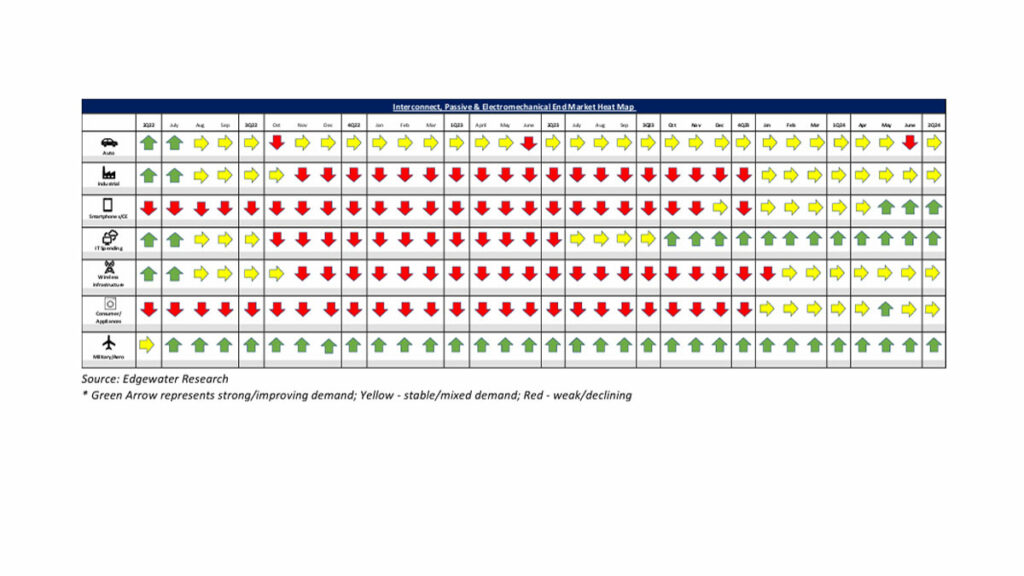

July 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

2Q 2024 viewed largely inline & mixed; bookings moderating in automotive in late-June into July

What’s Changed/What’s New?

1. Orders seen as more mixed in June/July with softening in Auto, stability in Industrial, continued strength in Mil/Aero, AI and Consumer, and an uptick from distribution reflecting inventory normalization. B2Bs viewed as ~1 exiting 2Q and relatively flat Q/Q.

2. 2H Auto connector demand is seen as softening since June with bookings slowing, cancellations increasing, and volumes revised lower for some programs driven by delays and production cuts in Europe and N.A.

Other Key Takeaways:

3. 2H Auto volume cuts seen driven by foreign OEMs in China, EV program delays in the West and production cuts in Europe/N.A.

4. China Auto still a bright spot. Tier 1 suppliers still gaining share NT though sustainability a concern MT on Chinese possibly catching up.

5. Comm Transport seen as remaining soft in N.A. with an uptick in Rail offset by continued digestion in heavy truck and ag.

6. Industrial still mixed with 2H demand seen flattish, lacking upward momentum despite pockets of inventory normalization.

7. Disti connector inventory viewed as normalized entering 2H, but order replenishment noted as muted by end-demand uncertainty.

8. Mil/Aero demand still robust. Amphenol/TE lead times upticking. TE AD&M leader seen leaving, possibly due to recent op struggles.

9. Amphenol/TE/others seen raising pricing in distribution by 1-3% for select lines on 7/1. Price increases noted as narrower than anticipated.

Conclusion

Demand signals remain mixed through the end of 2Q, with overall sales tracking largely inline with expectations entering the quarter. While shipments appeared to have bottomed out in the 1st half of the year, the pace of the recovery still remains muted, with the overall bookings environment turning more mixed as 2Q progressed.

B2B ratios are still noted as ~1x exiting 2Q, but backlog for most markets remain non-existent for 2H24 with distribution/OEMs/EMS continuing to focus on turns orders vs. any providing any extended backlog to IP&E suppliers. Furthermore, bookings were noted as moderating in June/July, in particular in the Automotive industry, while most other markets were noted as stable.

While the slight moderation is noteworthy, we still continue to believe the IP&E industry fundamentals are healthier than semis and would look for continued improvements through year-end before returning to more historical growth rates in 2025.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research