Siberia is the largest natural mining operation for palladium and nickel, MLCC electrode metals and whose supply chain is threatened by current tensions in Europe. Dennis Zogbi, Paumanok Inc. discusses How the Supply Chain Is Reacting to Eastern European Tensions in his article published by TTI Market Eye.

Feedstocks for MLCC electrodes are individual elements on the periodic table and therefore they can be traced to their ore source by country and region. Primary sources include hard rock and artisanal mining, as well as “urban mining” of MLCC electrodes from recycled printed circuit boards (the older the board, the more palladium).

We estimate the global value of primary metals consumed as electrodes in the global multilayered ceramic chip capacitor (MLCC) market at $1.9 billion USD worldwide in 2021, a figure that includes engineered powders and pastes manufactured from palladium and nickel. [1]

Paumanok IMR tracks these materials on a monthly basis as they represent a variable cost for our customers who manufacture electronic components, and also because they represent a risk for circuit board manufacturers and the brands they represent. This is only one of the many competitive advantages of mapping out blockchains connected to the 8532 HTS Code and storing that data for an extended period of time, so that insights can be made and events can be planned for and profited from, instead of reacting too late and being disrupted.

This MarketEYE article demonstrates how the results of focused study of interconnected industrial blockchains related to the 8532 HTS Code reveal where risk is greatest, and usually this happens with natural resources or advanced materials technology. [2]

A detailed blockchain study of the 8532 HTS Code reveals that one key “flash point” is in the connection between palladium (Pd) and nickel (Ni) and their mutual consumption as competing electrodes into the global MLCC market. Connecting industrial blockchains to engineered materials, feedstocks and ores also creates new nodes based upon geography and sheds light on the interesting way that Mother Nature dispersed elements around the planet.

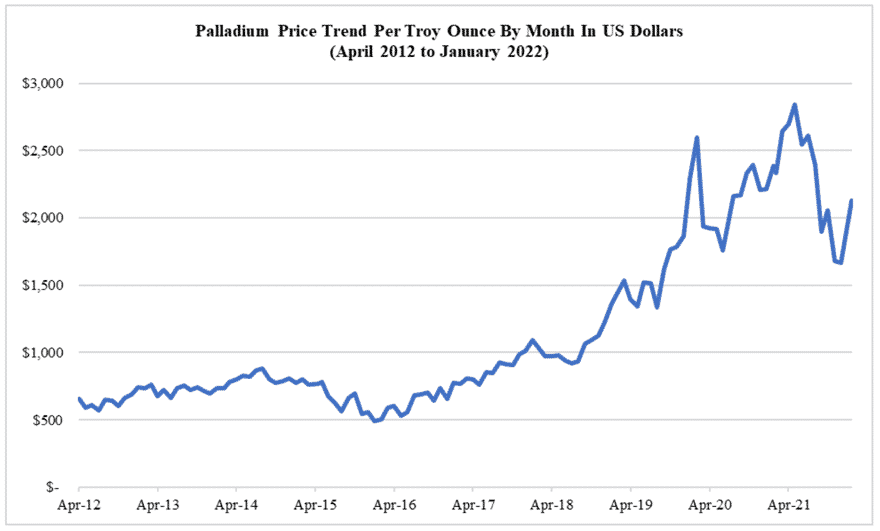

Palladium Price Trend 2012-2021

Palladium is a platinum group metal that is mined in Russia and South Africa, among other locations and is consumed primarily for auto-catalysts (a key enabling material for automotive manufacturers to meet emissions goals and minimize carbon footprints), but also as the primary electrode material in precious-metal-based MLCC, which are in turn used in high-reliability, high-temperature and high-voltage vertical product markets globally.

Such high feedstock pricing impacts costs to produce for many MLCC manufacturers and this is the primary motivating factor behind the movement to alternative electrodes and alternative MLCC designs in many end-markets where it has not been used before such as fossil fuel engine electronics, defense, space and oil and gas electronics.

The recent spike in palladium price is alarming from a cost issue, and the continuation of supply has become a concern as key markets compete for the metal. Note in the chart below the recent rise in the price of metal. This is in response to current tensions in eastern Europe and the threats of an embargo, which includes palladium and nickel.

Nickel Price Trend: The Prime Alternative to Precious Metals in MLCC Electrodes

Nickel is the primary electrode material consumed in base metal electrode multilayered ceramic chip capacitors (BME MLCC). The fluctuations in nickel price are primarily the result of competition for the metal with the steel industry, where it is used as a metal hardener. Nickel supply is, in turn, important for the production of X5R, X6S, Y5V and X7R MLCCs (via technology-related blockchains into barium titanates and ceramic dielectric materials). These are the capacitors of choice for the operation of smartphones, computers, automotive and home theater equipment. The overall price trend for nickel between April 2012 and May 2021 has been remarkably and comparably stable (see Figure 2).

The historical stability of price for nickel is a great selling point, for its use in MLCC electrodes to displace palladium/silver (Pd/Ag) designs. The reader should note that it is the rapid shift of materials pricing within existing contracts that have caused the most negative impact on profitability over time. (On the other hand, smart contracts using blockchains that designate the paths of raw materials will not allow for fluctuations in future price contracts.)

The most successful passive component manufacturers have the tendency to purchase raw materials when the prices are lowest and consume them when the materials price is at its highest – in effect “manufacturing profitability” by converting the added value of the materials when they offer the greatest opportunity for profit from the vendor. This technique is a method by which certain manufacturers today are using blockchain technology and mapping techniques to increase throughput of manufacturing and maintain product profitability.

Figure 2 shows the impact tensions in Eastern Europe are having on the price of nickel. This upward trend in electrode costs for MLCCs are expected to impact the markets in the March 2022 quarter.

MLCC Lead Time Trends

The Paumanok Monthly Index tracking MLCCs illustrates how demand has been steadily increasing and driving up the lead times to almost 25 weeks. The chart below shows how lead times for MLCC are increasing and the correlation between events in materials and its measured impact on MLCC supply and demand. Expect the chart below to move upward if tensions in eastern Europe persist.

Summary and Conclusions: Materials Markets and Outlook

Tensions in eastern Europe have impacted the price of both palladium and nickel because they are sourced in large volumes from a single mining operation in Siberia. Palladium and nickel are used in MLCC electrodes [6]. MLCC are the workhorse of the entire passive components industry and are found in all printed circuit boards. MLCC with nickel electrodes are consumed in consumer and professional electronic sub-assemblies, while palladium-based MLCCs are consumed in high reliability electronics.

The connections among electronic components and raw material ecosystems are important to monitor as they reveal specific changes in the markets, and how actions in one ecosystem create reactions in other ecosystems.

References:

[1] Zogbi, Dennis M. derived from “Nickel and Copper in MLCC: World Markets, Technologies & Opportunities: 2021-2025,ISBN #1-89-3211-38-X(NICUMLCC2021)” Published January 2021; Paumanok Publications, Inc. www.paumanokgroup.com., accessed January 28th 2022.

[2] Zogbi, Dennis M. derived from “Palladium and Silver in MLCC: World Markets, Technologies & Opportunities: 2021-2025,” Published January 2021; Paumanok Publications, Inc. www.paumanokgroup.com., accessed January 28th 2022.

[3] Zogbi, Dennis M. derived from “Paumanok Monthly Report On Passive Electronic Components- January 2022 Edition,” Published January 27th 2022; Paumanok Publications, Inc. www.paumanokgroup.com., accessed January 28th 2022

[4] Ibid.

[5] Ibid.

[6] Zogbi, Dennis M. derived from “MLCC: World Markets, Technologies & Opportunities: 2021-2025 ,” Published January 27th 2021; Paumanok Publications, Inc. www.paumanokgroup.com., accessed January 28th 2022.