The overall positive market sentiment expressed by the North American ECIA’s Electronic Component Sales Trend Sentiment ECST participants only lasted two months before the overall average fell below 100 in the September ECST survey.

The overall index fell to 98.8, a drop of nearly 10 points. While the September results are only slightly below the threshold of 100, the main message is that the momentum that appeared to be building has been lost. The market is still struggling to gain its footing to support consistent month-to-month growth.

Expectations had been high for continued solid growth in September with an outlook roughly equal to the August results. While not a reliable indicator in recent months, the October outlook calls for the index to struggle above 100 to reach 104.6 in October. Give credit to the industry for sustaining optimism even during a difficult period in the market. The results of the Q3 2024 ECST survey gives cause for optimism looking toward the end of the year as expectations for Q4 sales improvement over Q3 was very solid across product and market segments.

Both Semiconductors and Passive components were hit hard with drops in index scores of nearly 12 points in both product segments. However, Passive components saw its score fall all the way to 93 while Semiconductors at least stabilized at 100. Electro-Mechanical components was the most durable

segment in September as its index score only fell by 5 points and still came in above 103.

Every Passive category saw a steep drop in sales sentiment in September. While all three Passive categories are expected to see improved results in October, only Inductors is expected to reach 100. Meanwhile, Semiconductors are forecast to see improved market conditions with an improvement of nearly 7 points to reach 106.9 in October. Electro-Mechanical components continue to be the most robust segment as the October outlook for market improves to 108.8 in October, the best score for this market since May. The industry continues to face strong headwinds, especially with the dockworkers strike, the first since 1977, shutting down ports across the East and Gulf Coasts of the U.S.

The most recent survey revealed a strong alignment across all three supply chain sectors:

Manufacturers, Manufacturer Representatives, and Distributors. The average sales sentiment scores for these three segments show Distributors only 3.7 points below the overall average and Manufacturer Representatives reporting sentiment 3.0 points above the overall average and Manufacturers 2.0 points above the average. In the October outlook all three groups remain closely aligned in their expectations with the same relative positions compared to each other. Typically, these three groups have more diverse views of the market. Hopefully, the similar view across the industry bodes well for achieving the improved sales sentiment in October.

The index score for the overall end-market for electronic components remains in neutral territory as it improves ever so slightly from 100 in July and August to a score of 101.6 in September. The strongest outlook for October comes from the assessment of the overall end-market as its score jumps to 112.7. The most positive result for September as Industrial rebounds by over 20 points to reach 115. Along with Military/Aerospace, they are the only segments with scores above 100 in September. However, the October outlook predicts resilient results with every segment but one scoring well above 100. Only Mobile Phones fail to top 100. However, it is still projected to jump by 20 points in October. The endmarket outlook for October is the brightest spot in the September ECST results.

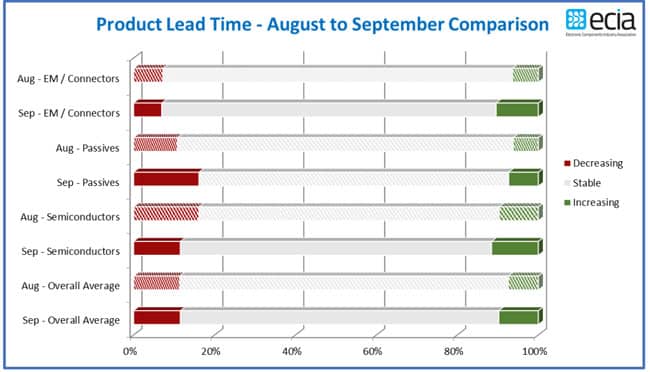

Lead time stability that has been sustained for many months slipped in September as some slight increases in reports of extending lead times were reported. Semiconductors and ElectroMechanical/Connector components saw reports of increasing lead times grow while Passive components saw a greater number reporting decreasing lead times.