The article written by Dennis M. Zogbi, Paumanok Inc and published by TTI Market Eye discuss impact of Russia-Ukraine war to materials and passive electronic components supply chain.

Tension turned to conflict in eastern Europe in March 2022, causing prices for multilayered ceramic chip capacitor (MLCC) keystone metals to increase accordingly.

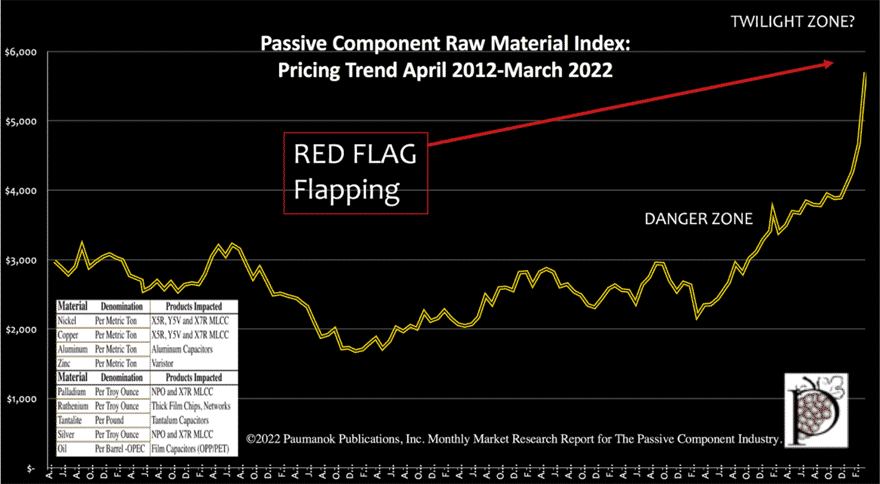

Pricing for nickel and palladium, both MLCC electrode materials, increased sharply, with nickel taken off the London Metal Exchange (LME) due to a one-day, triple-digit price hike, causing the Paumanok Passive Component Raw Material Index to spike to uncharted levels (see figure 1).

The price of palladium also jumped during the month as investors at key choke points in the high-tech supply chain worried about rising ore costs on top of hyperinflation, coupled with fear of continuity of keystone metal supply.

Such materials-related events in the past were ingredients for panic buying of electronic components consumed in handsets, computers, game consoles and automobiles.

We are forecasting the potential disruption of MLCC capacitors, resistors (all types), aluminum capacitors and all ferrite products in the April-December 2022 timeframe. Disruption may come in the form of volatile pricing for nickel, palladium, copper, titanium, aluminum and iron ore, and may result in materials shortages for electrodes, dielectrics and terminations consumed in electronic components.

This also means that these feedstock materials will have intrinsic value as packaged components, thus potentially fueling net-new sources of recycled metal.

A channel check of the mission critical PGM MLCC supply chain revealed that key suppliers of PGM-based MLCC for mil-spec, space, medical, oil and gas and semiconductor manufacturing equipment had palladium – a key choke point – stockpiled for 18 to 24 months of continued operation.

The aluminum supply chain also reacted with a price jump because of the concentration of smelting operations in eastern Europe from RUSAL PLC. The supply of aluminum is important for aluminum capacitors as dielectric anode and cathode foil, but is also keenly important for resistors, produced largely in China. The feedstock material for resistor substrates is 96 percent alumina ceramics and therefore, the perceived value of resistors, the weakest link in the entire high-tech economy, just increased substantially.

Magnetics are most compelling. The target of the war in eastern Europe seems increasingly that it may be the iron ore mines in and around Poltava, which are feedstocks for steel, but also for ferrites. Chinese factories reported a shortage of iron ore for steel on March 28, 2022 and a 4 percent, 1-day price increase. We caution on the entire ferrite-based supply chain (ferrite beads, bead arrays and ferrite cores).

This report shows that aluminum capacitors and plastic film capacitors showed increased demand and tightening in March 2022, while MLCC and tantalum showed signs of weakness due to excess inventories in handset and automotive supply chains. Thin film resistors, based upon nickel, showed tightening, but this supply chain was also affected by the Fukushima quake as was the supply of high voltage anode foil.

Also, mining operations in China are reporting that the resurgence of COVID-19 in China in March is hindering the return to steady production flows of key materials.

Component Market Updates

Capacitor Markets – MLCC and tantalum capacitor lead times declined in March 2022 on a month-to-month basis as excess inventories caused pushback in handset and automotive channels. Aluminum electrolytic and plastic film capacitors, on the other hand, experienced increases in lead times due to raw material problems for feedstocks affected by the EU conflict. Aluminum prices skyrocketed. Also during the month, the supply chain was impacted by the earthquake in Fukushima, impacting a key factory for radial leaded aluminum capacitors and high voltage foils.

Going forward, we expect tightening in MLCCs as keystone materials of nickel, copper, palladium and titanium all increase sharply in price-impacted, variable, raw material costs for these components.

Ceramic Capacitor/MLCC Lead Times – MLCCs are of more concern heading into April 2022 due to the rising tensions in eastern Europe as prices for nickel, copper and palladium, key MLCC electrode materials, have jumped up and can affect the costs to produce and the availability of MLCC (about 85 percent of MLCC units are nickel and 15 percent of units are palladium). The markets dropped off in March due to excess inventories in the MLCC supply chains for handsets and automobiles; those end product markets did not materialize in the holiday buying season due to semiconductor shortages. The markets are expected to tighten in anticipation of rising costs. All keystone materials for MLCC including titanium, nickel, copper and palladium are all choke points now due to the EU conflict.

Aluminum Capacitor Markets – Lead times for aluminum electrolytic capacitors increased sharply in response to fears over supply chain problems stemming from the war in Ukraine. Russia is a major smelter of aluminum. The aluminum electrolytic capacitor ecosystem has been disrupted by rolling blackouts in China, causing problems with formed foil production. Meanwhile, freight problems hamper shipments of finished capacitors as well. Multiple product lines reported a significant increase in demand amidst a tightening supply. Fears in eastern Europe further urged this market into concerned buying and stockpiling.

Tantalum Capacitor Markets – Tantalum capacitor lead times showed signs of weakening from December 2021 through March 2022 as much of the pressure that was on the supply chain to support the global increase in demand for computing devices began to level off. The supply chain for tantalum capacitors continues to be among the most concerning with respect to increases in overall lead times. The parts are largely consumed only in circuits where other capacitors cannot be consumed because of the need for high capacitance, high voltage and small case size. Tantalum is not largely impacted by the conflict in eastern Europe. Tantalum continues to be largely sourced from Congo, Australia and Brazil. As the year progresses we predict more demand and value for tantalum due to its cross reference with MLCC.

Plastic Capacitor Markets – Lead times for plastic film capacitors jumped up in March 2022 on a month-to-month basis and remain elevated. Because of its key use in renewable energy systems – PHEV and EVx propulsion – film capacitors got a boost in the March Quarter of 2022. However, the product line is also an alternative to MLCC, which may come in short supply due to supply chain issues with key materials. Lead times for all types of plastic film capacitors have jumped up because of pandemic-related supply chain issues with polypropylene feedstocks. Also, there is real demand for X&Y capacitors consumed in line voltage (X&Y) circuits, and this market continued to grow in demand. Plastic film capacitors are also exposed to petrochemical feedstocks and crude oil prices, which may increase sharply in the coming months.

Resistor Markets – In March of 2022, resistor market lead times showed mixed results as fears of a European conflict became real on a month-to-month basis. Resistor products exposed to nickel such as thin film chips and axial and radial resistors showed signs of tightening. Thin film chip supply chain was also impacted by the Fukushima earthquake in March 2022.

Thick Film Chip Resistors – Lead times declined sharply in March 2022 in response to excess inventories from the December quarter impacting the supply chain in the handset and automotive supply chain, creating pushback across the case sizes and weakness in net new buying patterns. Thick film chip resistors have exposure to the EU conflict through alumina raw materials. Ruthenium metal price did in fact jump up again in response to the conflict, but not as dramatic a price increase as nickel and copper.

Thin Film Resistors – Markets reacted swiftly to the increased nickel price, with lead times increasing 10 percent to 15 percent at the end of March 2022. The 0402, 0603, 0805 and 1206 chip sizes all showed sharp increases in buying as customers expected price increases in April 2022. The thin film chips were all based upon nickel chromium thin film solutions. Also, the world’s largest vendor of thin film chip resistors has production facilities in the Fukushima region of Japan where an earthquake impacted precision equipment in the region – thin film chip resistors and aluminum capacitors.

Resistor Networks – There was a large increase in lead times and demand for thick film multi-chip resistor arrays and resistor networks beginning in October 2021 and increasing in October, November, December and again in January 2022; however, in February 2022, the markets weakened and began to plummet in March 2022 in response to high parts inventories in handsets and automotive supply chains. The legacy SIP and DIP networks, which consume large volumes of alumina and ruthenium should experience some price increases. DIP and SIP thick film products have shown increased demand since June 2021 through March 2022.

Axial and Radial Leaded Resistors – In March 2022, demand for nichrome film resistors declined slightly but remained at elevated levels. These legacy axial and radial resistors rely on nickel for thick film and thin film industrial solutions and for wirewound solutions. Expect price increases in accordance with rising nickel prices.

Discrete Inductors – In March 2022, discrete inductor demand showed mixed internal product results from the prior month and remained at elevated levels. 5G related handsets and base station infrastructure continue to keep demand elevated. Ferrite beads showed weakness in the month of March, but chip coils showed an increase in demand. Axial and radial inductor markets remained unchanged from over the past 30 days.

Iron ore is a key feedstock material for all ferrites. Disruption of iron ore supply from Ukraine is already upsetting consumption in China as of March 28, 2022.

In March 2022, discrete inductor demand remained unchanged from the prior month and at elevated levels.

Recent consolidation in this supply chain has created increased concern about this supply chain as has its reliance on multiple key metals and titanium based ceramics. Iron ore is a choke point for ferrites and a key export from mines in Ukraine. Key mines around Poltava were the target of advancing Russian forces. These iron ore mines are critical in steel production, but they are also part of the ferrite supply chain.

Overall Passive Market Update

The passive component supply chain – the mass-produced capacitors, resistors and inductors that support semiconductors – are the largest number of units manufactured worldwide for all products.

We expect a continued “open spigot” policy on passive components as it becomes more common knowledge that keystone metals of nickel, palladium, titanium and copper – all EU choke points – will impact MLCC supply chain at multiple points; and aluminum raw materials for aluminum electrolytic capacitors and plastic film capacitors also impacted, as are the substrate materials for all chip and through hole resistors because of their reliance on alumina ceramic substrates and ruthenium metal.

The model shows clear movement toward higher prices due to higher costs of goods sold for the forecasted next two quarters (June 22 and September 22) impacted the overall valuation of the passive components industry (see figure 1 above).

Clear choke points due to the conflict in eastern Europe are converging in MLCC (palladium, nickel, titanium, copper), aluminum (foils for capacitors and substrates for resistors) and ferrites (iron ore). Only the tantalum supply chain has limited exposure to eastern Europe.

We expect two rounds of value increases in the passive component supply chain through the September 2022 quarter. Management will have to choose profitability channels that best suit investors, but competition and panic buying will drive up value substantially. Managing variable costs will become the challenge on a 30-day moving average as channels will react to changes.

ESG compliance could be a factor in triggering eastern European conflicts. Since EVX and Autocat are key carbon emissions champions, and metals and their ore sources in autocratic nations would not comply with the Paris Agreement, a struggle ensued that challenged the DNSH amendment.

There are also reports of many parts going into inventories and not being consumed right away, but serving as a buffer due to unknown freight cycles amidst the pandemic and its strains.

We show pricing for passive components peaking in the December 2021 quarter and then moving down in the March 2022 quarter as inventories build in key sectors, but now, suddenly, faced with choke points due to EU conflict, the price of key materials is skyrocketing. The cost of this war and of ESG compliance will be high, and will be paid for by everyone who buys a phone, computer, TV set, home appliance or automobile.

Raw Materials: PPI Analysis – The raw material price index for passive electronic entered a new level of cost in March 2022, a banner month in the history of monitoring the global supply chain index, eclipsing the $5,500 level, which it has never reached before and is a reflection of the impact of inflation on raw materials and war in Europe as it impacts the 8532 and 8533 HTS Codes. We consider $3,000 the “danger zone” and anything above $4,500 the “twilight zone” as such events signify an impending correction in the market. The market reacted swiftly to the hot war in Ukraine, sending the costs of keystone materials to more than twice the normal level.

MLCC Metals: PPI Analysis – Nickel and palladium supply are controlled by NORNICKEL in Siberia, with 25 percent of the global nickel supply and 50 percent of the global palladium supply under their immediate control. The MLCC supply chain is now on notice. Nickel and palladium are the two primary choices for MLCC electrodes. While 85 percent of MLCC are nickel based 15 percent are palladium based in terms of volume. Copper and nickel have reacted to the increase in tensions and dual embargos. This was always a major risk to the high-tech economy and we expect price increases. Note that palladium and silver have not as of yet reacted to the tensions, so their prices may spike, or there is enough speculation in trading of precious metals that this has already occurred, while nickel and copper, being more industrial in nature, reacted almost immediately.

Other Keystone Metals – The aluminum price was clearly affected by the conflict in eastern Europe, as Russia is a key smelter in the supply chain. The ruthenium price reacted upward as well, as ruthenium is a by-product of platinum mining, which will be impacted by a shortage of palladium. The zinc price also reacted upward. Tantalum however, with limited ties to eastern Europe, showed a slight uptick in price. Still, all keystone materials consumed in passive electronic components reacted to the conflict in Europe by increasing, with aluminum directly affected and also showing increased lead times further up the chain.

Conclusion

The aggressive pursuit of ethics, sustainability and governance as keystone concepts of Industry 4.0, described as the next industrial revolution (the fourth revolution), created conditions ripe for war in eastern Europe.

Russia, Ukraine and Belarus consistently score low points on ESG compliance metrics for their key materials operations in palladium, nickel, iron ore, aluminum, copper and gold. Other countries that join them are the U.S., Chile, Peru, Columbia and Brazil.

Countries that excel at ESG compliance include all of western Europe and Japan, who use palladium autocatalysts to scrub the emissions and nickel and copper in their EVx propulsion sub-assemblies and iron ore for their ferrites/magnets to qualify, but have limited access to the feedstocks to accomplish these ethical actions without the massive mining and smelting operations to sustain these ideals.

The movement toward ESG compliance in Europe has created tremendous disparity between ethics and sustainability, and in the process has created future wealth in specific unmovable assets. Mines for the high-tech economy will become the new battlegrounds. Expect more of these conflict mineral alignments everywhere folks with limited visibility on supply chains are making decisions without thought or simple knowledge of where supply chains begin. If you build planes and don’t know what bauxite is, there will be choke points along the way.