Source: EPCIA newsletter

EPCIA has published the recent 2015-2017 European passive components statistics.

The European Passive Components Industry Association (EPCIA) represents and promotes the common interests of the Passive Components Manufacturers active in Europe to ensure an open and transparent market for Passive Components as part of the global market place.

Based on the aggregated results of the common European Passive Components Statistics (EPC-eStat), the markets developed as follows:

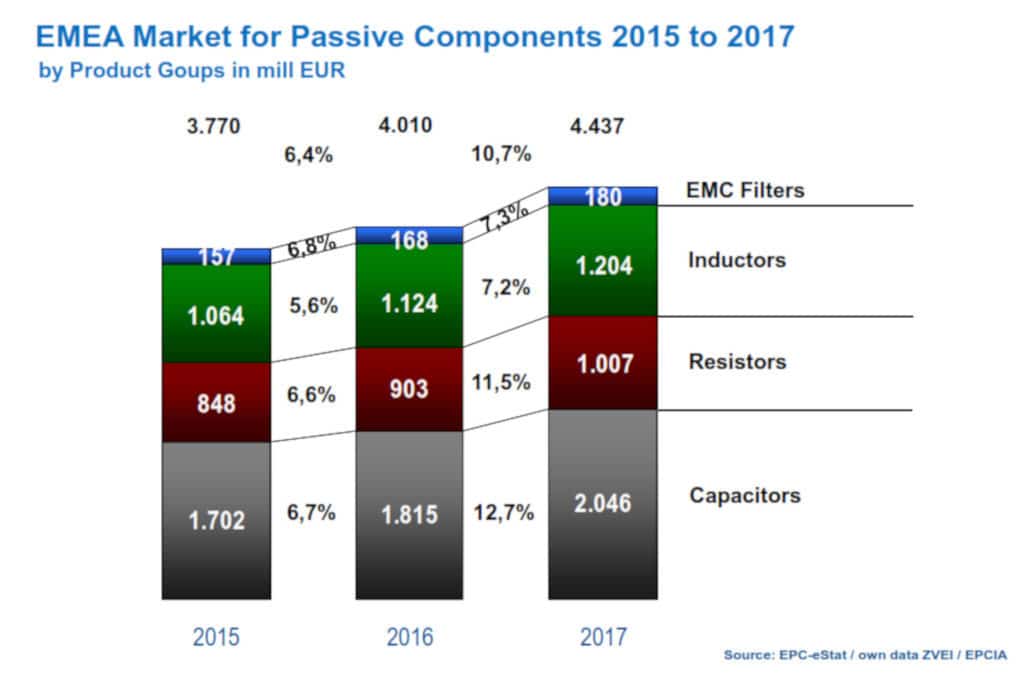

In 2015 the European Passives Components market increased to a volume of EUR 3.8 bn and could continue the healthy development in the following years 2016 and 2017 with a steady growth of 6.4% and 10.7% to a total of EUR 4.4 bn in 2017.

Product Groups

With a share of 45% and a volume of EUR 1.7 bn in 2015 Capacitors are the biggest product group of the Passive Components Market in Europe. Compared to 2015 the market grew by 6.7% followed by a huge increase of 12.7% in 2017, reaching a level of EUR 2.0 bn.

In 2015 the Resistors market reached a volume of EUR 0.85 bn. With a growth rate of 6.6% in 2016 and 11.5% in 2017 the Resistor market was able to break the EUR 1.0 bn last year.

Inductors represent the second biggest product segment among Passive Components in the EMEA market with a share of nearly 30%. The pleasing growth of 7.2% in 2017, however, was relatively moderate compared to the other product groups. The Inductors market reached a size of EUR 1.2 bn in 2017.

The market of EMC Filters totaled EUR 180 mill in 2017. It showed a steady annual growth of 7% on average from 2015 to 2017.

Main European Market Segments

The Automotive sector still represents half of the total Passives EMEA market. Hence, strong growth – as in the last two years – is of highest importance for Passive Components in Europe.

The Industrial segment as the second largest in the EMEA market and with a share of one third is of major importance, too. Here, the market development was also positive from 2015 to 2017 with moderate growth rates.

featured chart source: EPCIA