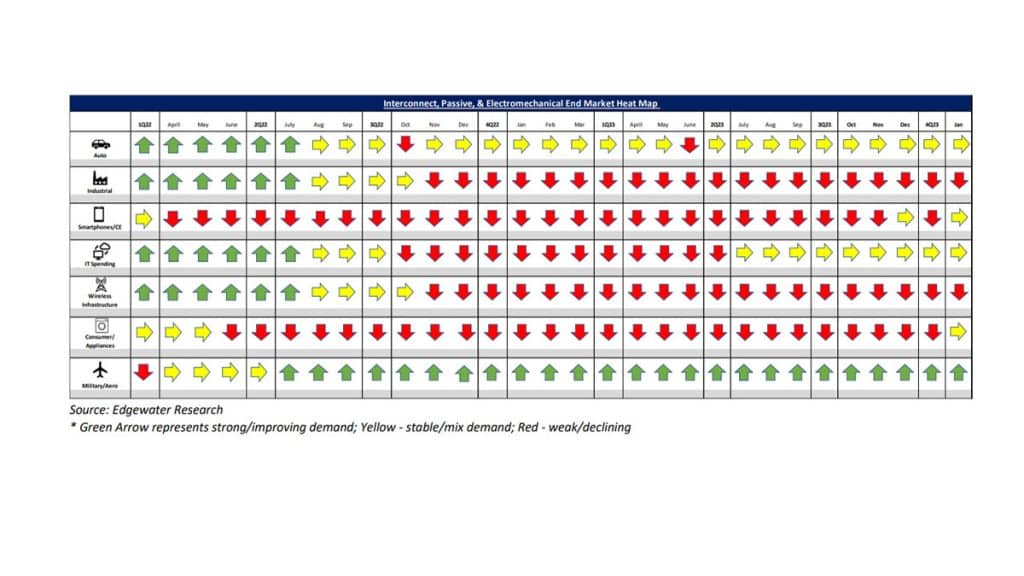

January 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Auto outlook in the West more mixed on slowdown in EVs but better than semis at +MSD on limited pockets of inventory.

2. CY24 China Auto demand feedback constructive, projected up HSD on normal inventory and share regains vs. Chinese suppliers.

3. Pricing is viewed as stable, including in Auto with pockets of flexibility in new designs but select LSD uptick from Jan 1 in disti.

4. Bookings seen as stable/mixed with signs of green shoots but also pushouts in EVs; B2B in distis seen upticking to 0.9x-1.0x.

Top 4 Channel Comments:

• 4Q in N.A. finished as expected, down 3-5% Q/Q. Overall demand is still soft, but we are seeing some green shoots. I wouldn’t say inventory is improving across the board, but we see signs of digestion. We see an increase in the percentage of customers coming in and placing sudden orders for select parts for immediate delivery.

• We see a reversal in China Auto OEM’s attitude. Two years ago, we were losing share to Chinese copycat connector suppliers. Today OEMs are coming and telling us they need our products because they realized that the quality of Chinese connectors is poor, and it is not worth jeopardizing the performance and quality of a vehicle over a few pennies of cost savings on a connector.

• The one area that we see a clear change in Europe is EV – the market has become stagnant for both EV and EV Chargers. The demand has flattened or slowed to a modest growth vs. robust growth just a few months ago.

• Industrial remains the weakest market in Europe. We continue to see major customers having too much inventory – the question is how long it will take to digest and to be honest no one knows. IFM Germany recently told us not to come asking for orders in 1H, particularly for passives; for connectors they said maybe they will start placing orders in May/June.

Other Key Takeaways:

5. 4Q demand seen finishing relatively in-line with downside in Europe on prolonged factory shutdowns and mixed Asia demand.

6. CY24 outlook still at +LSD reflecting 1H destocking, mixed Auto, cautiousness in Industrial and assumptions of 2H rebound.

7. 1Q outlook seasonal in N.A. but sub-seasonal on extended shutdowns in China (CNY) and in Europe.

8. Industrial demand/outlook still viewed as weak but with early signs of green shoots, implying inventory progress.

9. AI feedback remains robust with incremental demand tied to AMD projects. Traditional IT outlook unchanged at flat to +LSD.

10. Consumer demand, mainly Apple seen as stabilizing after completion of inventory destocking. Appliance market showing signs of thawing.

11. EV Charger (US, Europe) and renewable energy demand (Europe) seen paused on pullback in subsidies and China sourcing uncertainty in the US.

12. Connector inventory seen as still elevated in some end-mkts but better relative to semis. Digestion still projected through 1H24.

13. Passive inventory improving and viewed as mixed, pricing still stable but concerns that pricing can flip more aggressive should demand improve.

Conclusion

Following the initial signs of stabilization in IP&E fundamentals in our last update, January’s feedback points to a continuation of the trend going in 2024, with the emergence of green shoots in orders. While IP&E inventory is still seen as a headwind near term we see signs of optimism and firming expectations that digestion would be largely over by the middle of 2024, particularly for connectors where inventory levels are seen in better shape. Encouragingly, compared to semis, IP&E pricing is seen as more stable in 2024, particularly in interconnect, while passive pricing is seeing moderate concessions in certain regions and channels. In aggregate, CY24 IP&E outlook remains conservative at low to mid-single digit growth, but we are cautiously optimistic about IP&E fundamentals will show signs of improvement in 2H24.

Full report available from:

Dennis Reed, Sr. Research Analyst, Edgewater Research