ECIA’s Electronic Component Sales Trend Sentiment (ECST) slips in May but sustains solid positive sentiment with robust Q3 growth expectations.

The May ECST survey results from ECIA reveal a notable slip in sales sentiment as the May index saw a loss of roughly 70% of the gains achieved in April.

Despite a drop of nearly 12 index points, the overall score still registered a solid 112.3 and delivered the fourth consecutive month of positive overall sales

sentiment. Survey respondents expect the sales environment will claw back a significant amount of lost ground in June to reach an index score of nearly 120. The Semiconductor segment took the biggest hit in the May survey as its score collapsed by over 18 points to fall below 113.

While not as steep as Semiconductors, the Electro-Mechanical and Passive markets also saw a significant drop as they fell by 10 and 6.8 points, respectively. As a result, the sales sentiment scores for all three categories come in at. a fairly tight range between 106 and 118. Looking toward June, Passives are expected to see the strongest rebound with an improvement of 10.5 points followed by Electro-Mechanical with a 7.1-point growth.

Semiconductors come in with a smaller, yet respectable, anticipated increase in the index of 5.3 points in June. While the May results are certainly not what had been hoped for and projected in the April ECST survey, the ECST survey results still point to a solid start for Electronics Component sales in the first half of 2024 with fairly consistent, month-to-month improvements for six months following a low of 77.8 in December.

In an interesting development, the movement in sentiment between the three major constituencies diverged in the May ECST survey. Distributors and Manufacturer Representatives delivered a strong negative drop in May scores compared to April with declines of 17 and 12 points, respectively. Heading

the opposite direction, Manufacturers actually delivered an average increase of 4 points in the sentiment index in their survey responses.

In the June outlook Manufacturer Representative expectations shift back into positive gear with a strong rebound in their average sales sentiment. This

results in a very close grouping in sentiment across the three groups in the June outlook with scores. between 117 and 124. A more unified view of the world among these groups causes greater confidence in the outlook. However, this unity failed to anticipate the drop in the May index.

The index score for overall end markets delivered a strong gain in May as it improved by 8 points to 119.7 and passed the product index score heading the opposite direction. This market optimism carries over into June as it continues to improve to top 126 in the overall index. The “rising tide” in the overall market did not lift all boats as five markets saw their scores fall and Telecom Mobile Phones, Telecom. Networks, and Consumer Electronics slipped below the 100-point threshold. However, all but Telecom Mobile Phones are projected to improve above 100 in June.

Automotive and Industrial Electronics both delivered 5.5-point gains in May which allowed Automotive to top the 100-point mark for the first time since July 2023. Avionics/Military/Space and Industrial Electronics continue to lead the markets with scores between 136 and 126 in May. Medical Electronics saw its sentiment index drop down to 111 in May.

Caution regarding market improvement is still prudent given the continuing concern reflected in economic indicators including inflation. However, technology is the brightest spot in the marketplace with three tech stocks passing the $3 trillion level in market cap recently.

The results reported in the Q2 2024 ECST survey present a highly encouraging picture looking toward the second half of the year. All three product categories see a significant jump in both overall positive growth and growth expectations between 3% and 5%. For Q2 2024, 58% of respondents expect

relatively flat market growth with only 35% viewing positive growth during the quarter. Fortunately, only 8% expect a decline in sales.

In the Q3 outlook the overall number projecting growth jumps to 53% with 18% expecting growth between 3% and 5%. Among the three product categories, the greatest optimism for Q3 growth is in Electro-Mechanical / Connectors with 61% anticipating growth and 24%. believing growth will top 3%. This survey result reinforces the expectation coming into 2024 that growth for the year would be driven by second half performance.

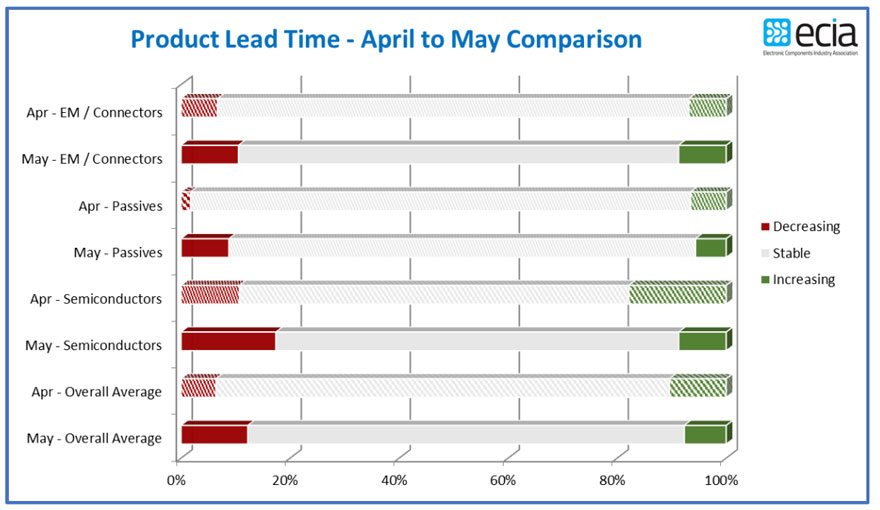

Reports of overall decreasing product lead-times doubled between April and May to increase to 12%. At the same time reports of increasing lead times dipped slightly from 10% to 8%. Big increases in decreasing lead time reports came from Passive Components and Semiconductors. Still, stable leadtime reports dominate with 80% of respondents seeing stability in the supply chain. There is an increasing sense that excess inventory is continuing to be worked off.