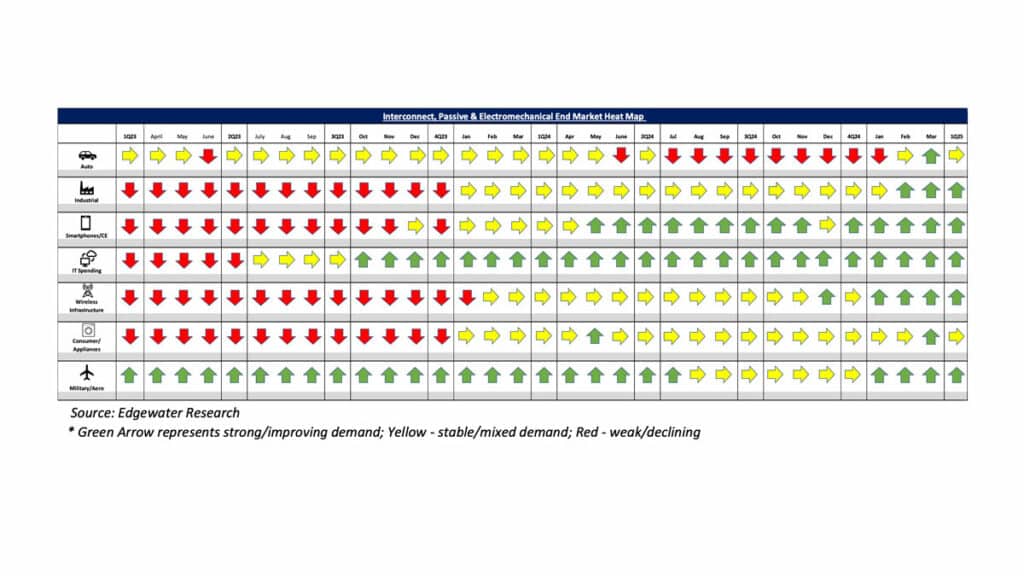

Edgewater researchers report first quarter of 2025 upside across end markets; second quarter reads stable amid tariff uncertainty. April 2025 collection of news summaries, survey results, and channel market insights on Interconnect, Passives components & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1Q shipments and orders showed improvement and surpassed targets across most end markets, indicating an upside trend. B2B shipments improved by more than 100% compared to the previous quarter.

Amid heightened uncertainty, the median 2Q demand feedback appeared relatively stable. While there were potential pull-ins in distribution and CE, the feedback was less pronounced compared to semiconductors. The full impact of tariffs is yet to be fully realized as customers are assessing the evolving risks.

Unlike semiconductors, IP&E products are subject to broader tariffs. On average, 20-40% of U.S. supply is estimated to come from outside North America, depending on the supplier. While suppliers are firm on passing tariffs, some connector suppliers are reevaluating planned price hikes due to the added burden.

AI demand forecasts remained relatively unchanged, with growth skewed to the first half of the year. The first quarter demand showed improvement, and the second quarter is projected to rise by mid-teens compared to the previous quarter.

Top 4 Channel Comments:

– Mass market bookings in North America increased by 10-12% year-over-year, while shipments finished up by 5-6% in the first quarter compared to the target of flat. We observed strength in military and aerospace, as well as EMS, where inventory appears to have become too low. Similar trends were seen in Europe in both bookings and shipments, which compares to the forecast of a decline in year-over-year sales. Additionally, B2B sales exiting the first quarter improved by more than 100% compared to approximately 100% in the fourth quarter.

– Auto demand rose by 100% quarter-over-quarter, primarily driven by the positive outlook in the United States. The impact of tariffs remains unclear. There were no cancellations or pushouts observed, although OEM plant layoffs in Canada and Mexico raise questions about potential output shifts versus net reductions. We have not observed any demand impact through mid-April.

– 80% of connector lead times appear stable, while 20% are increasing, primarily due to specialty connectors, antennas, contactors, and relays.

– We have observed a significant spike in demand for SKUs that had previously had zero demand for the past 18 months. There were a few SKUs that were almost discontinued because they had not received orders for so long. This trend suggests that industrial inventory burn is almost over.

Other Key Takeaways:

– AI connector shipments from China and Asia bound for U.S. customers are mostly routed through Mexico for server assembly, with USMCA mitigating the impact of tariffs.

CY25 Nvidia NVL rack projections remain unchanged at approximately 25K, with less than 10K units expected in the first half of the year. Some improvement has been noted in system builds, but backplane challenges persist. The change in the GB300 board is considered immaterial for connectors.

The risk from the CPO is still seen as limited. However, the risk from MT/LT is expected to persist for scale-up, although Nvidia adoption is not anticipated until Feynman.

Trn2 supply chain issues are improving, and rack builds are expected to ramp through June. AMD is targeting the MI400 rack MP for the second quarter of 2026, and the backplane design is ongoing.

Auto demand is expected to finish ahead in the first quarter, driven by positive sentiment in North America and a stabilizing Europe linked to improved ICE. The pre-tariff outlook is viewed as improved, although sentiment appears cautious amid tariff risk, mixed signals on pull-ins, and uncertainty around OEM output.

Industrial demand is improving due to distributor replenishment and signs of inventory normalization at some direct customers. North American commercial auto is also showing early signs of improvement. Mil/Aero demand is noted as strengthening, particularly in Europe.

Conclusion:

IP&E fundamentals in the broader market have shown signs of improvement through March and into early April.

In aggregate, the first quarter shipments were better than expected, with gains across virtually all end markets. This growth was driven by stronger end demand in the Mil/Aero/AI sectors and inventory replenishment in the Industrial/Auto sectors.

While the breadth of improvement is encouraging, the outlook for the second quarter and the remainder of the year has turned more uncertain.

The predominant risk cited is potential impacts from geopolitics and tariffs. The industry is working diligently, and while rising tariff risks have clearly widened the range of potential outcomes for 2025, we remain cautiously optimistic that the IP&E market has passed its cyclical bottom, barring any significant disruptions to end demand.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research