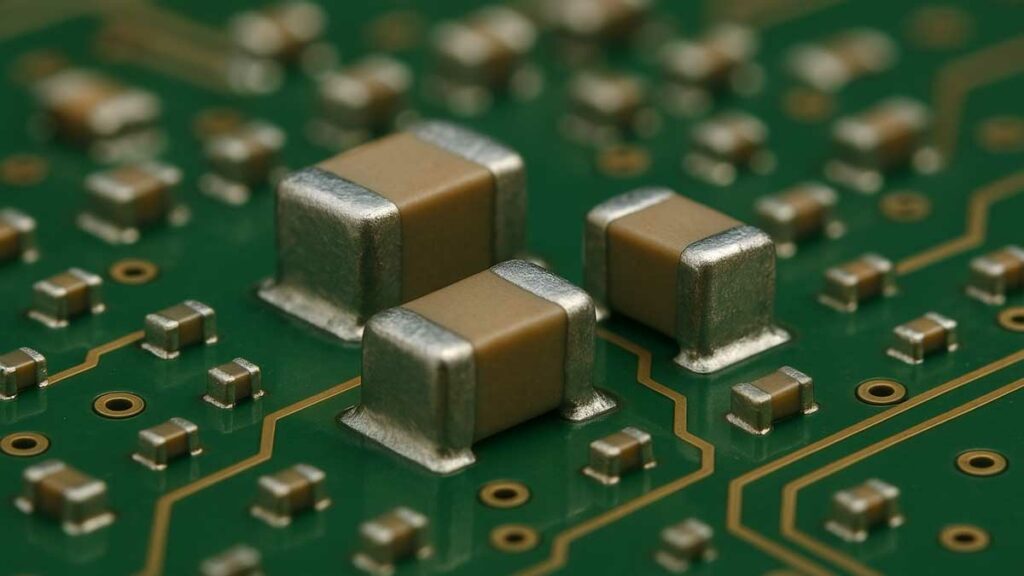

Chinese multilayer ceramic capacitor (MLCC) manufacturers, such as Guangdong Fenghua Advanced Technology, Chaozhou Three-Circle Group, and Eyang Technology, have experienced rapid expansion in the global market. Established manufacturers such as Samsung Electro-Mechanics (Semco) and Murata have to adjust their strategies.

Their market share has surged to 10% of total revenue in the second half of 2024, a significant four-percentage-point increase from 2019, as reported by Business Post and Futubull. This growth indicates heightened competitive pressure on established players like Samsung Electro-Mechanics (Semco).

Traditionally, China relied on importing IT-grade MLCCs from South Korea, Japan, and Taiwan. However, the post-COVID boom in remote work and digital learning led to a surge in demand for computers and home appliances, accelerating the expansion of local MLCC production. According to the Korea Trade-Investment Promotion Agency (KOTRA), this trend has prompted strategic investment in China’s foundational components ecosystem.

A researcher at South Korea’s iM Securities noted that as Chinese OEMs gain influence in IT hardware, they are also strategically cultivating supply chains for essential component materials like MLCCs to support large-scale manufacturing.

Despite their growth, Chinese MLCC firms still lag behind in technical capabilities and hold a relatively small share compared to global leaders. In the first half of 2024, Samsung Electro-Mechanics captured 24% of the global market, second only to Japan’s Murata Manufacturing. However, Chinese smartphone brands have reportedly begun using domestic MLCC suppliers as leverage in pricing negotiations.

Semco, a major player in the MLCC industry, faces challenges due to its significant reliance on China for approximately 40% of its revenue. To mitigate this vulnerability, the company has intensified its efforts to diversify its portfolio, focusing on high-margin segments such as automotive electronics and AI servers.

Semco’s strategic shift is already yielding tangible results. In 2024, its automotive MLCC division experienced double-digit revenue growth. Moreover, the company secured a substantial supply deal worth several hundred billion South Korean won with Chinese electric vehicle manufacturer BYD, with shipments already underway. At the March 2025 shareholder meeting, CEO Chang Duckhyun revealed that automotive MLCCs now constitute 15% of total MLCC revenue and have the potential to surpass 25% by the end of 2025.

AI servers are also emerging as a key growth driver. These systems require significantly more MLCCs compared to traditional servers, with estimates suggesting up to eight times more MLCCs per AI server compared to conventional units, as per SK Securities. This increased demand is fueled by the rise of AI accelerators, autonomous driving, and the growing adoption of electric vehicles.

According to The Korea Economic Daily, Samsung now holds approximately 40% of the global MLCC market for AI servers, narrowing the gap with Murata’s 45%. This near-equal footing contrasts sharply with the broader MLCC market, where Murata leads with over 40%, while Semco, TDK Corp., Yageo Group, and Taiyo Yuden collectively hold between 10% and 20%.

Beyond the field of artificial intelligence, Samsung recognizes substantial growth potential in the high-voltage automotive MLCC market. Mordor Intelligence projects the global high-voltage MLCC market to expand from US$4 billion in 2024 to US$11 billion by 2029, with a compound annual growth rate of 22%.