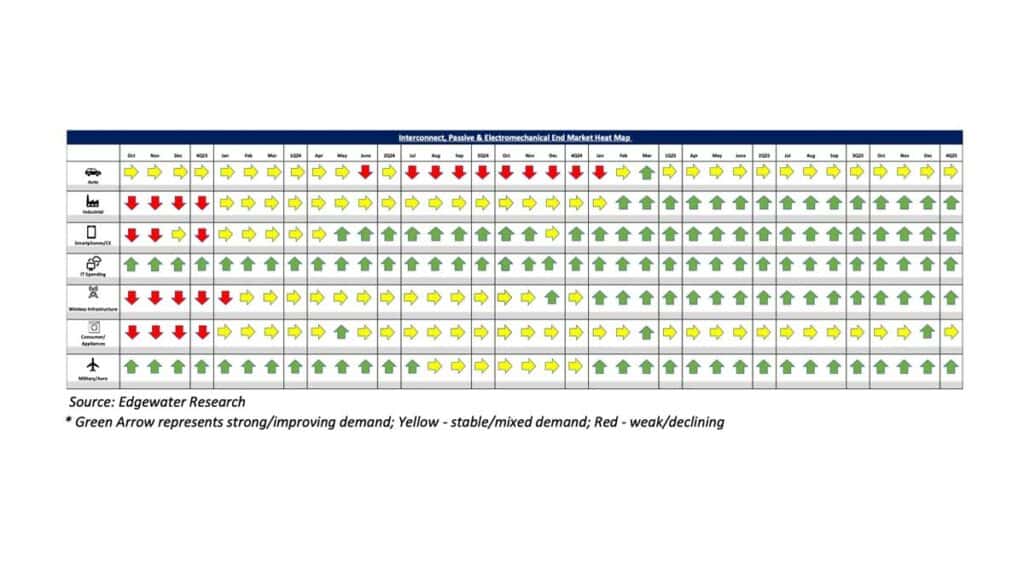

Edgewater researchers report that January 26 AI strength continues; Cyclical markets improving bolstering outlooks in early 2026.

This January 2026 collection of news summaries, survey results, and channel market insights, covers Interconnect, Passives, and Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

Aggregate demand is improving, with the fourth quarter ending ahead of expectations. This is primarily driven by the strength of the AI, Mil/Aero, and industrial sectors, while the auto sector remains relatively stable.

Bookings have been increasing since October and November, with B2B bookings reaching approximately 1.1 times the previous quarter. This has helped extend the backlog coverage and supported a strong first-quarter setup.

The outlook for 2026 is firming up. Some IP&E suppliers are pushing for an average price increase across distribution and direct channels, which is tied to the inflation of metals costs.

The demand forecast for AI continues to rise, with the connector industry projected to see a demand increase of approximately 2 times in the next year, with some projections suggesting a doubling again in the following year.

Top 3 Channel Comments:

- Demand trends have improved since October, and the sentiment from customers and distributors at CES was positive. We have seen a healthy concern from buyers regarding supply assurance, which is a positive sign for suppliers. While buyers are concerned about inflation and component price increases, they seem willing to pay. We are forecasting double-digit growth in sales for 2026.

- Interconnect B2B improved to approximately 1.1 times in the fourth quarter compared to approximately 1.0 times in the previous quarter. This improvement was driven by the strength of bookings, which continued into early January. Our backlog coverage for the first half of 2026 has significantly improved over the past three to four months, and our focus has shifted to filling in the second half of the orderbook. We are optimistic and forecasting sales growth of 10-12% in 2026, including the impact of AI.

- Nvidia and hyperscalers are aiming to flatten the scale-out network from a three-tier structure to a two-tier structure while expanding the scale-up domain.

This shift is expected to begin with VR and extend into Kyber.

Other Key Takeaways:

- Demand improvement appears to be at least partly driven by increased customer focus on supply assurance, given the signs of broader tightening across electronic components. This includes an uptick in IP&E lead times and metal inflation impacting pricing.

- TPU CY26 forecasts are up again to approximately 68–69K racks compared to around 60K in the previous year and less than 40K in CY25. The TPU connector TAM is projected to increase by over 90% in CY26.

- CY26 Nvidia GB connector TAM is projected to be around 60K racks, with an upside potential of approximately 80K. VR volumes are expected to be incremental, with shipments beginning in the third quarter of 2026.

- CY26 Trainium connector TAM is estimated to increase by over 55% year-over-year in terms of rack volume growth, with moderate content uplift linked to the backplane.

- Copper is expected to continue to be a key component in AI NT/MT, particularly in scale-up applications. The active copper/CPC is likely to remain viable until the 448G/lane era.

- The transition to optics is unlikely to be a significant hurdle in the next three years. The CPO volume adoption is expected to potentially occur in 2027 for scale-out applications, while scale-up is likely to occur in 2028 and beyond.

- Auto demand is expected to remain stable after the fourth quarter, with the first-quarter outlook being seasonal. The CY26 production outlook is still relatively flat, with risks from tariffs, the USMCA agreement, and memory issues.

- CY26 Auto connector sales are likely to increase due to the MSD support and pricing.

- Industrial demand is expected to improve moderately, with better visibility. The CY26 demand is projected to increase due to the MSD support. Mil/Aero demand is projected to increase due to the HSD/LDD support.

- Capacitor demand is expected to strengthen due to the AI market, with lead times stretching and factory utilization already high. Resistor and inductor demand is also expected to increase, with lead times remaining stable and supply generally available. Passive B2B demand is expected to strengthen to approximately 1.2 times on average.

Conclusion:

Early 2026 IP&E indicators remain encouraging, following a strengthening in fundamentals towards the end of 2025. Similar to previous months, AI continues to be the primary growth driver for the industry. However, feedback from December and early January suggests that the recovery is gradually broadening across other end markets. B2B ratios have improved heading into 2026 (typically exceeding 1.1x in our work), alongside

Firm backlogs and pricing discipline collectively support a more constructive near-term outlook. Notably, the buyer’s tone appears to be shifting, with procurement behavior moving towards supply sufficiency and securing allocation. This should further reinforce fundamentals. We are also beginning to witness genuine improvement in select industrial pockets (beyond pure restocking), although a significant portion of feedback still characterizes auto and industrial consumption as stable. Overall, data points appear supportive of a more durable recovery trajectory in 2026, although we would like to see broader confirmation in underlying consumption trends.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research