The ECIA survey results for September 2025 pulse sales sentiment results reveal a persistent and optimistic outlook in the sales industry.

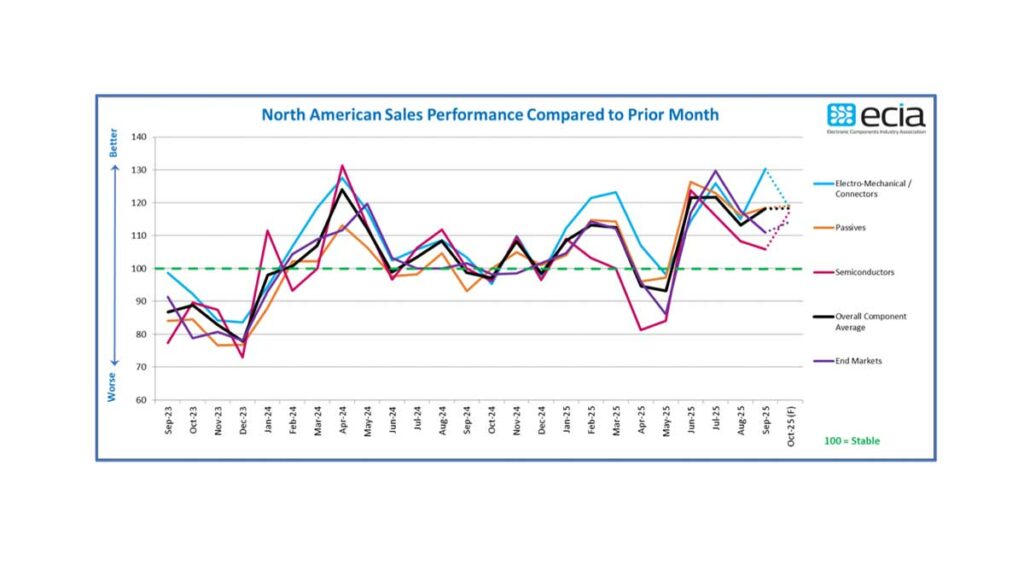

The overall product sales sentiment index improved by 5 points between August and September, reaching 118.2 in the September Industry Pulse survey.

Although the actual survey results fell short of the optimistic forecast in the August survey, the improvement in the index in September and the fourth consecutive month of scores firmly above the threshold of 100 are highly encouraging. The July and August monthly survey results align with the Q3 Industry Pulse survey expectations.

The primary driver of the improvement in the September overall index is the significant jump in the Electro-Mechanical category, which surged from 115.0 to 130.3. The Passives category experienced a slight improvement of 2.2 points, while Semiconductor sentiment declined again, dropping to 105.9 in September. In the October outlook, the index forecast for all three component categories converges around 118.3. Only a narrow margin of 1.5 points separates the Passive index forecast at 119.1 on the high end and Semiconductors at 117.6 on the low end. Achieving this forecast would be a promising start to the fourth quarter sales environment.

The end-market index score diverged from the product index, falling from 117.5 in August to 110.9 in the September measurement. Despite this divergence, the overall strength of the end-market score remains solid, as every category delivers results above 100 in both the September assessment and the October outlook, except for Consumer Electronics. However, Consumer Electronics is anticipated to deliver the strongest performance.

Improvement in the October outlook is evident as it is forecasted to increase by 9.9 points, reaching a new high of 93.8. Other categories experiencing significant forecast improvements in October include Industrial Electronics and Medical Electronics. Surprisingly, the strongest segment, Avionics/Military/Space, is projected to witness a substantial decline of 12.8 points in sales sentiment between September and October.

In recent surveys, ECIA commenced measuring sales sentiment in comparison to the same month in the previous year. The results of this measurement surpass the month-to-month perspective. The year-over-year overall index score for both Electronic Components and End Markets consistently averaged over 140 points between June and September. All three component segments report strong year-over-year sentiment.

Avionics/Military/Space and Industrial Electronics lead the sales sentiment scores in the year-over-year End Market results.

One area of concern is the pattern of exceptionally low sales sentiment reported by Manufacturers starting in July and continuing through the October forecast. The overall average score from Manufacturers between July and October is 17.5 points below the average for all three groups. The scores for Semiconductors and Resistors are particularly negative as reported by Manufacturers. In contrast, Manufacturer Representative index scores have consistently averaged 14.7 points above the average from the three reporting groups between May and October. The negative sentiment expressed by Manufacturers persists throughout the forecast period.

The results for the end-market assessment also show a decline. The October outlook for manufacturers drops to 100 points, which is over 29 points below the average of Manufacturer Representatives and Distributors. This suggests that direct sales may be significantly lower than channel sales for manufacturers in recent months.

Reports of increasing lead times also decreased by an average of 5 percent between August and September as stability returned to the authorized channel.