Lead times are increasing for multiple types of passive electronic components in 2021. Dennis M. Zogbi comment the latest trend in demand and leadtimes in his article published by TTI Market Eye.

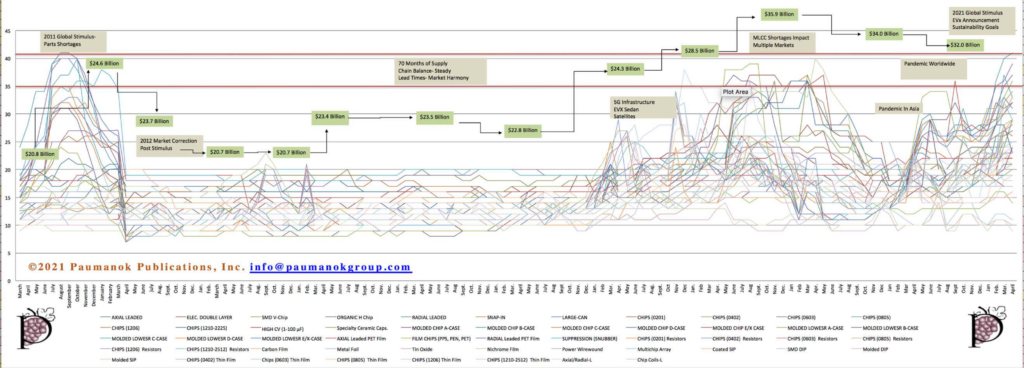

Figure 1 below is from Paumanok’s latest market research report titled “Passive Electronic Components: World Market Outlook: 2021-2026.” It reveals that we are about to enter a new level of value in the passive component supply chain.

The index, which follows 53 types and configurations of passive component (capacitors, resistors and inductors) show a spike in lead times reminiscent of recent spikes that demonstrated shortages and price increases.

Source: Passive Electronic Components: World Market Outlook: 2021-2026. Paumanok Publications, Inc., Passive Electronic Component Global Market Monthly Report Summary: March 2012-April 2021 (122 Months) Lead Times and Corresponding Market Value for 53 Types of Passive Electronic Components.

Overall Capacitor Lead Times

Lead times increased again in April for almost all capacitor products tracked in the index, following a strong increase in demand for March 2021.

Lead times increased by 7.1 percent in February, 6.8 percent in March 2021 and 2.9 percent in April 2021. These increased lead times for capacitors are due to strong demand from battery electric vehicles and the telecom infrastructure sector, while computing and gaming demand remained at above normal levels of demand as part of the global “stay at home” trend.

Source: Passive Electronic Components: World Market Outlook: 2021-2026. Paumanok Publications, Inc. “Monthly Market Research report on Passive Components for April 2021.”

Overall Resistor Lead Times

In April of 2021, resistor market lead times increased again, with thick film chip resistor demand up sharply, as well as demand for thin film chip components. However, lead times for resistor networks declined across the board for all types and configurations.

The visual interpretation of the data is presented in the chart below. The chart shows an increase in lead times for the month of April 2021 as demand for thick and thin film chips increased on a month-to-month basis to support telecom infrastructure and automotive electronics demand in the month.

Sources: “Passive Electronic Components: World Market Outlook: 2021-2026.” Paumanok Publications, Inc. “Monthly Market Research report on Passive Components for April 2021.”

Overall Inductor Lead Times

Discrete inductor demand increased sharply in April 2021, as lead times increased 10.4 percent on a month-to-month basis. As a key component in noise suppression, inductor markets remain elevated. Demand is related to 5G base stations, but is also impacted by auto telematics and auto radar circuits which are driving up demand for robust discrete inductors for challenging environments.

The jump has affected all three key sub-categories in discrete inductors and is an oddity, having never occurred before in the history of this index.

Demand for all discrete inductor products increased sharply on a month-to-month basis for April of 2021, following increases in January, February and March of 2021 as well. The increase came in demand for all types of discrete inductors across the board and is very odd having never occurred before in the lifetime of the index. The latest demand for inductors remains generally elevated because of their use in communications end-markets, especially 5G base stations, but also by demand for uses in telematics and radar circuits for driver assist.

Source: Passive Electronic Components: World Market Outlook: 2021-2026. Paumanok Publications, Inc. “Monthly Market Research report on Passive Components for April 2021.”

Raw Materials Prices

Passive components are raw-materials intensive. Raw materials, in the form of engineered powders and pastes, make up the largest variable cost associated with the production of passive components.

The raw material price index for passive electronic components increased by 2.3 percent in April on a month-to-month basis, and remains elevated at 120-month highs.

Pricing of palladium and ruthenium are at all-time highs and impacting the costs to produce specialty MLCCs and thick film chip resistors.

Source: Passive Electronic Components: World Market Outlook: 2021-2026. Paumanok Publications, Inc. “Monthly Market Research report on Passive Components for April 2021.”

Summary and Conclusions

The passive electronic component portion of the market outperformed in the March 2021 quarter due to pre-buying of capacitors, resistors and inductors by the automotive and handset industries, in anticipation of unit recovery in those two end-markets after the pandemic.

Demand from battery electric vehicles as a subset of the automotive industry is creating net new market value for capacitor, resistor and inductor manufacturers who are selling into the fledgling converter, inverter, charger and battery management system markets.

The raw material price and availability situation is expected to worsen through the summer months and then begin to subside. The rising prices of ruthenium, palladium and tantalum will have the greatest impact on production costs going forward.

Copper and nickel prices are also expected to fluctuate as both are key materials in batteries and infrastructure. Expect longer lead times and rising raw material prices as a result.