The results of the December 2021 ECST survey delivered a pleasant surprise. Measurement of actual sales sentiment for December outperformed the sales outlook for December from the prior survey by a wide margin according to the ECIA’s Electronic Component Sales Trend (ECST) December and Q4 2021 Surveys summarized by Dale Ford, Chief Analyst.

The overall component sales sentiment outlook for December published in the November report was 95.2, an indication of expectation of a month-to-month sales decline. The actual sentiment measured for December in the latest survey is 114.4, a difference of 19.2 points and an indication of sales growth.

This was also an improvement over the November actual sales sentiment of 111.0. Even more encouraging is the jump in the index in expectations looking forward to January 2022. The sentiment forecast for January jumped to 125.8, the highest level since August 2021. The overall end-market sentiment index mirrors the product index closely.

From the longer-term perspective, the Quarterly ECST results deliver a similar encouraging view. The survey results for Q4 2021 show that 64% of respondents expected growth in Q4 2021 and this remains stable looking toward Q1 2022 at 62% of respondents. Semiconductors measure the highest level of optimism with over 70% expecting growth in both Q4 and Q1.

The principal difference between Semiconductor expectations for Q4 and Q1 is a much smaller percentage expecting growth above 5%. All component categories show a trend toward growing expectations for growth between 1% and 3% in Q1 2022 compared to Q4 2021. While higher growth expectations are being tempered looking forward, they still provide an optimistic picture for the continued long-term growth of electronics component sales.

The detailed monthly survey measurement of sentiment for end-market demand shows every market sustaining a sentiment above 100 for December. Only three end markets report an expectation of sales sentiment below 100 for January – Computer, Consumer and Mobile Phones. However, all three are only slightly below 100 in January expectations.

The greatest optimism looking toward January is found in Avionics/Military/Space, Industrial Electronics and Medical Equipment. As noted previously, the market and component indices exhibit an element of seasonality in the month-to-month growth expectations. The electronics and electronics component markets have exhibited this typical, seasonal pattern of growth through most of its history. Average fourth quarter growth is usually the lowest quarter during the year. Fortunately, it appears the seasonal impact has still not resulted in a month-to-month decline in expectations of sales growth in the later months of 2021 and first month of 2022.

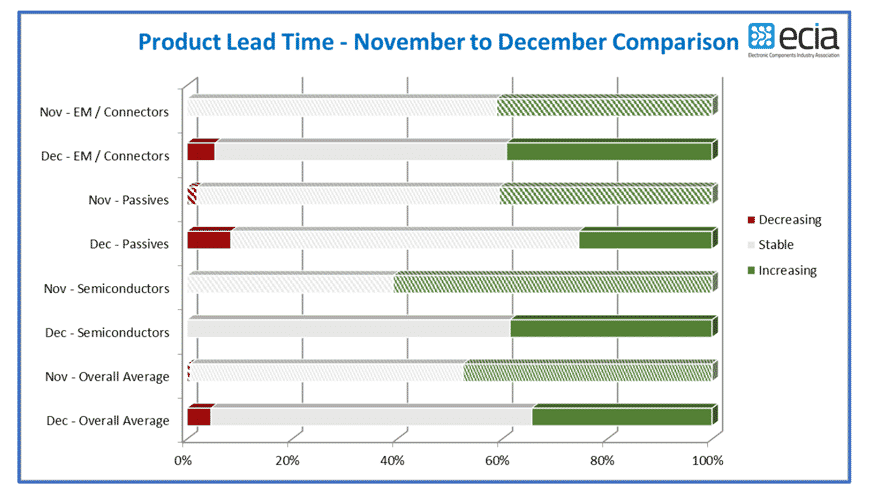

Comparing the results between the November and December surveys shows a notable easing in lead time pressure for Semiconductors and Passive components as those reporting increasing lead times declined substantially. Electro-Mechanical components maintained a fairly steady level. However, even this category saw a meaningful share reporting decreasing lead time. All of the component subcategories reported a decline in lead time pressure.

see complete ECIA pdf report: