ECIA’s Electronic Component Sales Trend Sentiment (ECST) survey participants in January 2024 delivered very encouraging results as all areas showed strong improvement in index scores for January 2024 results.

Results from the January 2024 ECST survey of electronic components supply chain participants delivered very encouraging results as all areas showed strong improvement in index scores for January results and

anticipation of a robust continuation of the upward trend in February.

The overall component index jumped by over 20 points to 98, the highest level in 21 months, almost reaching the positive growth threshold of 100. All three major segments achieved strong growth. Semiconductors delivered amazing results with a leap of nearly 39 points to top the index with 105 points. Electro-Mechanical components and Passive components both achieved double digit index score improvements in January.

The growth in the overall index fell short of the 27.8 point improvement predicted in the December survey. However, as noted in the analysis of the December survey, even delivering half of that projection would indicate a strong start to the new year. Achieving an improvement of over 20 points is truly exciting. To build on the good news, survey respondents expect the overall index to improve by an additional 9.4 points to

break above 100 and reach 107.4 in February.

While Electro-Mechanical components and Passive components experienced strong improvement in January, their results fell well short of expectations. They came up 20 and 17 points below expected growth. At the same time, the Semiconductor index score exceeded expectations by over 24 points. In the February outlook, Semiconductors are forecast to improve their score to 117 and Electro-Mechanical components are expected to join them above the 100 threshold at 105.

Even though Passive components are projected to deliver the strongest improvement in the index for February with an improvement of 11.8, this increase will still leave it just short of positive growth territory at 98.8. Once again, some caution is in order for the index outlook. If the February projections hold true, it will result in the index improving by 29.6 points in a 2-month period. The index has only surpassed this performance twice in its history. The last time the index grew at this rate was in September 2020.

However, this prior leap in the index followed the crash in the overall index score of 59 points between February and May 2020. This earlier index performance could be described as a “rebound” from the COVID impact while the current period is behaving more as a “recovery” from an extended slump of 1.5 years.

The end-market index also reports solid improvement in January even though it is slightly weaker than the growth in the component index. The January market index increased to an overall score of 93. Continuing their strong performance, the markets in Avionics/Military/Space, Medical, and Industrial all scored above 100 points. The most exciting news from the end-market index is the projection that every market, except Telecom Mobile Phones, will achieve scores above 100 in February. The overall endmarket index is forecast to reach 103.1 in February. Overall optimism abounds in the results from the January ECST survey. Hopefully, the electronic components industry can sustain the momentum it has achieved starting 2024.

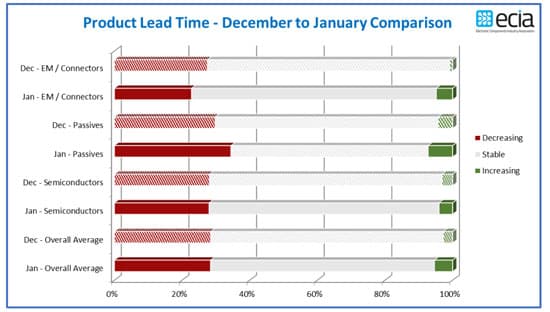

Product lead times continue to maintain a solid performance that continues to be dominated by reports of stable lead times averaging 66% share of respondents for January 2024. The number reporting increased lead times grew in all three component categories. Still, the highest number of reports came in Passive components at only 7%. The overall percentage of survey participants reporting increasing lead times grew slightly from 3% to 5%. At the same time the average percentage reporting declining lead times remained stable at 28%. These results indicate the supply chain continues to be in a relatively healthy state despite ongoing elevated inventory levels. Supply chain managers are delivering a strong performance in the management of the flow of products through the supply chain.