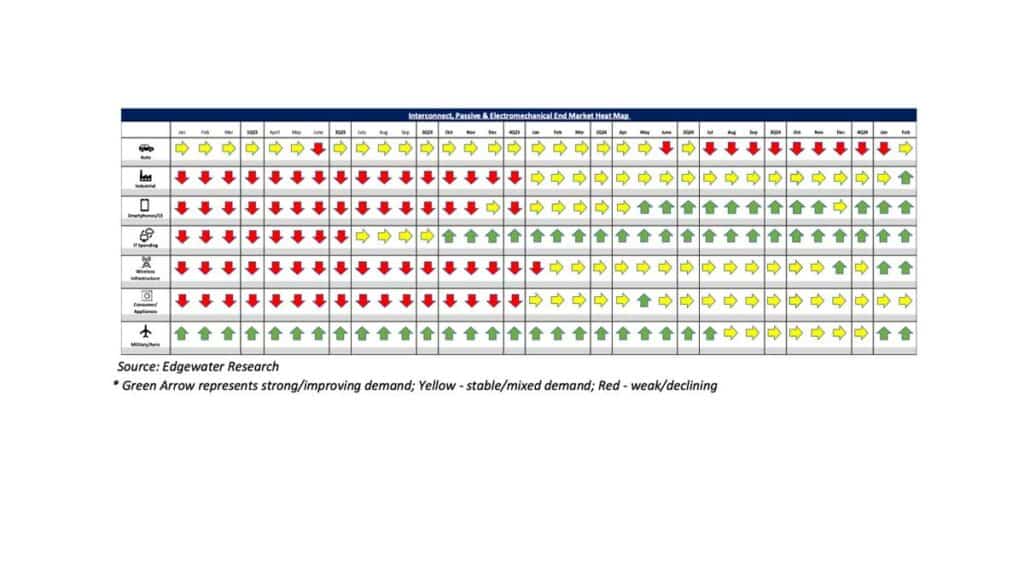

Edgewater researchers encouraged that IP&E fundaments have bottomed, and the industry is returning towards shipping to consumption which ultimately supports our mid-single digit growth outlook for the year. March 2025 collection of news summaries, survey results, and channel market insights on Interconnect, Passives components & Electromechanical Components from Edgewater Research.

AI Outlook Still Robust Despite Roadmap/Content Changes, Broader Market Trends Showing Signs of a Rebound

What’s Changed/What’s New?

1. Global demand trends improving, with upside in 1Q shipments and uplift in sentiment regarding cyclical recovery.

2. Orders trends outperforming shipments driving B2Bs above parity in every geo. Demand seen strengthening in Mil/Aero, improving in pockets in Industrial and mass market, remaining strong in IT datacom, and stabilizing in Auto in the West.

3. Improving demand seen primarily driven by normalizing inventory downstream and conservative end customer forecasting.

4. Distribution inventory seen as approaching lean levels for connectors and some electrotechnical on improved sell-through, driving increasing replenishment by private distis. Lead times for certain interconnect, relays and tantalum capacitors seen pushing out.

5. Full year forecast seen as little changed despite near-term upside and improving trends. Sentiment seen shifting to cautious optimism capped by uncertainty tied to potential demand pull forward and tariffs, geopolitical uncertainty.

Top 4 Channel Comments:

• In Asia, we had the best disti bookings 2 months in a row since 2022 with POS also improving. Demand seems driven by smaller customers and Auto as inventory has been cleared and there is concern about supply.

• As of early March, 65% of our 2Q target is booked. While last year’s 1Q strength in Europe faded, 1Q25 is outperforming 1Q24, with Europe inventory down 25% Y/Y. We’re cautiously optimistic about a real recovery.

• Major AI customers are asking us to ramp and ship as soon as we can. The connector demand normally leads system builds by 2-3 months. We see sequential growth in connector overweight in 1H25 with potential adjustments to 2H demand based on system builds.

• Nvidia’s Kyber architecture uses a midplane PCB with board-to-board connectors connecting the GPU and the NVSwitch trays in a canister. However, the 4 canisters still need to be connected so all the GPUs can talk. Nvidia hasn’t figured out yet how to do it but that will likely involve DAC or AEC. The number of cables is likely to be less but it’s unlikely that Nvidia eliminates all cables entirely.

Other Key Takeaways:

6. AI demand forecasts unch. at +40% with growth skewed to 1H on supply assurance; 2H seq. growth contingent on system builds.

7. Nvidia GTC product announcement seen creating IP&E content opportunities; increased power consumption driving demand for passives; Nvidia remaining committed to copper for scale up applications through 2H27 with content also trending up on projected increase in data rate and GPU density.

8. Nvidia GB system forecast unchanged at ~30K, still contingent on smooth design/test/ramp of GB300 in 2H.

9. Hyperscale and enterprise customer seen increasing their due diligence on suppliers, system designs and architectures given going supply chain/manufacturing/reliability challenges with cabled backplanes at several AI customers.

10. Industrial demand trends seen as improving from distis globally and select direct customers in Europe. Auto trends in the West seen as stabilized for a second consecutive month; China Auto demand viewed as remaining strong with continued Y/Y growth.

Conclusion:

IP&E fundamentals continued to show signs of improvement in March.

IT Datacom remains a key near term driver of growth, however in February and March, we have seen more signs of cyclical improvements from the broad markets in distribution and Industrial.

The Aerospace, Defense & Military market remains robust, and we are seeing signs of stability most notably within the Automotive market in EMEA. While the industry is encouraged by the near-term improvements, the overarching view remains cautiously optimistic as this downturn has been plagued with several false starts.

We remain encouraged that IP&E fundaments have bottomed, and the industry is returning towards shipping to consumption which ultimately supports our mid-single digit growth outlook for the year.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research