Source: TTI Market Eye article

by Dennis Zogbi, Paumanok Inc.

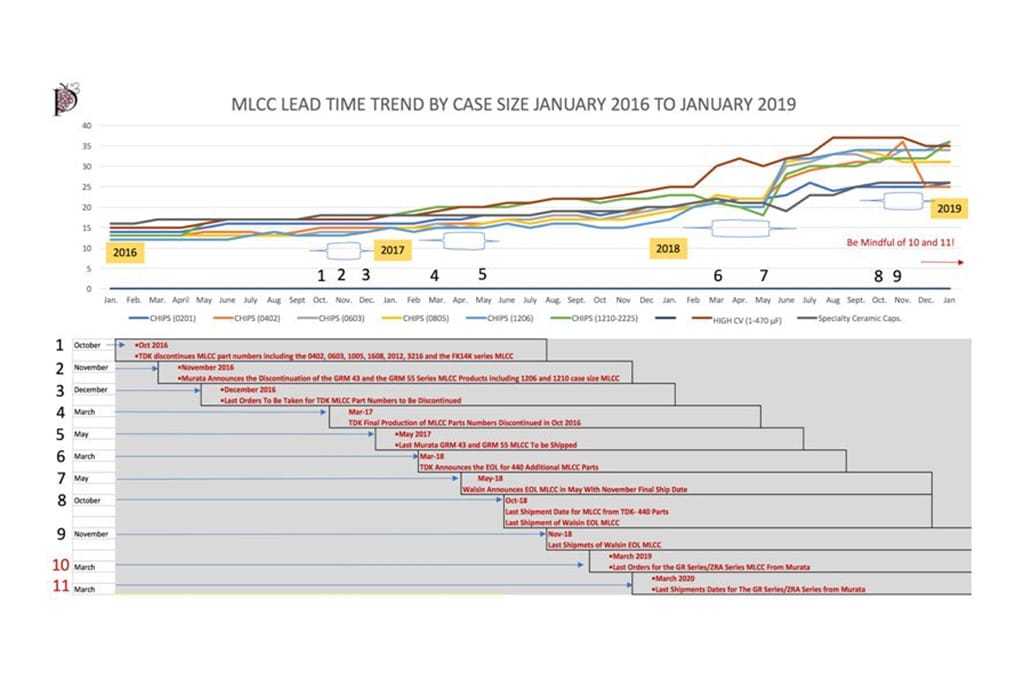

In this MarketeEYE article, Dennis Zogbi of Paumanok Industrial Market Research creates a timeline of discontinuation announcements for multilayered ceramic chip capacitors (MLCC) and demonstrates their impact on lead times, and offers the reader a glimpse about what is coming at them next with respect to MLCC in 2019.

Background

Multilayered ceramic chip capacitors (MLCC) have been in short supply since mid-2017, and this problem compounded itself in 2018 as many customers went below their comfort threshold in MLCC inventories or had to curtail product production because they could not get enough of the “right” MLCC. Primary sources interviewed for this MarketEYE article have consistently pointed toward the combined discontinuation of MLCC by Murata and TDK from 2016 through 2018 as the primary reason why this shortage has occurred. TDK and Murata are not the only vendors who have curtailed or stopped production of MLCC, and Paumanok notes that such vendors as Samsung, Taiyo Yuden and Walsin have also pulled back from large case size MLCC production or consolidated that production for the automotive industry in 2019. The following creates a timeline of discontinuation, last order date and final production date and compared it to MLCC lead times.

- EOL- End-Of-Life-Announcement of Discontinuation –

Manufacturers of MLCC who wish to stop production of a specific series will make an announcement in which the (1) end-of-life (EOL) date of the component is established, followed by a last order date and a final shipment date. - Last Order Date – The last order date for an MLCC means the last date the manufacturer will accept orders for this specific series.

- Last Shipment Date -This date is the last date upon which the factory will ship MLCC in the discontinued series

These three criteria help us to establish a time line and then match that time-line to subsequent analytical data showing the changes in lead times for MLCC by date as well, and how the end-of-life dates are significant in how they created shortages in the supply chain that continue in 2019.

Reasons for Discontinuation of MLCC Product Lines

In each of the press releases between 2016 and 2019 that announced the discontinuation of MLCC from TDK, Murata, Taiyo Yuden and Walsin, reasons were given for the action as follows-

- Unprofitable The primary reasons given in 2016 were that the specific lines chosen for discontinuation were not profitable.

- Deteriorating Equipment In 2017 it was also noted that the manufacturing equipment for larger case size MLCC was deteriorating and difficult to maintain and replace, and that the equipment vendors had stopped supporting larger case size production in favor of ultra-small case size production.

- Inconsistent Raw Materials Supply for some of the specialty parts, such as those employing high voltage, the ceramic dielectric materials are ready to mix formulations that come from the merchant market. The raw material markets for ceramic capacitors have also shifted in support of high capacitance ultras-small chip sizes and does not continue the advancement of specialty materials, such as high voltage and high temperature ceramic dielectric materials.

The Timeline for MLCC Discontinuation

The following creates a timeline of discontinuation, last order date and final production date.

- OCTOBER 2016: TDK discontinues 280 MLCC part numbers including the 0402, 0603, 1005, 1608, 2012, 3216 and the FK14K series MLCC. On October 31, 2016 TDK announced the discontinuation of “non-profitable and low demand” MLCC. This roster included 280 part numbers with case size designations spanning the portfolio of production and included (in mm and as written) the 0402, 0603, 1005, 1608, 2012, 3216 and the FK14K series MLCC.

- NOVEMBER 2016 – Murata Announces the Discontinuation of the GRM 43 and the GRM 55 Series MLCC Products including 1206 and 1210 case size MLCC. One month after TDK, Murata announced they too would be withdrawing product form the market and noted their GRM 43 and GRM 55 MLCC would be discontinued. On November 30th 2016 Murata announced that they would discontinue their GRM 43 Series MLCC and their GRM 55 series MLCC which included 100 microfarad maximum capacitance and 10-volt maximum voltage products. This targeted the 1206 and the 1210 case size chip MLCC. The discontinuation of the GRM 43 and GRM 55 product lines were finalized \ May 31, 2017. At the time of the announcement Murata noted that their manufacturing equipment was deteriorating and the raw material supply chain was not keeping up with supplying the market with advanced materials. Murata also discontinued the GRM 55 Series- High Voltage MLCC product line, which included the difficult to replace 2000 volt and 1000 volt NPO and X7R large case size MLCC in 1808 and 1812 case size configurations. This also included the mid-voltage parts in 500 Vdc and 250 Vdc with capacitance values in the pico-farad range but rated to 125 C for general purpose automotive use under the hood. These large case size (2220) were operating at 33000 pico-farad and 39000 pico-farad and were available in X7R and U2 J ceramic chemistries. The combination of the high voltage and high capacitance MLCC requirements inherent in the GRM 55 series makes them difficult to find alternatives to, especially in the larger case sizes. It is my primary experience that manufacturers of line voltage equipment (Internet of Things products, smoke alarms, security alarms, cable set top boxes) are most effected by the discontinuation of this product line, as are manufacturers of industrial electronics products such as power supplies, fans and blowers, switchgear and switchboard apparatus and motor controllers.

- DECEMBER 2016 – Last TDK Orders to be Taken for 280 MLCC Part Numbers to be Discontinued Also TDK noted that by December 31, 2016 last orders would be taken and by March 2017 the MLCC lines would be discontinued at the point of production.

- MARCH 2017- TDK Final Production of 280 Parts Numbers Discontinued in Oct 2016. This established three new economic criteria into the supply chain for electronic components that had short term impact on supply and demand- these are the date of the announcement, the date of final orders and the date of final shipments.

- MAY 2017 – Last Murata GRM 43 and GRM 55 MLCC to be Manufactured. In May 2017 the last GRM Series MLCC 43/55 was manufactured, according to Murata.

- MARCH 2018 – Murata Announces Discontinuation of The GR/ZRA Series MLCC. In March of 2018; Murata announced the discontinuation of the GR/ZRA Series MLCC which included high capacitance MLCC at low voltage, parts that Murata believed could be absorbed by competitors in China. These included parts such as the 22 -microfarad at 25 volts in X5R; the 47 microfarad at 4 volts, the 47 microfarad at 6.3 volts and the 22 microfarad at 16 volts. Murata noted that the product portfolio they were discontinuing was from 22 to 47 microfarads and from 4 to 25 volts. The company noted that the parts were consumed in mobile phones, video cameras, auto navigation, HSS/SDD, tablets, personal computers and set top boxes. In the release, Murata is quoted as follows- “Increased demand for Multilayer ceramic capacitors (hereinafter referred to as MLCC) in consumer and automotive electronic goods has led to a MLCC supply issue globally. The gap of supply and demand in the MLCC industry continues to expand and is expected to continue to do so. In order to provide as much continued support as possible to the market Murata must adjust our production capacity away from Legacy products to those in market demand. Therefore, as for the target items of this EOL, we will gradually reduce the production capacity and restrict the supply quantity to discontinue the production.” If the reader looks closely at GR/ZRA series closely it becomes apparent that Murata is viewing the 22 microfarad and 47 microfarad MLCC as “legacy,” as it moves into 220 microfarad, 330 microfarad, 470 microfarad, 680 microfarad and 1000 microfarad mass production The last product order for GR/ZRA Series MLCC will be in March of 2019. The last shipments for the GR Series/ZRA Series will be in March of 2020. And this suggests to me that this area of industrial and consumer electronics will continue to be plagued by shortages as a result of the discontinuation of this product line. And while we have seen migration to Western vendors of air fired MLCC to address some of these problems, as well as the testing of alternative dielectrics such as tantalum and metallized PEN films, the economies of scale to produce alternative dielectrics pale in comparison to MLCC and the technology required to produce high capacitance AND high voltage is considered advanced in the field of ceramic dielectrics.

- APRIL 2018 – TDK Announces End of Life for 440 Additional MLCC Part Numbers. In April 2018 TDK Corporation expanded their “End-Of-Life” process to an additional 440 MLCC part numbers, with the final order date established as April 2018 and the final ship date from the manufacturer established as October 2018

- OCTOBER 2018 – Walsin Discontinues Multiple MLCC Products. Walsin also discontinued the Y5V MLCC High Capacitance product in October of 2018 with effective dates of final shipments in November 2018 and this included the 0402, 0603, 8085, 1206, 1210, 1812 case size MLCC in 10 Vdc, 16 Vdc and 50 Vdc; and also included low pro9file Y5V products in the 50 Vdc at 100 microfarad (not easily replaceable) as well as the 47 microfarad at 6.3 volts, the 2.2 microfarad at 50 volts, the 1.0 microfarad at 250 volts (all X7R).

- MARCH 2019 – Last Orders to be Taken for the GR Series/ZRA Series from Murata. What is coming next will be that the last orders for the GR Series/ZRA Series will be taken by the end of March 2019.

- MARCH 2020 – Last Shipments of the GR Series/ZRA Series from Murata. What is coming in March of 2020 will be that the last shipments for the GR Series/ZRA Series will come from the manufacturer by the end of March 2019.

Summary of MLCC Discontinuations

22 and 47 Microfarad MLCC (Large Case Size)

When viewed collectively, the conclusion that can be drawn is that the gaps that were created were in the 22 microfarad and 47 microfarad capacitance ranges, with some key products in the 100 microfarad range (Y5V) also deemed legacy and discontinued. Also of note was that the discontinuations of MLCC series also had added factors such as low ESL, and an overlap of parts discontinued with “low profile” configurations and a large emphasis upon getting away from Y5V ceramic chemistries.

High Voltage MLCC

The other key MLCC shortage that can be traced back to these end-of-life processes were the discontinuation of the high voltage MLCC in the 250, 500, 630, 1000 and 2000 volt ranges. As well as specific product lines geared toward automotive applications to 125 degrees C for under-the-hood applications.

In many instances the vendors of note requested that their customers migrate to smaller case sizes. However, it was clear early on that many products that were made with ceramic dielectric could not be replaced by alternative dielectrics such as tantalum or film capacitors but instead could only be another ceramic solution.

Case Size, Voltage and Operating Temperature

Key shortages remain that are largely being designated based upon MLCC case size, voltage and operating temperature. Based on a detailed analysis of every product series available, we can trace back supply shortage problems impacting line voltage equipment, telecommunications infrastructure for POTS networks- tip and ring capacitors; and automotive under-the-hood for fossil fuel engines; commercial aircraft engines; lighting ballasts and industrial motor controllers and power supplies.

Finally, please note that the last orders for Murata’s GR Series/ZRA Series will be taken on March 2019 and the last shipment date will be in March of 2020. And for this reason, and in accordance with the comparative data in the chart below, extended lead times for MLCC could last to 2020.

featured chart: MLCC Lead Time Trend By Case Size- January 2016 To January 2019, source: Paumanok Publications, Inc.