Murata Manufacturing Co Ltd, which dominates the market for ceramic capacitors, has seen no slack in demand for smartphone parts as manufacturers carry on with their plans for releases of new models despite global coronavirus woes according to article published by Bloomberg

February and March orders from phone vendors kept up with last year’s levels despite uncertainties around end-user demand, Norio Nakajima, a Murata veteran who is set to take over as president in June, said in an interview on Wednesday. China’s Huawei Technologies Co Ltd and Oppo Mobile Telecommunications Corp Ltd have not deviated from their road maps laid out before the outbreak, Nakajima said, without naming the companies directly.

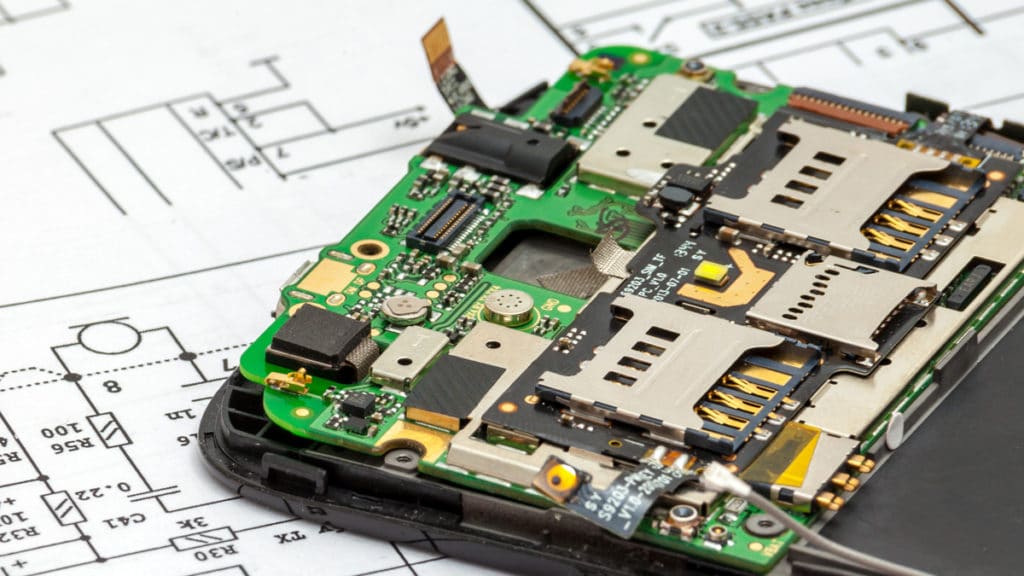

The pandemic has been a mixed bag for Murata, whose components are found in everything from Apple Inc iPhones to televisions and automobiles. While the company expects demand from carmakers to crater this year, orders for parts in wireless base stations remained strong as carriers build out their 5G cellular networks. A sudden rise in telecommuting and people stuck at home in quarantine has also led to a spike in demand from data centres and game console makers.

“The situation is hard to read, because the drivers are not economic,” Nakajima said, speaking from the company’s headquarter in Kyoto. “A lot depends on the pace of vaccine development and progress in treatment. But so far, the preparations are being carried out same way as last year.”

Key Insights:

- Smartphone companies are still on track to unveil new models in the fall, but the actual sales may slip depending on how the pandemic progresses.

- Manufacturers typically place orders in June for September launches and bookings usually peak by October. This year, the timing may slip.

- Production in China has mostly recovered from factory closures, with Murata’s own plants in the country operating at 80% capacity.

- The company is moving ahead with plans to increase output capacity by 10% next fiscal year and has already placed orders for new equipment.

Murata’s shares stood largely unchanged in Tokyo yesterday.

Worldwide smartphone shipments are expected to decline 2.3% to 1.3 billion units in 2020 as the Covid-19 outbreak spreads, according to research firm International Data Corp. The outbreak is projected to trigger a 10.6% decline in first-half shipments followed by a recovery from the second half and 5G will help accelerate demand in 2021.

“We like the long-term trends surrounding Murata with 5G and electrification of vehicles, but short term there is just too much uncertainty,” said Romeo Alvarez, equity analyst at William O’Neil & Co, who removed Murata from his ‘Buy’ list on March 9. “This was supposed to be the year when 5G goes mainstream. But we are not so sure anymore.”

Murata gets about half of its revenue from parts used in communication applications, including capacitors for base stations, bandwidth and noise filters in handsets. Automotive is its second-biggest business division, accounting for about 16% of sales. The company in October forecast ¥230 billion (RM9.16 billion) in operating profit on ¥1.51 trillion in sales for the year ended March 31.

Nakajima, 58, joined the company in 1985 and spent most of his career in Murata’s module business. He will be taking over from Tsuneo Murata, son of founder Akira Murata, who will continue as chairman.