Denis Zogbi, Paumanok Inc. discusses high reliability passive components trends and market in his recent article published by TTI Market Eye.

Global passive electronic component markets are currently experiencing a significant amount of financial turbulence, a situation brought about by global economic stimulus programs and the continued impact of the pandemic on key materials and component segments of the high-tech economy.

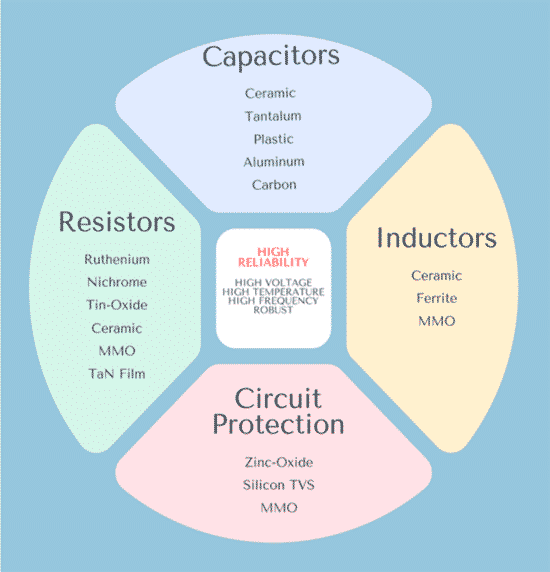

In short, 2021 revenue and volume numbers for capacitors, resistors, inductors and circuit protection components are reaching all-time highs. A significant amount of these revenues are being converted into excess capacity, especially in areas of technological sophistication where the market needs more competition – areas such as high voltage, high frequency, high temperature and robust mechanical passive component designs.

Component vendors throughout the market, but especially those in Japan, Korea and China, are subsequently eyeing higher-reliability market segments for acquisition, partnership and aggressive expansion as of November 2021.

High-Reliability Passive Component Products By Definition

The following chart (Figure 1) illustrates how passive components are all required in “high-reliability” segments of the global market, with emphasis upon capacitors, resistors, inductors and circuit protection components.

In addition to basic passive functions in a circuit (i.e. providing capacitance, resistance, inductance and overvoltage/overcurrent protection) these components are also subjected to additional stimuli that requires a robust design. Component suppliers add value by engineering them to operate at increasingly higher voltages, higher frequencies and higher temperatures.

The Need for Passives in Mission-Critical Markets

Capacitance, resistance, inductance and circuit protection are required in almost all electronic circuits and are fundamental to electrical and electronic system architectures. Mission-critical end markets are no exception to this rule, which places strategic importance on key parts in the application-specific and mission-critical parts ecosystem.

To satisfy the demand for capacitance and resistance, the primary components consumed are multilayered ceramic chip capacitors (MLCCs) and ruthenium thick film chip resistors. All other passive components – including tantalum, aluminum, plastic film, nichrome, carbon, tin oxide and various types of mixed metal oxides (MMOs) – find their way into high-reliability supply chains because of the precise nature of specific components and their known reliability in harsh and demanding environments.

What Qualifies as “High-Reliability”?

The following criteria are used to determine the differences between mass commercial markets for passive electronic components and their high-reliability counterparts. This is a simple technical-economic comparison of channel requirements to compete.

End-Market Considerations – Markets in which high-reliability passive components are consumed include aerospace/defense/satellite, medical implants, medical test and scan, downhole pumps, downhole logging tools, radar pulse forming networks, TV transmitters, welding equipment, munitions electronics, undersea cable repeaters, semiconductor RF sputtering devices and optical networking infrastructure devices.

Volume and Value Considerations – High-reliability passive components are dominated by low-volume, high-price parts. Price is considered secondary to product performance when it comes to high-reliability capacitors, resistors, inductors and circuit protection designs.

Operating Margin Considerations – The operating margins associated with high-reliability passive components are among the highest in the industry. Operating margins are typically as high as 75 percent in key markets such as medical, downhole pump and defense, and 30 percent in telecom infrastructure and specialty power supplies.

Price Stability – Price volatility is typically not an issue in high-reliability passive component markets because price is secondary to product performance, unlike the mass commercial markets where price volatility is rampant and quarterly price reviews are not uncommon. Downward price pressure in the mass commercial markets is generally accepted as the norm, whereas such volatility is generally not present in high-reliability component ecosystems.

End-Product Lifecycle Considerations – The lifecycle of the end product into which these high-reliability passive components are sold is also a consideration. In general, the life expectancy of these end products is five to ten years, while the lifecycle of mass commercial products is one to three years.

Population-Driven vs. Performance-Driven Product Considerations – High-reliability passive components are sold to customers based upon their performance criteria and their inherent and expected quality, while mass commercial products are sold in large volumes to meet the needs of a much larger population.

Regional Market Considerations – The largest high-reliability passive component markets are the United States, France, the United Kingdom, Germany and Japan, with China and the rest of the world as emerging markets for these advanced parts.

Competitive Environment Considerations – High-reliability passive component vendors are generally smaller “mom and pop” type manufacturers that specialize in one, or a few, specific fields of expertise, such as high voltage products, high frequency products or high temperature products. These manufacturers have years of experience and subsequent “sticky” customer relationships that defy traditional channels of business, and which remain highly profitable and coveted segments of the supply chain (the greenest part of the ecosystem).

Value-Added and Application-Specific Market Knowledge Requirements

From a business perspective, the motivation of the component manufacturer to pursue more technologically demanding component markets is based upon well-documented risk/reward criteria:

Increased Share and Operating Margins Through High-Reliability Passive Component Markets – Certain passive component manufacturers have penetrated commercial and professional markets to such a great degree that increasing their operating margins and market share requires entrance into the high-dollar-value, high-profit-margin passive component segments of high-voltage, high-frequency, high-temperature and robust passive component markets worldwide.

High-Voltage, High-Q, High-Temperature, Robust/Overlapping – High-reliability passive components offer some intrinsic value based upon their structures, which includes their ability to operate at high voltages, at high frequencies or in high-temperature or otherwise harsh environments. Sometimes these criteria overlap, i.e. a capacitor may be required to operate at high voltage and high frequency (for example, in MRI equipment), or at high voltage and high temperature (in defense related circuits, or in some downhole pump or geothermal circuits).

This combination of multiple requirements increases the price and profitability of these components accordingly. Also, this author’s research has determined that when high voltage, high frequency and/or high temperature requirements are combined – especially in oil well services industries, defense electronics and medical electronics – the prices are especially high and the margins exceptional for the finished products.

Component vendors can also command a premium if passive components have unusual voltages, capacitance values or capacitance change with temperature requirements – or, if the components require an unusual electrode or termination material (such as platinum or gold) or an unusual termination type (such as polymer flexible termination).

Importance of Customer Relationships & Vendor Responsiveness – It is also important for readers to understand the importance of personal customer relationships in the high-reliability passive component market segment. Since the number of specialty customers requiring these components is limited, certain individual salespeople in the field have been known to move from brand to brand within the segment, taking large customer bases with them in the process because of personal loyalty between customer and salesperson. This is very common in oilwell services, aerospace, satellite and medical segments of the high-reliability end markets.

High-Reliability Market Segments in Electronic Components

High-Voltage Segment – High voltage passive component products include chips, axial and radial leaded designs, single layered discs and “doorknob” categories of components for harsh or demanding applications. Prices for these components remain high, especially for doorknob capacitors consumed up to the 100 kV range. The largest application is power supplies, which require capacitors, resistors, inductors and circuit protection for input/output filtering circuits and which are fundamental to the power supply; converter and inverter architectures and/or the entire sub-assembly may be exposed to high temperatures and harsh mechanical and physical environments, based upon altitude, depth and/or rapid-on/off cycling.

High-Frequency Segment – High-frequency passive components include both thick and thin film designs, as well as multilayered and single layered configurations. Ceramic-based passive components are favored in these circuits for their farad and ohmic stability at high frequencies. Applications include communications infrastructure, RF sputtering, transmitters, radar equipment, lab test equipment, medical imaging devices and specialty feedthrough EMI filters.

High-Temperature Segment – High-temperature circuits (i.e. operating temperatures above 200C) are challenging environments for component manufacturers because of the tendency for capacitance, resistance and inductance to change with applied temperature, thus impacting the fundamental function of the component in the circuit. Specific categories of plastic film capacitors are preferred in this environment because of their self-healing capabilities, but solid-state dielectrics such as tantalum and ceramics thrive here because of their inherently robust nature. High-temperature ecosystems include space, defense and oil and gas electronics, including downhole pumping and logging tools.

Summary and Conclusions

Component manufacturers are currently moving toward more “conviction-related” investments and supply chains. In order to capitalize on this, vendors are refocusing their efforts on high-reliability categories of passive components where pricing and profits are secondary to component performance and reliability.

These components are fundamental to the circuit assembly, and include capacitors, resistors, inductors and circuit protection devices. Specifications are determined based upon the need for high-voltage, high-frequency or high-temperature, and/or the robust nature of the components required. End markets where mission critical and application specific circuits can be found include the defense, medical, oil and gas, infrastructure and advanced industrial sectors.