Source: Maxwell news

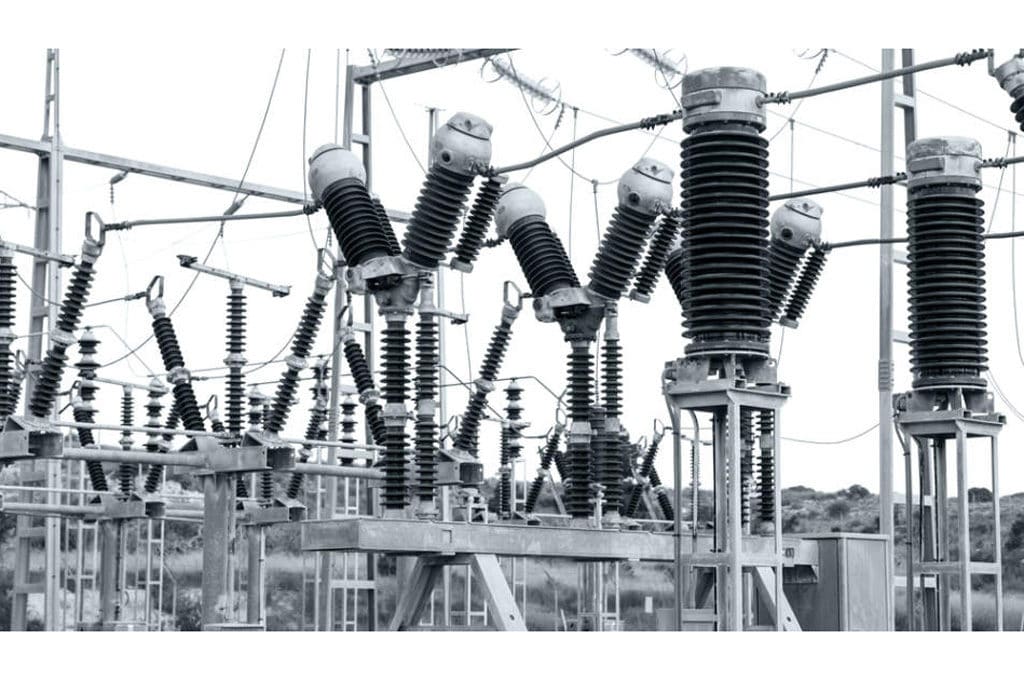

SAN DIEGO and LAUSANNE, Switzerland, Dec. 19, 2018 /PRNewswire/ — Maxwell Technologies, Inc. (NASDAQ: MXWL), a leading developer and manufacturer of energy storage and power delivery technology, today announced it has simultaneously signed and closed a definitive agreement to sell its High Voltage (HV) product line to Renaissance Investment Foundation.

Under terms of the agreement, Maxwell sold all shares of its Swiss subsidiary, Maxwell Technologies SA, and its CONDIS® line of high voltage capacitors for $55.1 million in cash and up to $15 million in potential future milestone payments to a special purpose holding entity and affiliate of Renaissance Investment Foundation (“Renaissance”). During the nine-month period ended September 30, 2018, its high voltage product line generated revenue of approximately $19.4 million for Maxwell, approximately 21% of the total revenue reported.

“This action was taken to put the necessary resources in place so Maxwell can better focus on and pursue the tremendous growth opportunities presented by the markets of auto, wind, rail and grid served by our Ultracapacitor technology as well as to properly support research and development efforts to advance our Dry Battery Electrode (DBE) technology,” said Dr. Franz Fink, Maxwell’s chief executive officer.

“It is becoming increasingly clear that our DBE technology holds significant advantages over currently available energy systems for electric vehicles (EV) and positions us for significant long-term value creation as a result. We felt the time was right to shift our focus to further develop disruptive technologies and energy systems that address burgeoning global markets, notably the dramatically expanding EV market,” Fink said. The International Energy Agency forecasts the number of EV’s on the road will grow from 3 million in 2017 to 125 million by 2030, a nearly 42X increase.

“While the decision to sell the HV business was difficult, it underscores Maxwell’s commitment to create long-term value driven by technologies that have the potential to dominate the markets they serve on a global basis. We remain steadfast in executing our plan and continue to explore all avenues to enhance shareholder value and improve our competitive position,” Fink added.

Maxwell is a company with an enviable tradition of creating innovative technology that holds notable competitive advantages for itself and those who employ it. This is very much the case with its Ultracapacitor technology in its Energy Storage product line, which has tallied significant design-wins while experiencing a growing sales pipeline, and remains a key component of the Company’s growth plans.

“This transaction is a win-win for Maxwell and Renaissance in that Maxwell is able to fuel their DBE development activities and we are able to add a business with a growth curve that fits well with our portfolio and investment approach,” said Xavier Paternot, managing partner at Renaissance. “Importantly, customers currently benefitting from their use of Maxwell HV products can rest assured performance and support, in all regards, will continue at a high level under the stewardship of Renaissance.”