively low compared to previous years, extending through April 2025. However, April 2025 witnessed a slowdown in inductor shipments, stable capacitor deliveries, and an increase in demand for resistors.

The global financial tightening has led to a decline in the value of U.S. dollars, impacting trade and the overall market value of components. Furthermore, global efforts to curb hyper-inflation and cool down a strong dollar continue to erode the value of the entire ecosystem.

In contrast, the decline in raw material prices has positively affected production costs. Despite these challenges, the net new demand for components supporting AI chipsets and electric vehicles continues to create value.

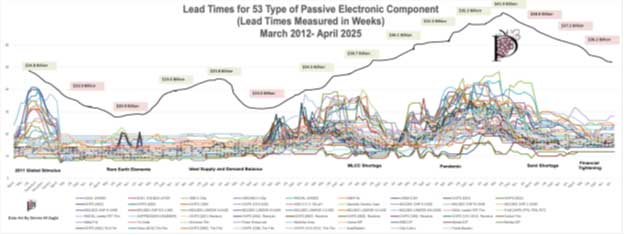

The following chart illustrates the global lead times and corresponding global market value of consumption in U.S. dollars for 54 types of passive electronic component (capacitors, resistors and inductors).

CAPACITORS

Capacitor lead times and demand declined slightly in April of 2025 on a month-to-month basis. Weakness was noted in all dielectrics, including MLCC, aluminum electrolytic, tantalum and plastic film, indicating a clear correction in the global capacitor markets for April 2025. See Figure 2.

This chart is a visual interpretation of the collective data for 44 types and configurations of capacitors we monitored, showing that the global capacitor markets have displayed stable lead times over the past 120 months following years of turmoil. April showed a slight downward trend in lead times on a month-to-month basis.

Multilayer Ceramic Capacitors

Ceramic capacitor markets have been stable for the past five months, showing very little signs of activity, but the markets continue to outperform other parts we cover in this article. The outlook for 2026 remains extremely positive for MLCC for AI chipset decoupling and EVx propulsion. We forecast that MLCC revenues are going to increase to support strengthening the yen and won to the U.S. dollar.

Volume business for MLCC is sluggish due to a slowdown in portable electronic device production (handsets, tablets). Meanwhile, there is value demand coming from the GPU supply chain for decoupling at 105°C. Certain vendors who can support volume demand for such MLCC are showing 45% year-over-year growth rates in dollar value. The majority of MLCC are produced in Japan, Korea, China and the Philippines.

Aluminum Capacitors

The aluminum electrolytic capacitor data has demonstrated volatility for the first four months of the year, with weakness in the axial leaded supply chain (primarily used in automotive) and slowdowns in snap-in and large can aluminum capacitors usually consumed in infrastructure and industrial automation projects. Meanwhile V-chip, H-chip and radial-leaded conductive polymer capacitors continue to outperform where the products overlap in AI chipset decoupling and EVx propulsion. The majority of aluminum capacitors are produced in Japan, China, Malaysia and Korea.

Tantalum Capacitors

The tantalum electrolytic capacitors data suggests an increase in demand from AI chipsets for decoupling, SSD for storage and electric vehicle propulsion—a net new market for tantalum capacitors. Directionally, the markets had been trending upward in February and March of 2025 but dropped suddenly in April 2025 on a month-to-month basis. We noted increased demand for the “D, E and X” case size chip (EIA case measured in inches) in the first quarter of CY 2025. The majority of tantalum capacitors are produced in China, Mexico, Czech Republic, Thailand and Japan.

Plastic Film Capacitors

Lead times for plastic film capacitors, which are key use in renewable energy systems; PHEV and EVx propulsion; and demand has been elevated for some time. However, there was stagnancy in all plastic dielectric film (OPP, PET, PEN, PPS) product lines over the past three months with clear declines noted in axial leaded (automotive) and suppression (industrial automation and infrastructure). The majority of plastic film capacitors are produced in China, Japan and Germany.

RESISTORS

In the month of April 2025, resistor lead times have increased. This is a key economic indicator because of the ubiquitous nature of thick and thin film chip resistors in the high-tech supply chain. The supply chain is extremely sensitive and the shift in demand, even slightly, is encouraging because it reflects the positive impact of actual demand from customers who are replenishing inventories.

Fixed linear resistors in chip format are amongst the highest volume and lowest priced essential products on every printed circuit board. The value of the industry has been relegated to a few global vendors with massive economies of scale in Japan and China.

Thick Film Chip Resistors

Demand for thick film chip resistors has been growing each month since December 2024 and escalating from January through March of 2025, suddenly stabilizing in April 2025 on a month-to-month basis. We note increasing lead times for all thick film chip case sizes from 0201 to 1206 from January to March 2025 as customers replenish inventories. The majority of thick film chip resistors are produced in China and Japan.

Thin Film Resistors

In the first four months of 2025, the market for thin film resistors began to increase as well, especially in 0402 to 1206 case sizes (similar to their thick film counterparts). This market showed signs of slowdown in the smaller cases sizes in April but continued growing in the larger case sizes through April 25, 2025. The majority of thin film chip resistors are produced in Japan and China.

Resistor Networks

The resistor network line has been very stable for the past six months (from November 2024 to April 2025) with no change in lead times for Arrays, SIPs and DIPs. The majority of these products are manufactured in Mexico, Germany and Japan.

Axial and Radial Leaded Resistors

Axial and radial leaded resistors, especially those consumed in high voltage applications, showed increased demand in April on a month-to-month basis, including tin-oxide, carbon film and nichrome film axial and radial leaded resistors. The majority of these products are manufactured in the U.S., Germany and Japan.

INDUCTORS

Discrete Inductors

Discrete inductor demand showed steep declines in April on a month-to-month basis, the largest drop we have seen in magnetic components demand in many months. Chip coils and ferrite beads, both consumed in mass produced products such as handsets and portable computers and games, saw a sharp slowdown in April on a month-to-month basis. SMD chip inductors are consumed in handsets, computers and TV sets and for applications in AI chip set decoupling and for electric vehicle propulsion. One common theme we see in the signature of what is happening across multiple component groupings is a slowdown in automotive demand across the board regardless of technology in April 2025.

This chart is a visual interpretation of the collective data for 3 types and configurations of discrete inductors monitored by Paumanok IMR, and shows the overall market volatility over the past 120 months.

STRONG DOLLAR!

In April 2025, the currency exchange rates for the yen, won and NT dollar weakened as the U.S. dollar strengthened in value quite noticeably. The spike in yen, won and NT dollar will impact revenue forecasts for FY 2026.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 1q |

| Yen | 107 | 110 | 106 | 110 | 132 | 139 | 151 | 152 |

| Won | 1080 | 1165 | 1183 | 1149 | 1299 | 1308 | 1356 | 1442 |

| NTS | 29 | 31 | 29 | 28 | 30 | 32 | 32 | 33 |