Source: RF Design news

The automotive industry is one that relies heavily on supply chains and procurement – with no one manufacturer having the capability to produce all of the parts and components required. Add to that modern EV’s, HEV’s and PHEV’s, where electronic components are required more than ever before in the control electronics, and pitfalls open up.

The resultant requirements have seen OEM’s and component suppliers working hard to keep up with the accelerating pace of technological advances – none more so than capacitor manufacturers. Chris Noade, Regional Sales Manager of Knowles Capacitors explores the items to consider when sourcing components, for the automotive sector, that has sparked a revolution in capacitor technology.

The first task is obviously to find and qualify suppliers, which can sometimes be the biggest procurement challenge of them all! Though Asia and China are still leading the way in the EV market, manufacturers across both Europe and the US are becoming established players which means the pool of available suppliers is vast, and ever increasing.

With reliability and efficiency of the components the number one priority, potential suppliers should be quantified for reputability and quality. Where the automotive market differs from others is that often, companies won’t necessarily go for the cheapest source as the risk of any issues must be minimized – no-one wants a costly recall situation.

Selecting a reputable supplier who has a reputation for quality products is a start, and to aid the selection process, there are a number of product qualifications and approvals to look for. However, just because a product has a certain certification this doesn’t guarantee the quality.

In considering the basic requirements for MLC chips, first we must consider the necessity for all components to meet the demanding requirements of AEC-Q200, the “Stress Test Qualification for Passive Components” laid down by Automotive Electronics Council (AEC) Component Technical Committee.

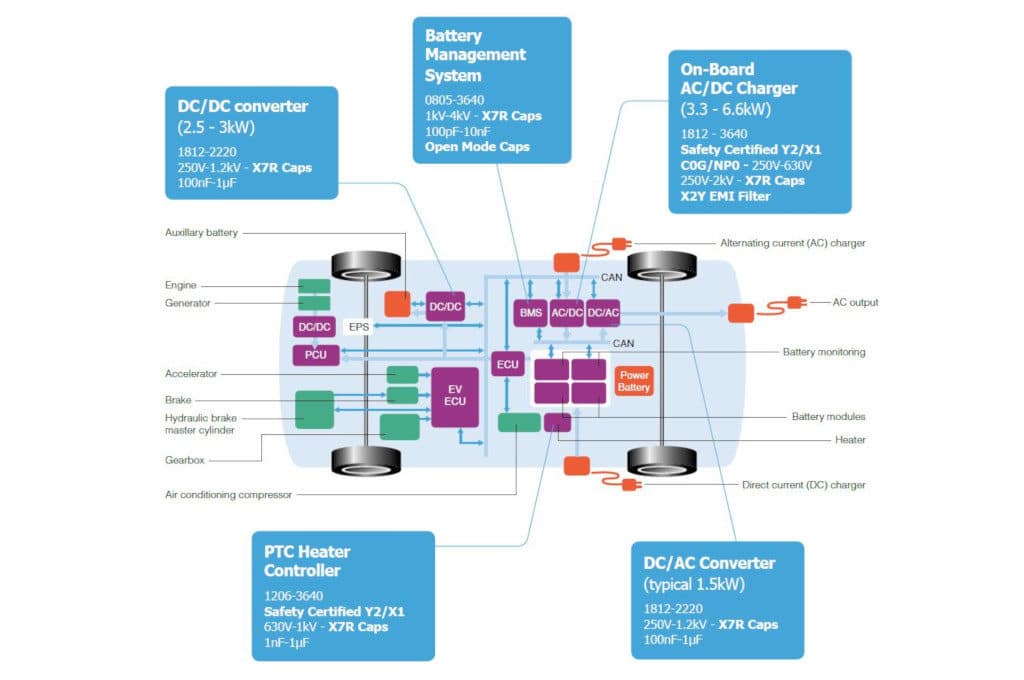

AECQ qualification subjects components to a set of rigorous tests to determine the basic reliability in application. Generally, the most severe tests for MLCC’s relate to the mechanical stresses induced by the board bend and thermal cycling requirements, designed to ensure a component is capable of withstanding the rigours of processing and handling, as well as the mechanical stresses experienced in application. In the EV sector there’s a lot of opportunity in the market for high voltage MLCC’s which aren’t traditionally used in this sector. This includes large case size, high voltage parts.

It’s true to say there’s a shortage of companies offering these options and even fewer who have AEC-Q200 qualification on those larger case sizes, Knowles being one that does. Boosted by the increasing electric content of vehicles, demand for AECQ parts is high and with market stock being consumed, we see the lead-time of AECQ MLCC’s being extended.

This is particularly the case for many types of standard and other MLCC’s, with high CV MLCC’s in the most critical shortage situation. For MLCCs, a 30+ week lead time is common, rising up to 80 weeks or longer on noncapacitor products. This highlights the importance of planning the purchasing decisions as, though some products may be more readily available, others may not. This is another area where Knowles are particularly strong, maintaining one of the shortest lead times – 7 weeks – for AECQ MLCCs in the market.

This is mainly thanks to our unique wet production process and the additional 50% production capacity created in recent years. For high demand products, such as high voltage AECQ parts (1206-2220, 500V-2kV, 1nF-1uF), Knowles maintain a stock which can be delivered in as little as 2 weeks.

It’s worth checking with a chosen supplier what their lead time and product has a certain certification this doesn’t guarantee the quality. In considering the basic requirements for MLC chips, first we must consider the necessity for all components to meet the demanding requirements of AEC-Q200, the “Stress Test Qualification for Passive Components” laid down by Automotive Electronics Council (AEC) Component Technical Committee.

AECQ qualification subjects components to a set of rigorous tests to determine the basic reliability in application. Generally, the most severe tests for MLCC’s relate to the mechanical stresses induced by the board bend and thermal cycling requirements, designed to ensure a component is capable of withstanding the rigours of processing and handling, as well as the mechanical stresses experienced in application.

In the EV sector there’s a lot of opportunity in the market for high voltage MLCC’s which aren’t traditionally used in this sector. This includes large case size, high voltage parts. It’s true to say there’s a shortage of companies offering these options and even fewer who have AEC-Q200 qualification on those larger case sizes, Knowles being one that does. Boosted by the increasing electric content of vehicles, demand for AECQ parts is high and with market stock being consumed, we see the lead-time of AECQ MLCC’s being extended.

This is particularly the case for many types of standard and other MLCC’s, with high CV MLCC’s in the most critical shortage situation. For MLCCs, a 30+ week lead time is common, rising up to 80 weeks or longer on noncapacitor products. This highlights the importance of planning the purchasing decisions as, though some products may be more readily available, others may not. This is another area where Knowles are particularly strong, maintaining one of the shortest lead times – 7 weeks – for AECQ MLCCs in the market.

This is mainly thanks to our unique wet production process and the additional 50% production capacity created in recent years. For high demand products, such as high voltage AECQ parts (1206-2220, 500V-2kV, 1nF-1uF), Knowles maintain a stock which can be delivered in as little as 2 weeks. It’s worth checking with a chosen supplier what their lead time and production expectations are, to not only factor in the purchasing decision, but help with consistency over time.

Key products to be sourced include high temperature and safety certified components. This new revolution in MLCC technology, used in control electronics, is being driven by modern on-board charging systems – PHEV & EV where mains AC is involved. Knowles brand Syfer has responded to demands by increasing its range of 250V-ac Y2 rated Safety Certified capacitors to 10nF.

Available in a 2220 case size, these X7R dielectric capacitors offer the user the option of greater total capacitance on the board, or piece part count reduction. For example, they can take the place of 2 x 4.7nF Y2 capacitors connected in parallel to reduce component count, size and weight – leading to a significant reduction in cost. Knowles high voltage capacitor expertise means this range offers the highest capacitance / widest range available for a class Y2 250Vac surface mount MLCC.

They are also certified to international UL and TÜV (UL ongoing) specifications. Knowles safety certified capacitors are also available with FlexiCap™ termination, which provides more ‘bend’ and flexibility in board design. With FlexiCap™ the risk of mechanical cracking is reduced, therefore ultimately meaning a failure is less likely. With EV’s, as well as heat, space can often be a problem due to the sheer amount of electronics systems required.

When sourcing parts, you want to save space and weight wherever you can – Knowles’ StackiCap™ could come into play here, offering the smallest footprint for high voltage, high capacitance MLCCs. Luckily in the area of passive components, and especially ceramic capacitors, obsolescence is something that’s not too much of an issue.

Generally speaking ceramic capacitors don’t chop and change as frequently as semiconductors for example, however, as with all areas of procurement this is a factor that must be considered. As we enter the next generation of automobile electronics, demand for components looks set to surge. This is good news not only for suppliers such as Knowles, but for the buyer as with choice comes purchasing power, which will increase around the globe.