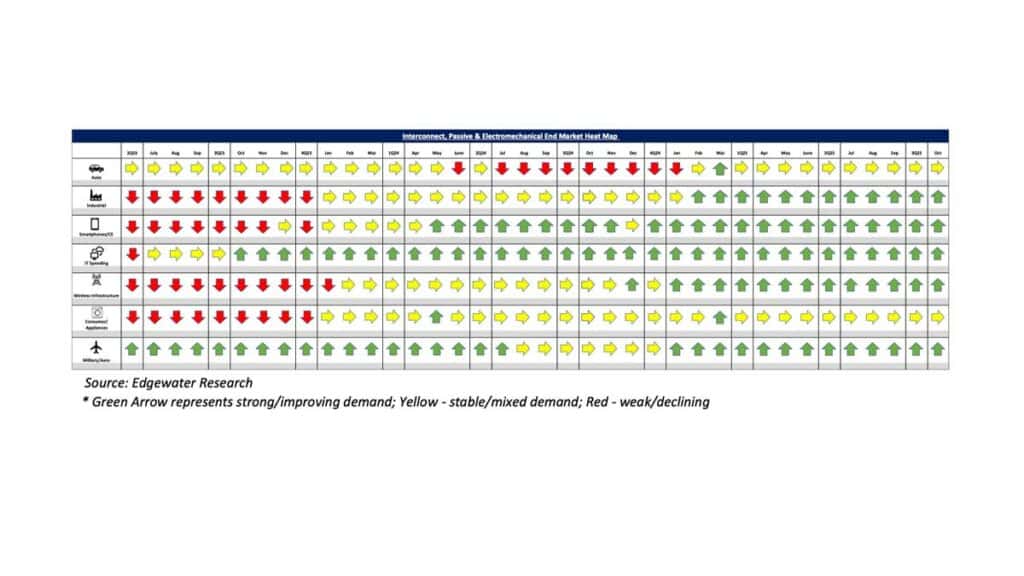

Edgewater researchers report that November AI outlooks is broadly strengthening, Industrial/Auto/Other little changed in late 2025.

This November 2025 collection of news summaries, survey results, and channel market insights, covers Interconnect, Passives, and Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

Aggregate reads have improved, and the 4Q tracking is ahead on the upside potential of AI, military, and aerospace. The seasonal 1Q outlook, excluding AI, is firming on the uptick in October orders.

The demand reads for AI are improving month-over-month, driven by feedback from most customers and programs that have made upward revisions for 2026 and beyond.

Google’s 2026 TPU rack forecasts have been revised higher by over 20% to 60K units, compared to the previous forecast of 48K units. We estimate that the TPU connector TAM will grow by over 60% year-over-year in 2026, driven by a significant increase in rack units and a rise in content tied to the adoption of higher ASP ACCs in the second half of 2026.

The odds of the VR144 backplane reverting to a bi-directional design are increasing due to recent improvements in SerDes technology. While contingencies remain, there is a potential to avoid the double-density design.

The top three channel comments are:

- NVIDIA has recently made progress on the SerDes required for bi-directional connectivity, which would enable it to avoid doubling the cable-backplane density in VR144. The remaining challenges include the readiness of the bi-directional connector and long-reach signal integrity. However, we believe the odds have shifted to approximately 55% in favor of the bi-directional design over the double-density backplanes.

- We anticipate that CPO, NPO, and CPC will all coexist in the near future, as end customers have different requirements. CPO is likely to enable scale across, while the other technologies are likely to be used inside the rack, at least until CPC reaches its limit. We have observed several CPC designs with flyovers recently, which should extend the lifecycle of copper.

- NVIDIA has shared its latest optics outlook, projecting a significant increase in the demand for InP (Indium Phosphide) wafer TAM from 2026 to 2030, reflecting the expected acceleration in optical content across scale-up, scale-out, and scale-across.

Key Takeaways

The demand across markets is stable to improving. The 4Q shipments are expected to track ahead through mid-November, driven by the strength in the AI and Mil/Aero markets. The Ind and Auto trends remain stable to modestly improving, with unevenness by geo/sub-markets.

October orders are expected to step up M/M globally. There are pockets of upside surprise tied to typical seasonality ahead of YE shutdowns in the West and some replenishment demand for early 2026. B2Bs remain noted as above 1x and closer to 1.1x, driven by AI and Mil/Aero, resulting in continued backlog improvement and firming up in expectations for at least seasonal 1Q globally.

By geo, EMEA demand reads appear better M/M with improving order trends following somewhat disappointing September. This is driven by Mil/Aero and Energy, while Ind and Auto recovery trends remain muted. Americas demand trends remain modestly improving, driven by Mil/Aero strength and pockets of channel replenishment, particularly by high service distribution ahead of anticipated January price increases from interconnect suppliers. Asia demand trends remain relatively better, driven by AI and EVs.

2026 forecasts excluding AI are little changed. They project a mid-single digit increase in shipments, consistent with expectations for a continued measured recovery.

Other Takeaways:

- CPC designs are gaining momentum across various programs and customers, validating their market relevance.

- CPC, CPO, and NPO are expected to coexist in the near term. CPC and NPO are favored for scale-up, while CPO is preferred for scale-out and across. Copper is projected to continue its role in these designs.

- To surpass the 448G limit (2028+), AMD might potentially cede its share to optics LT. However, the durability of copper shouldn’t be underestimated.

- AEC TAM predicts robust growth for 2026, with units potentially doubling year-over-year, approaching high single-digit to 10 million across PCIe and Ethernet.

- The market is structurally large enough to support multiple suppliers, and there are no signs of aggressive pricing actions to date.

- Initial optics feedback is also bullish, supported by Nvidia’s projection of a 20-fold increase in market demand by 2030. The supply is noted as tight, particularly in the NT segment.

- The momentum for the 1.6Tb design is strong, with feedback indicating a broader shift in the DSP share towards AVGO at Asian module suppliers.

- There are signs of potential inventory build across Nvidia and AWS supply chains, but feedback remains universal that the dynamic has not resulted in any material changes to orders or robust 2026 expectations.

- The auto reads are stable month-over-month. Asia leads, while the West still lags behind. The Americas mix is expected to shift towards ICE, and Europe’s recovery is not expected until the second half of 2026.

- The industrial reads are mixed, with stable to modest increases projected into 2026. Military and aerospace reads are still constructive, driven by the strengthening outlook for the EMEA region, which is causing some incremental supply tightness for military and aerospace SKUs. Amphenol and TE are expected to push larger than typical low to mid-single-digit January price increases in distribution to offset the inflation in metal costs.

Conclusion

the IP&E fundamentals remain positive and broadly unchanged month-over-month. AI continues to drive sector strength, and there is a more muted but healthy recovery across non-AI end markets. As 2025 winds down, the 2026 outlook appears similar: strong IP&E fundamentals supported by continued robust double-digit AI growth and a mid-single-digit recovery across other markets. We continue to track AI inventory levels and non-AI end-demand signals for indications of additional upside or emerging risk in 2026.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research