Edgewater researchers remain optimistic that the industry is still in the early stages of recovery. They anticipate that the IP&E sector will spearhead the component industry’s recovery, achieving mid-single-digit growth in 2025. February 2025 collection of news summaries, survey results, and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

AI Outlook Still Robust Despite Roadmap/Content Changes, Broader Market Trends Showing Signs of a Rebound

What’s Changed/What’s New?

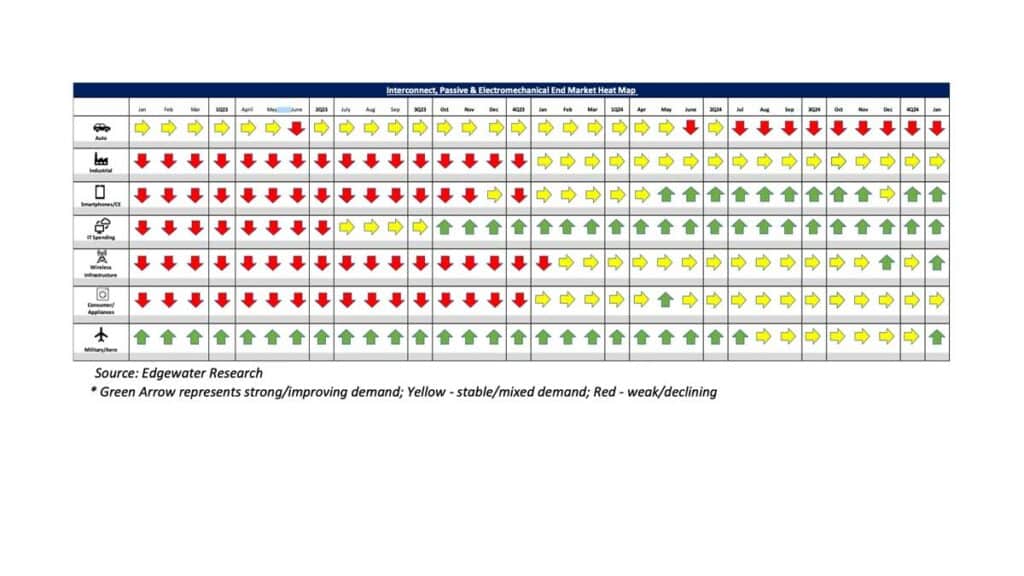

1. Broader demand datapoints better with positive B2B gaining momentum on order improvement from distis globally, Telco, Traditional IT, Mil/Aero and pockets of mass Industrial accounts, including in Europe.

2. Additional signs of inventory bottoming in 4Q, IP&E suppliers beginning to ship to end demand levels, some restocking occurring.

3. CY25 AI demand still projected strong, but with growth expectations seen moderating due to changes in Nvidia roadmap/content. Near term revenue impact seems limited with 1Q demand tracking slightly ahead driven by customers’ focus on securing supply.

Top 3 Channel Comments:

• The challenge in AI comes from an architectural standpoint, not capacity. Everything is a race right now, there are no fixed specifications, changes are happening on the fly, and customers and suppliers are learning on the fly.

• Industrial demand from Europe distribution has improved since the start of the year with B2B jumping to 1.1 in Jan/Feb from <1 in 4Q. We are also starting to book some backlog orders. We remain cautiously optimistic as a year ago we got fooled by 1Q bookings.

• Auto demand in the West remains tough but it feels like we’re past the worst, at least in Europe. I wouldn’t say Auto in Europe is getting materially worse compared to what we saw over the last several months.

Other Key Takeaways:

4. 1Q demand seen tracking slightly ahead of targets with seasonal Asia, slight Q/Q growth in Americas, and flattish Europe.

5. Auto reads in the West still cautious for 1H, with 2H optimism in Europe on potential EV incentives, ramp of pushed out programs.

6. Industrial reads better for 2nd month, on replenishment by distis globally and improvement in sell-through. Demand recovery also seen from distis in Europe with connector suppliers reporting jump in Jan/Feb B2B to 1.1-1.2 vs <1 in 4Q.

7. Within IP&E, connector trends noted as leading the recovery, followed by passives and electromechanical with pockets of remaining elevated inventory at customers for the latter group. Lead times for some passive components going into AI applications seen extending with capacity utilization for certain product lines approaching 100%.

8. Nvidia Rubin and GB300 seen potentially adopting a hybrid backplane design; PCB design projected for future rack generations.

9. Nvidia NVL288 single rack concept seen potentially using orthogonal PCB design; prospects for NVL288 mass production unclear.

10. Amazon Trn2 rack ramp-up seen as slower than expected on supply chain setbacks; issues noted as more modest compared to Nvidia NVL. Official forecast for 2025 noted as unchanged but builds likely more 2H weighted vs original plans.

Conclusion:

IP&E fundamentals continued to show signs of improvement in February. The IT Datacom market remains the primary growth driver, though the supply chain continues to grapple with technical and scaling challenges around new Nvidia platforms. Beyond IT Datacom, we see encouraging improvements across multiple end markets, particularly in the mass market business in EMEA, which was among the more challenging regions exiting 2024. With sustained strength—albeit at moderating growth rates—in IT Datacom and early signs of a rebound in other markets, we remain confident that the industry is in the early stages of recovery. Given that inventory levels are widely seen as healthier than in semiconductors, we expect the IP&E sector to lead the component industry’s recovery, returning to mid-single-digit growth in 2025.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research