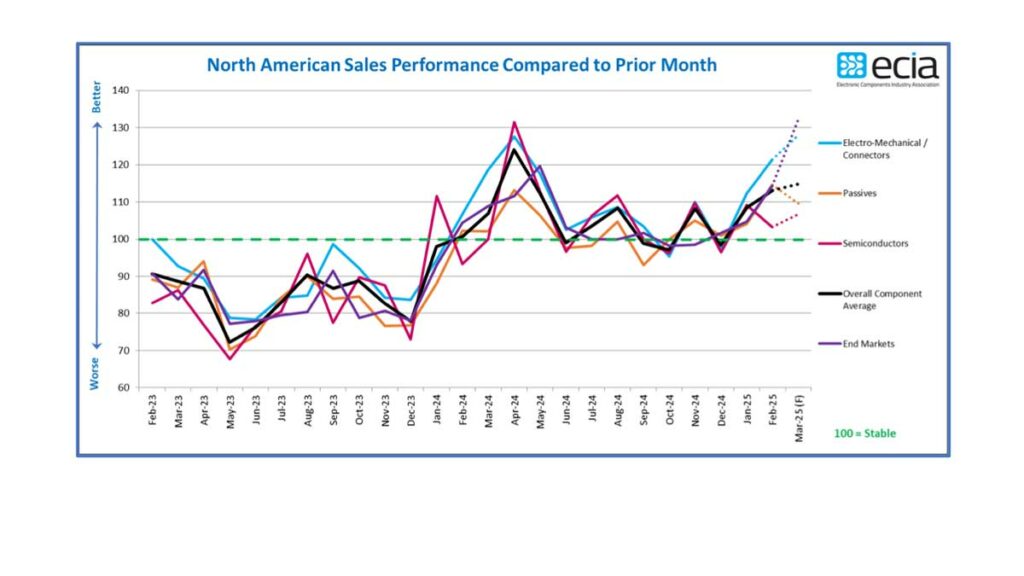

Sales sentiment for electronics components shows a solid improvement in the overall sales sentiment index for electronic components in February 2025 according to the ECIA North American sales sentiment survey.

The February ECST results demonstrate a significant improvement in the overall sales sentiment index for electronic components, with a notable 4.7-point increase, reaching a high score of 113.1. This marks the highest score since April 2024. While the actual results fell short of expectations by 6.8 points, this improvement is a cause for optimism.

Electro-Mechanical components stand out with the most impressive results, experiencing a substantial 9.2-point jump in February’s actuals and a 6.6-point increase in March’s outlook, culminating in a score of 128.0. Semiconductors, on the other hand, saw a slight dip of 5.9 points in February but managed to recover with a modest 3.4-point increase in March, resulting in a score of 106.7. Passive components, however, exhibited a contrasting pattern, with a significant 10.6-point increase in February followed by a 5.1-point decline, ultimately settling at 109.6.

While the overall results in the latest survey are somewhat mixed, it’s worth noting that all component categories maintained solid results above the 100-point threshold, indicating continued month-to-month growth.

In contrast to the January ECST results, Distributors expressed growing pessimism across all categories in February and March compared to other participants. Manufacturer Representatives, on the other hand, delivered the most positive scores in February and maintained a relatively strong position overall in March. Although their scores were slightly negative compared to the overall results, they surged to the strongest expectations among all participants in March.

Among the component subcategories, Electro-Mechanical components continued to lead the way, followed by Semiconductors and Passive components.

The MCU/MPU category was the only one to fall below the 100-point threshold in February, with a score of 91.3. However, in March, all subcategories achieved scores of 100 or higher. The lowest score in the March projections is Inductors, which scored 100.

The overall index score for end markets demonstrated strong performance in both February and March, surpassing 132 in March. The only categories that fell below 100 in February were Automotive (90.0) and Consumer Electronics (92.7). Consumer Electronics is the only segment that continues to be below 100 in March.

The Q1 Quarterly ECST survey revealed positive results for Q1. Respondents who reported growth expectations accounted for 39% of the total, while those who reported declining expectations made up only 12%. Growth expectations for Q1 were modest, with 29% expecting growth between 1% and 3%. Slightly less than half of respondents anticipated a flat quarter-to-quarter growth in Q1.

While maintaining a generally positive outlook, the Q2 outlook has a more moderate perspective. 32% of respondents expect growth, while 16% predict a decline. This more cautious outlook is likely influenced by uncertainties surrounding various economic factors, particularly the impact of tariffs. The industry hopes to demonstrate resilience in the face of uncertain economic prospects for 2025.