Source: DigiTimes news

Several passive component companies have pushed back the schedule to install new equipment and facilities for additional production capacities, judging from a number of macro factors creating uncertainty on the demand side, according to industry sources.

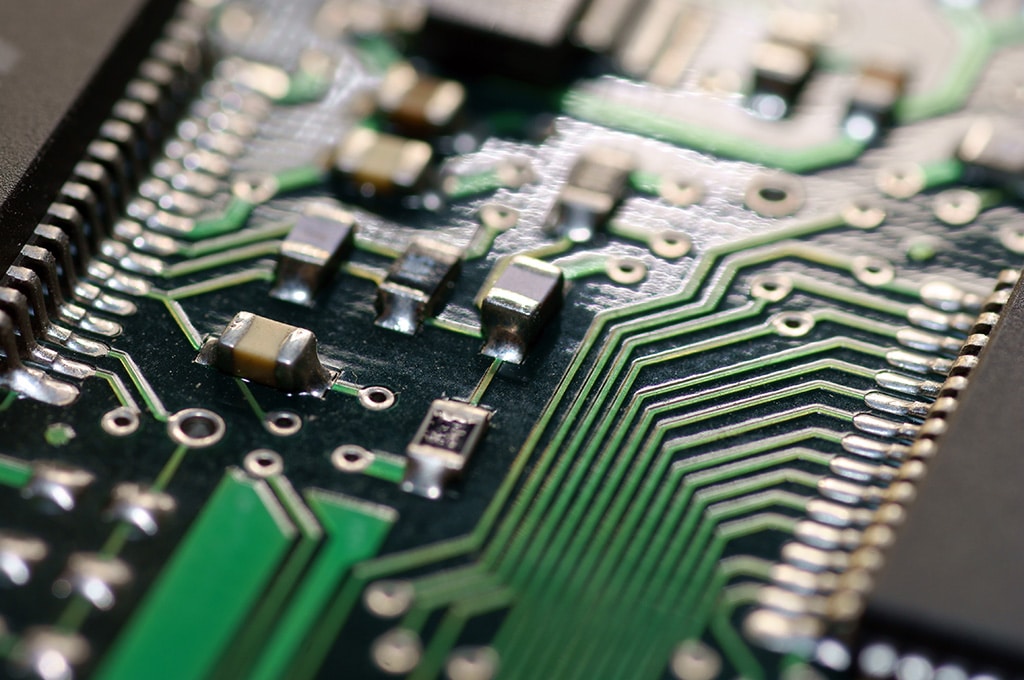

Murata, Samsung Electro-Mechanics, TDK, Yageo and Walsin Technology all have plans to expand production capacities, foreseeing strong demand for passive components will be driven by AI, automotive electronics and 5G device applications.

However, some of them are expected to slow down their expansion pace, said the sources. Walsin, for example, will postpone its new equipment installation schedule by one to two quarters.

China-based passive component makers focusing more on mass-market applications have also moved to scale up their output at a slower-than-expected pace, the sources said.

The global supply of passive components, particularly MLCCs, was tight in 2018 causing the chip prices to rally. The supply shortfall started improving later in the second half of last year, but demand has turned weak dragging down MLCC and other passive component prices since the start of 2019.