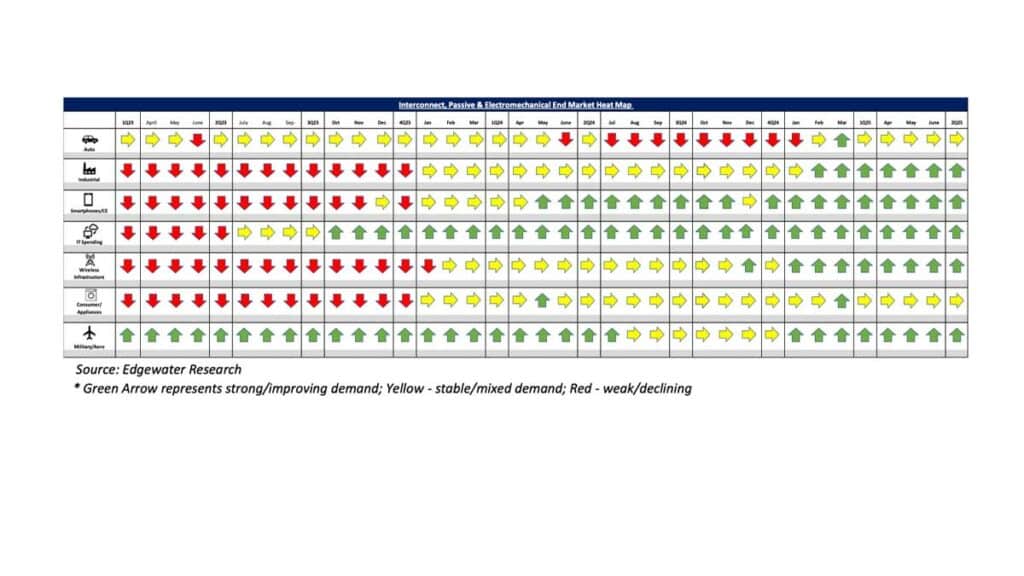

Edgewater researchers report that AI momentum continues to support the second half of 2025, while a broader recovery is still in its nascent stages. This June 2025 collection of news summaries, survey results, and channel market insights, covers Interconnect, Passives, and Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Demand feedback generally constructive with 2Q finishing ahead. 2H outlook more measured, aside from AI, on limited visibility, moderate orderbook improvement, and mixed B2B and customer tone, consistent with early cycle dynamics.

2. AI demand feedback still positive, with 2Q upside likely and 2H strength projected on Trn2 and CSPs momentum.

3. CY25 NVL rack shipments forecast seen trending toward the high end of the prior 25–30K range, supported by continued build and deployment progress. Signal integrity noted as improved, with Amphenol’s backplane connector performance reaching acceptable levels.

4. TE expected to begin shipping as 2nd source for NVL backplanes in Jul; potentially capturing up to 20% supply by year end.

Top 4 Channel Comments:

• There was a lot of overpurchasing throughout the interconnect supply chain in 1H25. Some of this appears tariff-driven, but a lot of this was driven by preparing for B200 and GB200, and even strong general-purpose spend in C2Q25. March-May was particularly strong, then slowed in June, and now in July, demand is picking up again in preparation for B300/GB300.

• We are focusing downstream on our supply chain. We can support current demand, but we’re clearly seeing signs of a potential shortage ahead. These cycles are timeless: expedites pick up, turns orders rise, no one trusts the data, and then the bottleneck hits.

• Customers are ordering hand-to-mouth. They need product, but no one wants to commit; visibility is extremely limited. It creates a lot of rush orders. 2H shipments are likely to be up Y/Y, but not at the level we budgeted, as demand from direct Industrial is mixed.

• Our B2B exited 2Q at 0.98-0.99. We had positive B2B through most of the quarter, but in June, our shipments surged while bookings were more stable. We aren’t really concerned about 3Q as momentum remains positive; we are forecasting sequential growth globally.

Other Key Takeaways:

5. Trn2 demand seen stepping up in 2H25, reflecting May’s forecast increase; connector shipments appear above projected 2H rack deployment. Amphenol seen as likely to enter as 2nd source for backplane cables in 2H, potentially capturing up to 20% share.

6. CSPs seen showing interest in CPO for scale-up applications; development still early with initial adoption not expected before 2027.

7. Auto reads modestly improved with 2Q finishing slightly ahead on better output and customers hedging risks.

8. 2H Auto in the West projected flat to up, though concerns of 4Q downside persist. N.A. outlook slightly better on uptick in June/July orders. Europe 2H outlook remains muted/flattish on softer EV demand and program delays.

9. China 2H Auto still projected sub-seasonal, with potential upside from tier 1 Western supplier share gains; foreign OEM share also stabilizing.

10. Industrial demand seen as gradually recovering, led by warehouse automation, and some disti restocking. Direct demand more mixed with signs of recovery from core customers on inventory normalization, though visibility still limited; Mil/Aero demand still strong.

11. TE lead times for some Industrial and AI/Digital Data products seen rising on demand upside. TE repurposing capacity to support projected AI growth. Typical July price increase noted in the channel from TE with potential 2nd round tied to US copper tariffs.

Conclusion:

IP&E fundamentals exited 1H25 firmly in recovery mode, led by strong AI demand, while other markets showed continued signs of inventory normalization at varying levels, consistent with an early recovery cycle. Looking at the remainder of the year, 2H25 appear poised to follow a similar trajectory, with continued strength in AI and gradual improvement in non-AI markets as improved inventory levels allow shipments to catch up to consumption, despite ongoing uncertainty around tariffs and end demand.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research