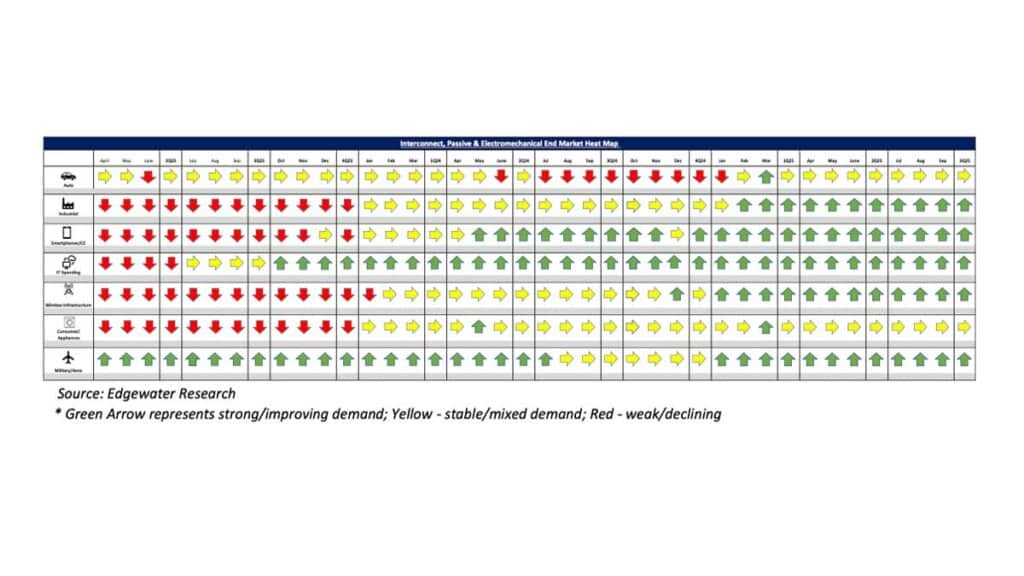

Edgewater researchers report that AI remains robust while CPC extends the copper life cycle, non-AI markets continue on a more muted recovery

This October 2025 collection of news summaries, survey results, and channel market insights, covers Interconnect, Passives, and Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

The demand for copper remains moderately positive, with the third-quarter demand finishing in line with slightly better-than-expected figures. The demand for AI is still robust, with a positive outlook for the third quarter and sustained growth in volumes and content, particularly in interconnect, power, and cooling.

TE has a clear understanding of the situation and expects to ramp up as a second source for Nvidia NVL backplane by March 2026.

Top Three Channel Comments:

- The rule of copper is still valid, as CPC allows users to continue using copper with higher speeds, improved loss insertion, and longer reach. Customers want to continue using copper inside the rack, and CPC enables them to do so. They may find creative ways to use copper for scaling up even for two adjacent racks.

- Eventually, the industry will have to move to CPO for scaling up, which will be driven by the need for higher speeds and lane requirements. However, before that, CPC can serve as an intermediate step, supporting 448G and up to 1000 lanes.

- We continue to see many new design wins with China Auto OEMs. Local suppliers are trying to establish themselves, but most of the competition still comes from global IP and E suppliers. We see significant potential for content growth in China, driven by increasing levels and penetration of ADAS and the need for high-speed cables connecting compute power, cameras, and sensors.

Other Key Takeaways:

- The medium-term AI outlook is better, as CPC and active cables are expected to extend copper’s viability into 448G, delaying the transition to optics or CPO.

- CY25 Nvidia NVL rack shipments are expected to be biased towards the lower end of the previous forecast of 25-27K. Some component shipments are still tracking to 50-55K rack equivalents, creating digestion risk, although the timing remains unclear given the lack of signs of a near-term slowdown.

- The power interconnect content in IT datacom is expected to rise sharply, potentially reaching around $10K per in the next-generation racks.

- The demand for AWS Trainium is mixed. The second half of 2025 is still robust, but the demand in 2026 is volatile due to noise surrounding potential Trn3 adjustments.

- Conservative projections suggest that the rack market will reach approximately 50,000 units by 2026. Amphenol is actively pursuing the acquisition of a second sourcing partner for Trn backplane cables, with the intention of starting this process in the second half of 2025.

- The adoption of AEC standards is expected to accelerate as the industry transitions to a 1.6 Tb/s scale-out architecture. Microsoft, Meta, and Amazon are anticipated to qualify as secondary sources by utilizing Marvel DSPs. Meanwhile, Avago’s participation in the market is expected to increase significantly in 2026.

- The auto market is experiencing stable M/M growth, with Asia leading the way. Europe’s growth is considered more subdued, while North America’s performance is better than anticipated so far this year. However, there are concerns about potential downside revisions in the market.

- China’s automotive market continues to grow, driven by the increasing penetration of ADAS technology, which is contributing to a mid-single-digit component content growth per vehicle.

- Western suppliers are consistently winning new design contracts at a rapid pace, particularly for critical safety applications such as ADAS, with Chinese OEMs playing a significant role in this trend.

- The demand for automotive products in the Americas is improving this year, driven by the positive outlook for electric vehicles (EVs) due to the expiration of credits and the discipline exhibited by OEMs in pricing. However, the outlook for 2026 remains uncertain, with the potential for downside revisions in scaled-back EV incentives and the possibility of OEM tariff pass-through.

- TE is planning to move certain direct automotive customers in the Americas to distribution on customer request to improve their terms of business.

- The industrial market presents mixed readings. Demand in North America is improving, but it varies across different submarkets. Europe’s recovery is considered muted, and it is expected to continue into early 2026.

- The medical and energy markets are experiencing strengthening demand. TE is benefiting from key medical programs and leveraging Richards’ integration to capture datacenter-driven power infrastructure content, while also improving its execution of ADM (Automotive Design Management).

- The inventory levels for IP&E (Infrared, Photonics, and Electronics) are considered normal. However, channel replenishment is seen to be pausing, particularly in Europe. Pricing is generally considered typical, except for interconnect, where select suppliers are passing on another increase in distribution costs. Lead times are stable, except for certain AI-related passives.

Conclusion

the fundamentals of the IP&E segment remain positive as we exit the third quarter of the year. This positive outlook is primarily driven by the strength in the AI market and the steady recovery across non-AI markets. Overall, the segment continues to outperform semiconductors, benefiting from more tangible AI-driven content gains and healthier non-AI inventory.

Levels—supporting earlier recoveries in Industrial, Medical, and other end markets. Although non-AI momentum remains uneven, we remain optimistic about the fundamentals of 2026, barring any significant deterioration in demand due to inflation or tariff-driven cost pass-throughs. Our forecast for mid-single-digit year-over-year growth in 2026 remains unchanged.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research