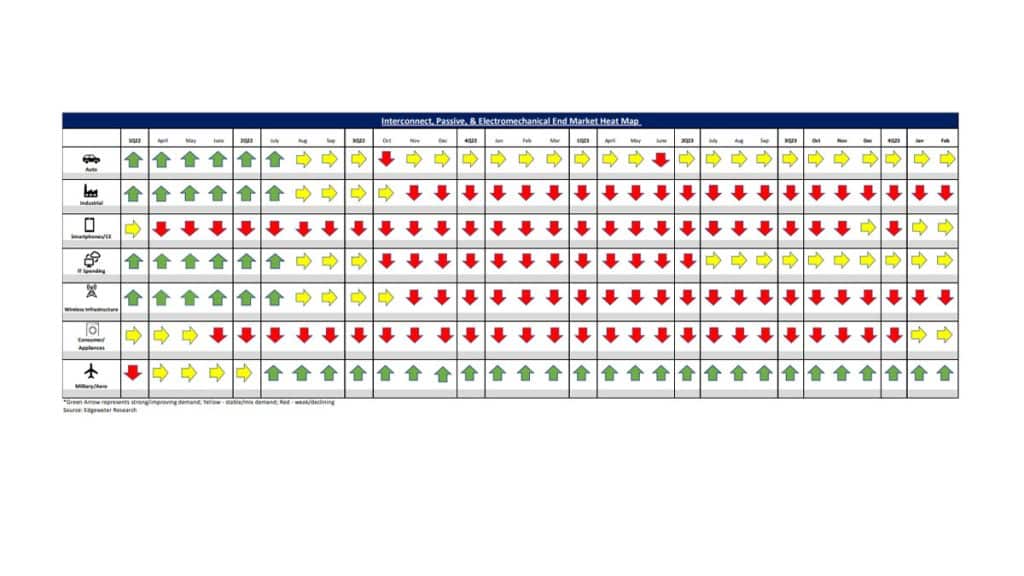

February 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Bookings stable with further pockets of improvement direct and from some distis but also continued pushouts in EVs.

2. EV feedback in the West trending down with production cuts seen across most OEMs including Tesla.

3. Auto design activity in the West seen pivoting to hybrids from BEVs, implying more modest content uplift near and medium term.

4. Industrial demand showing signs of green shoots in N.A. with rush orders direct for select products implying inventory progress.

Top 4 Channel Comments:

• We have started to reorder with IP&E suppliers. We are still managing SKUs that are not moving fast but we are adding stock to fast-moving ones. It is selective, not broad-based. We have made progress on our inventory, but we have more work to do.

• Connector demand is relatively stable, but we are concerned about the layoffs we see in EMS and distribution. It makes us question whether 2H demand would recover if the industry is laying off people.

• The Industrial business for us is just a bit better than distribution, which is the softest. We feel a bit more optimistic that direct demand from Industrial starts to improve before distribution in 2H24. That is based on conversations with large industrial customers.

• Auto connector demand remains good. We grew high single-digit last year. This year EV is a headwind in the West with some product rationalization, but we still feel we can hit mid-single-digit to high-single-digit growth based on programs and project wins.

Other Key Takeaways:

5. IP&E CY24 outlook little changed at up LSD-MSD on 1H destocking, mixed Auto, and assumptions of 2H rebound.

6. Supply chain still more optimistic connector destocking ends by mid-year on signs of progress and healthier inventory levels. However, recent ramp-up in cost control from EMS/distis seen as a cause of incremental concern around 2H demand shape.

7. Orders pre-CNY seen as weaker than normal; focus shifting to post-CNY order activity to gauge China demand momentum.

8. Despite incremental slowdown in EVs in the West, Auto connector outlook unchanged at +5-8% on strong China and stable pricing.

9. PHEV/HEV end demand seen as more stable in Europe.

10. Feedback little changed on pricing (stable) and inventory, which is seen as still elevated in some markets but better relative to semis.

Conclusion

Following the signs of stabilization in IP&E noted in our research at the end of 2023, our February update marks the second straight month of further improvements in fundamentals. We are growing more confident that the IP&E industry is poised to complete inventory digestion in 1H24, contrasting with the broader analog semis where visibility is more limited. Fundamentals by end market are mixed, with pockets of green shoots in Industrials and a further weakening in EV markets. While the near-term moderation in BEV is concerning, feedback points to an uplift in hybrid EV activity, which clearly does not carry the content opportunity of BEVs but still marks a step up compared to ICE vehicles. We remain comfortable with our low to mid-single digit growth outlook for the year, with opportunities for upside in 2H in traditional markets following the completion of inventory digestion, as well as expansion in newer markets like AI.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research