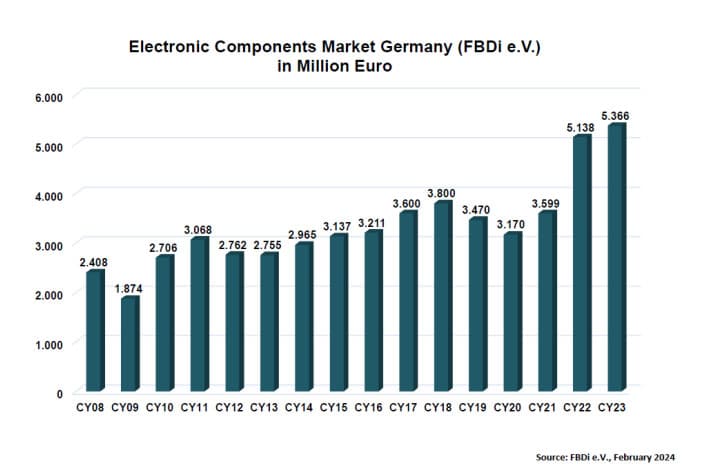

FBDi published its latest statistics of German component distribution market with slight sales growth in 2023 and negative outlook for 2024. However, the overall outlook for the future remains positive.

In the fourth quarter, the weak order intake of the last few quarters clearly hit sales.

The turnover of FBDi’s registered distributors fell by 20.1% to 1.08 billion Euros. As a result of the continued very weak bookings situation (-56% to 507 million Euros), the book-to-bill ratio ended at 0.47, indicating a difficult market situation for the coming quarters. Nevertheless, the full year 2023 remained positive despite the weak second half. Total revenues closed with an increase of 4.4% to 5.37 billion Euros.

The year for distributors was dominated by semiconductors. Although sales in the fourth quarter also fell by 21% to €745 million, for the year as a whole they grew by more than 10% to a record €3.73 billion. Passive components and Electromechanics performed less well (and have been doing so for some time).

They shrank both in the fourth quarter and for the year as a whole, with Passives down 15.9% to 136 million Euros in the fourth quarter (full year: -5.6% to 669 million Euros) and Electromechanics down 18.1% to 128 million Euros (full year: -7.3% to 620 million Euros). Similar declines were recorded for sensors, displays, power supplies and assemblies. The distribution of sales by component group remained almost unchanged.

FBDi CEO Georg Steinberger:

“The figures are not surprising, neither for the fourth quarter nor for the year as a whole. 2023 can be summarized by saying that it already includes a lot of business brought forward from 2024 and was therefore unrealistically high, which is exactly what will be missing in 2024. The next few quarters are likely to see a low level of new orders in the existing business, so the focus should clearly be on developing new designs and projects, which have probably not been a priority for customers due to the difficult delivery situation over the last two years.”

Looking ahead, Steinberger said: “The positive outlook of most market researchers for 2024 mainly concerns one area that could serve as a driver – memory and processors that support AI applications in data centers. This market is likely to be driven mainly by the US. The reality in Europe is different: We are facing a weakening industrial sector and an automotive sector under pressure, which are the two main customers for components and the main customer groups for distribution. The outlook for Europe this year is therefore rather moderate, with the hope of a turnaround after the summer. Our appeal would be not to get involved in pointless price wars, especially as component production costs are not getting any lower, but to focus on Europe’s innovative strength and inspire the market with new ideas”.

The overall outlook for the future remains positive

Steinberger continues: “We can now continue to moan about the crisis and complain about politics, or we can seize the enormous opportunities offered by digital transformation and the necessary, climate-friendly restructuring of society and the economy. Especially in the latter case, there are signs that companies are not only following the political guidelines, but are also leading the way, and that is also good for the electronics industry.

One issue that is not good for anyone, says Steinberger, is the increasing radicalization on the right-wing fringes of society, right through to the center: “It is time for us as an industry to take a much stronger stand against anti-human and anti-democratic tendencies in society. They damage society, the economy and Germany’s reputation as a cosmopolitan country.” Michael Huether of the Institut der deutschen Wirtschaft (IW) estimates the damage caused by the ‘audacious’ economic plans of the AFD and its allies at 500 billion euros in losses and 2.2 million jobs, not to mention the social upheaval.