This article written by Dennis Zogbi, Paumanok Inc. and published on TTI Market Eye describe MOV metal oxide varistors overview of its complex ecosystem in 2023.

Introduction to Metal Oxide Varistors

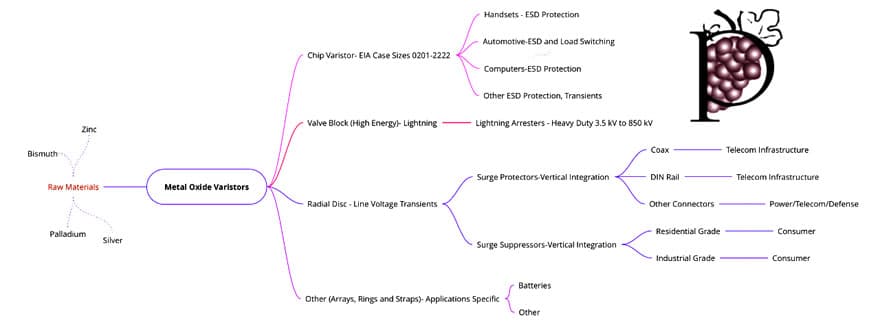

Surface mount chip varistors (or multilayered varistors – MLVs) are used primarily for electrostatic discharge (ESD) protection in digital electronics, and disc varistors and small valve block arresters are used for AC power line protection throughout the points of demarcation for power transmission and distribution networks worldwide.

Lightning arresters employ ring type valve block varistors stacked in porcelain or polymer housings for applications in the electrical grid.

Description of Metal Oxide Varistors

A varistor is an electronic component with a significant non-ohmic, current-voltage characteristic. A varistor is also known as a voltage dependent resistor (VDR) and, therefore, varistors are considered a sub-set of the variable resistor component segment. They are also considered to be part of the overvoltage protection component market segment.

Varistors are ceramic in nature and are created from ceramic slurry composed of zinc oxide and a variety of additives (like bismuth). Varistors are produced in two primary configurations: chip and disc. Disc varistors have been around for 50 years, while chip varistors are relatively new and have been available for about 25 years. Varistor construction methods are similar to ceramic capacitor production methods for both disc and chip versions. Disc varistors are “pressed ceramic pill” technology, while chips are stacked layers of ceramic and electrode paste.

Application of Varistors

Varistors are often used to protect circuits against excessive transient voltages by incorporating them into the circuit in such a way that, when triggered, they will shunt the current created by the excessive voltage away from the sensitive components. Multilayered chip type varistors are physically small and mirror the EIA (US) and EIAJ (Japan) accepted ultra-small case sizes consumed in digital electronic circuits for ESD (electrostatic discharge) protection. Larger configuration disc type varistors (pressed pill technology) are older, legacy type components that are used to protect sensitive line voltage equipment connected to AC power lines.

Construction of Varistors

Varistors are ceramic in nature and are created from ceramic slurry composed of zinc oxide and specific additives (such as bismuth). Multilayered chip varistors are produced in the same manner as multilayered ceramic chip capacitors, whereby ceramic slurry is screened through a doctor Blade, and then electrode materials composed of precious metals (palladium and silver or in some instances platinum) are applied to each consecutive layer of ceramic “green tape.”

The finished, stacked construction is then fired in either a batch or tunnel kiln, dried and then separated into the desired case size. The finished chips are then “terminated” with silver paste materials. Disc varistors are typically radial leaded in nature, whereby the ceramic powder mixture is compressed into a pill or “disc shape,” sprayed with silver conductive materials and then encapsulated in polymer materials.

Chip, Disc and Valve Block Varistor Configurations and Variations

As noted, metal oxide varistors are produced in two primary configurations: chip and disc. Disc varistors have been around for 45 years (legacy components), while chip varistors are newer and have been available for about 20 years. Varistor construction methods are similar to ceramic capacitor production methods for both disc and chip versions. Chip varistors have also evolved into array designed (primarily quad packs – four varistors in an 0603 or 0805 package), while disc varistors have evolved into large industrial block designs.

Since varistors are non-linear resistors, their physical size determines how much energy they can absorb. Thus, raw material consumption becomes an important part of the cost of goods sold. Also, redundant solutions are employed to gradually dissipate excessive voltage. The valve blocks are manufactured to be stacked in porcelain or silicone housings designed specifically to protect expensive electrical equipment from the effects of lightning strikes through the stacking of zinc oxide valve block components to achieve the required voltage of the transmission or distribution system.

Varistor Components Help Design Engineers Comply With Regulations Governing the End-Product

Circuit protection components are used redundantly for the end-product to comply with specific standards and regulations imposed by government or industry regulations. It is important for the reader to note that the component itself is not designed to be compliant with these regulations but helps the design engineer create an end-product that is compliant. Once again, compliance is usually accomplished through the redundant use of multiple types of circuit protection components.

Important Criteria: Surge Handling and Rise Times

There are many individual standards and regulations that shape the market for electronic circuit protection components; however, it is those specifications that require the greatest performance of the finished component with respect to either the surge current handling capability or the rise time of the transient event that dictate the respective market value for the components being sold.

The Importance of IEC 61000 and Varistors

Even though there are a myriad of specifications and regulations, we note that those specifications that are the most important to both the manufacturers of the circuit protection component and the manufacturers of the equipment these devices are supposed to protect are the GR1089-CORE, the IEC 61000 and the IEC 127 specifications. The 1089 spec and the IEC 61000 specs are for overvoltage protection components and the IEC 127 specifications are for the overcurrent protection components.

Those product lines that comply with the IEC 61000 specifications include varistors, gas tubes and TVS diodes; with the surface mount versions of varistors, or multilayered varistor chips (MLVs); and the surface mount versions of the TVS diodes (silicon avalanche) compliant with IEC 61000 4-2 for ESD protection. The gas tube and disc versions of the varistors and the TVS diodes are compliant with the more current intensive portions of IEC 61000 (because they are physically larger than their SMD counterparts). Prices for components that comply with the IEC specifications are in the $0.03 to $0.12 range.

The GR-1089 CORE specification is the most difficult to comply with because of the rapid rise time associated within the specification. Only the thyristor and line feed resistor can comply with this test. Gas discharge tubes can also comply with this test but require a varistor or TVS diode be placed in line with the gas tube to clamp the initial current. Products that comply with GR1089 have average unit pricing from $0.25 to more than $1.00 per unit.

The Importance of UL 1414 and UL 1449 and Varistors

Compliance with UL 1414 and UL 1449 are critical for foreign companies competing in the U.S. market. Generally, any UL compliance (underwriter’s lab) is considered a quality designation for the component manufacturer no matter where it is sold. CSA regulations are specific to Canada but mirror UL requirements. The VDE specifications are for Germany but are accepted throughout Europe and are largely based upon the overall IEC 61000 4 series specifications for circuit protection components.

- UL 1414 Across-the-Line Components

- UL 1449 Transient Voltage Surge Suppressors

- CSA C2221 01 Accessories and Parts for Electric Products

- VDE CECC 42000 Varistors for Use in Electronic Equipment

ESD vs. Lightning Protection and the Varistor

Distinct Market Drivers with Different Component Performance Requirements

There are two distinct markets for overvoltage protection components in both power and telecommunications markets, and there are internationally recognized regulations governing each of these two markets.

ESD, Lightning and Load Switching

The first market is for overvoltage protection components used to guard against the damaging effects of transients that result from electrostatic discharge (ESD), and the second market is for overvoltage protection components used to guard against transients imposed on power, coax and twisted pair lines resulting from lightning, or in the case of power lines, transients imposed on the line as a result of line or load switching.

The ultimate difference between the two markets is the type of transients resulting from electrostatic discharge as opposed to a lightning strike, each of which is equally damaging and which is measured with respect to the waveform it produces on the respective lines.

Competition Between Components for ESD Protection

For ESD protection, the primary components used are multilayered varistors, zener diodes and avalanche diodes. Generally speaking, those companies supplying these products successfully note that their components comply with specific regulations. The differences between the components are marginal and come down to slight variations in price or the specific volumetric efficiency of one component compared to the other or the general preference of the design engineer to work with silicon as opposed to ceramic components.

Competition Between Components for Lightning and Load Switching Protection

For lightning and load switch protection, we note that disc varistors, thyristors, surge networks and gas discharge tubes are employed, and once again, those companies who are successful at supplying these components generally note that their products meet a select group of requirements and/or regulations for the end-products which they are designed to protect. Regulations governing protection against lightning strikes are much more difficult to meet as compared to regulations governing protection against ESD.

In power, only varistors and silicon avalanche diodes boast their ability to withstand the IEC 61000 4-2 tests, while disc varistors are the only product line which can withstand the higher current handling portions of the IEC 61000 test. In no instance have we noted zener diodes as being able to withstand any overvoltage protection test; however, they are used in extremely large quantities for such applications anyway (in back-to-back or rail configurations).

Varistors Used With Other Telecom Surge Handling Components

It has also been determined that in some instances, the most notable being gas discharge tubes, that a varistor is placed in series with these components to enable the device to withstand the GR-1089 CORE (telecommunications) test and the ITU K.20 and K.21 tests, for example. The varistor clamps the initial pulse and gives the gas tube time to react.

The following is a detailed description of each test required for overvoltage protection components as mentioned above. Remember that the GR-1089, the ITU K.20 and K.21 and the IEC 61000 specifications are the most important.

Heavy Shift Toward Electrical in Larger Markets

Metal oxide varistors manufactured from zinc oxide ceramic materials have been demonstrated as key components for infrastructure and for electric vehicle propulsion circuits, which are net new sources of global revenue.

Slower Rate of Technology Development Leave Products Vulnerable

It is important to note the trend in modularization for applications in wireless communications devices and automotive electronic control units that should impact circuit protection components. Currently, it is slow to do so with this report showing a much slower rate of technology development with respect to component miniaturization when comparted to other parts such as resistors and capacitors, so this is resulting in multiple larger subassemblies subject to impacts of overvoltage ESD events on specific leading edge sub-assemblies. This lack of finite protection at the module level is being updated with new prototypes developed in the 0201 and 01005 chip sizes.

Strategic Acquisitions Affecting Global Market Share

There have been some significant acquisitions in the global electronic circuit protection industry that have affected global market shares in the sector over the past ten years. These include:

TDK’s Purchase of EPCOS

TDK’s merger with EPCOS created one of the largest passive component companies in the world. The combined positioning in circuit protection components should not be underestimated. The company achieved major share in metal oxide varistor products because both EPCOS and TDK had large share positioning before the acquisition with both companies having large share of the automotive and handset space end market demand for varistors.

Littelfuse’s Purchase of Harris Suppression Products Division

Littelfuse’s entry into the global varistor market was through the purchase of Harris Semiconductors’ Suppression Products Division many years ago. This captive MOV product line is at the heart of Littelfuse ESD protection portfolio, an asset upon which they were able to bolt on multiple added acquisitions and maintain key market positions in automotive and industrial segments.

Vishay’s Purchase of BCComponents

Vishay Intertechnology effectively extended their circuit protection product portfolio in 2003 through their purchase of BCComponents, which are the former operations of Philips Passive Components. BCC included aluminum electrolytic capacitors, DC film capacitors, nickel-chromium resistors and non-linear resistors. The non-linear resistor business included metal oxide varistors and humidity sensors.

Bourns Purchase of KEKO-Varicon

Bourns of California USA purchased KEKO-Varicon, a key European manufacturer of chip, disc and variable varistor configurations in their large factory in Slovenia. This enhanced Bourns’ large share position overall in the segment of circuit protection.

The Paumanok study, “Metal Oxide Varistors: World Markets, Technologies and Opportunities: 2023-2028,” has identified 35 factories supplying 41 brands with metal oxide varistors worldwide.

Raw Material Usage and Supply Issues

Many suppliers of electronic circuit protection components are still endeared to the use of specific precious metals in the construction of these devices. The most notable continued usage trend is in the use of palladium metal in multilayered varistor electrodes and in surge resistor pastes for line feed resistors.

Manufacturers of MLVs and LFRs argue that palladium costs are not a major factor, but these similar manufacturers have transitioned away from palladium in favor of nickel in their ceramic capacitor businesses. So cost here is a factor.

The price of palladium has been volatile over time, and we expect greater interest in base metal electrodes and base metal surge resistive pastes to help maintain profit margins in the face of inevitable long-term price erosion. Other raw materials that cause us concern include zinc, used in varistors. The reader should appreciate that metal oxide varistors are created through the combination of zinc oxide ceramic materials and palladium-silver metallization. This unique combination to volatile materials makes varistors susceptible the price fluctuations due to raw material supply chain instability.

There is also the unique supply chain for zinc metal, which is the active ingredient causing the overvoltage to lead to ground. This study shows recent impacts of pricing of both palladium and zinc due to hyper global inflation.

Key Growth Markets and Strategies for Varistor Vendors

Global markets that will continue to be stable for producers of electronic circuit protection components will be in the automotive electronic subassemblies markets, the large and small home appliance markets and the line voltage equipment markets (with emphasis upon lighting ballasts, alarm systems and switchmode power supplies).

Faster growth markets will continue to be in wireless communications devices as functionality increases and greater protection against ESD requires more circuit protection components per phone. Additional rapid growth markets include flat panel displays, cable and ADSL modems (which have an interesting technical barrier for circuit protection as many circuit protection components have inherent inductance and capacitance which interferes with video signals). Other fast growth markets will include the smaller DC/DC converter business (bricks) and of course the emerging telecommunications infrastructure markets for subscriber line interface card protection and cellular base station protection.

Medical electronics will also continue to grow for applications in both medical test and scan markets (i.e. GE, Philips and Hitachi) and in medical implants (i.e. Medtronics, Guidant and St. Judes). Defense electronics markets and aerospace markets will continue to grow for applications in avionics and in missile power up and guidance systems. Other value-added growth markets will be in mining electronics and downhole pump electronics (especially for temperature probes employing NTC and/or PTC thermistors).

Defense electronics is also a growth area as is its sister markets in aerospace engineering. Defense markets will grow as global armies require less human interaction to be replaced by more sophisticated electronic platforms solutions (UAV and UGV).

Oilwell services and mining service electronics are also key growth areas, as are class 7 and 8 offroad trucks. More oil will be required, and exploration electronics will key to that and to getting the most out of each well. Mining electronics will boom as more rare earths are required to run electronics industries and metal industries in the face of increasingly tighter restrictions on Chinese exports.

Movements to Smart Grids and Renewable Energy Systems: Major Impact

The other key areas for growth will be in power transmission and distribution electronics for creation of smart grid technology worldwide. This will have major positive impacts on thyristors, snubber capacitors, disc varistors, gas discharge tubes and especially industrial grade fuses. Also, the augmentation of renewable energy systems such as solar, wind and wave generation equipment also pose new and exciting challenges for circuit protection companies worldwide. It is obvious from all major vendor’s websites and press releases that this is the key direction for many players.

Varistor Configurations and Variations

As noted, metal oxide varistors are produced in two primary configurations: chip and disc. Disc varistors have been around for 45 years (legacy components), while chip varistors are newer and have been available for about 20 years. Varistor construction methods are similar to ceramic capacitor production methods for both disc and chip versions. Chip varistors have also evolved into array designed (primarily quad packs – four varistors in an 0603 or 0805 package), while disc varistors have evolved into large industrial block designs. Since varistors are in fact non-linear resistors, their physical size determines how much energy they can absorb. Thus, raw material consumption becomes an important part of the cost of goods sold. Also, redundant solutions are employed to gradually dissipate excessive voltage.

Multilayered Ceramic Chip Varistors

The multilayered chip varistor is a stacked ceramic device that employs varying layers of ceramic (usually zinc oxide but also variations on titanate ceramics may also be employed) between layers of precious metals (usually palladium and silver electrodes). Multilayered ceramic chip varistors are used in portable electronics for protection against electrostatic discharge. Larger chips are also employed for larger surge handling capability in computers, industrial, professional and consumer electronic devices. Case sizes are available in the ultra-small 01005 to the larger 2220 (or larger) chips.

Disc Varistors

Radial leaded disc varistors have circular heads and come in various head diameters with the larger heads being capable of handling higher voltages. In fact, disc varistors are largely used only for high voltage circuit applications to handle high energy dissipation in electrical circuits.

Varistor Chip Arrays

Chip varistors have also evolved into array designed (primarily quad packs, or four varistors in an 0603 or 0805 package), while disc varistors have evolved into large industrial block designs. Since varistors are, in fact, non-linear resistors, their physical size contributes to their ability to handle higher levels of transients. More simply stated, small varistors handle small transient levels and larger varistors handle higher levels of transients, thus, like other markets identified in this report, varistors segment into digital electronic markets and industrial or line voltage markets.

Strap Varistors

Usually square in design, robust and rugged, these types of varistors come with strap like leads; and will usually be thermally protected with a specific epoxy resin outer coating. They are used in high energy and high voltage circuit applications.

Block Varistors

These varistor components are also manufactured for use in harsher environments and can withstand large amounts of thermal and mechanical shock. They are usually found in harsh industrial environments and employ a hard molded resin case around a disc or strap varistor and have lugs instead of lead wires or terminations.

Low Profile Chip Varistors

A new design in surface mount varistors is the low-profile chip varistor that is employed in handsets and related portable electronic designs such as computer tablets because of its low-profile nature.

Axial Leaded Varistor

Axial leaded components usually are legacy in nature and can be found in automotive electronics and in lighting ballasts where the lead wire along the axis makes for a more volumetrically efficiency solution that chips or discs.

The Molded Chip Varistor

This is the new and existing development for varistors. The packaging of the varistor in a molded epoxy case for rugged professional applications where high humidity may be evident and where the molded case will withstand the impact of humidity and add to the thermal shock protection of the finished component. Such molded packages are used in the tantalum capacitor industry in the billions of pieces (for comparative example).

Ring Varistors for Power T&D Lightning Arresters

Ring varistors are produced captively for stacking in power transmission and distribution arresters. The formulas for zinc oxide ceramic technology are similar for all these parts.

Summary and Conclusions

The metal oxide varistor is used to protect sensitive circuits against the impacts of electrostatic discharge, line and load switching and the effects of lighting. The product line comes in many configurations including chip and disc, as well as exotic formats of valve block, ring and array. The application of a varistor in a circuit is typically at all points of demarcation and the technology is redundant to ensure maximum protection. The raw materials consumed include zinc, palladium and bismuth, all which are considered keystone metals for the electronics industry. The outlook for varistors and all high voltage electronic components is robust, especially for applications protecting infrastructure electronics and electric vehicle propulsion circuitry.