TTI MarketEye published article by Dennis M. Zogbi, Paumanok Inc. that dig into a hot topic of the current supply chain – metals supply chain, availability and price trends.

According to our current estimates, the global value of primary materials consumed as dielectrics, electrodes and terminations in the worldwide fixed passive electronic component industry stands at USD$12 billion in 2021.

Capacitors drive 70 percent of the demand for these materials in passive components, with the remaining 30 percent going to resistors, magnetics, sensors and circuit protection.

Feedstocks for capacitors include metals, ceramics, plastics and carbon – all of which begin in the form of ores or resins and are then transformed into powders, pastes and sheets before being consumed as finished capacitors. These components are used for bypass, decoupling, filtering and burst power circuits in modern electronics.

With trillions of pieces produced each year, materials consumption is moderate in terms of volume, but extremely consistent and profitable for miners and chemicals processing companies.

Technology-Driven Nanomaterials for Components

In an attempt to achieve desired surface area and capacitance, manufacturers use one of three methods: stacking, winding or pressing to maximize passive component functionality for modern portability in electronics. The active surface area of the materials described is created by advanced-engineered raw materials processing which includes primarily milling, etching, and metallizing.

Raw materials impact the overall costs to produce passive electronic components. In fact, dielectric materials, electrode materials and termination materials represent the largest variable cost associated with the production of electronic components. Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins for electronic component producers, but seldom does a component manufacturer (or their customers in OEM and EMS output) have long term visibility on the various sub-levels of the supply chain.

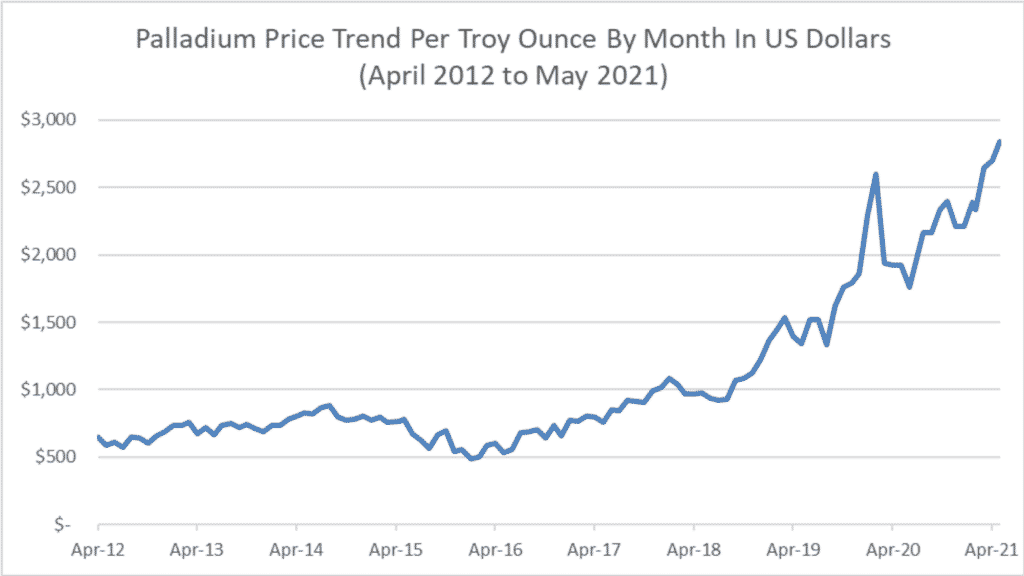

The Palladium Price Trend, 2012-2021

Palladium is a platinum group metal that is mined in Russia and South Africa, among other locations; it is consumed primarily for auto-catalysts, but also in jewelry, and as the primary electrode material in precious-metal-based MLCCs, which are in turn used in high-reliability, high-temperature and high-voltage product markets globally.

Such high feedstock pricing is impacting production costs for many small MLCC manufacturers, and this is the primary motivating factor behind the movement toward alternative electrodes and alternative MLCC designs in many end-markets where they have not been used before, such as fossil fuel engine electronics, defense, space, and oil and gas electronics.

The recent spike in palladium price is alarming from a cost issue, and the continuation of supply has become a concern as key markets compete for the metal.

Ruthenium Skyrockets into Uncharted Territory

Resistors represent a significant volume of worldwide consumption for ruthenium metal, alongside its additional uses as a cracking catalyst, as a hard disk drive coating and as a component in esoteric chemical compounds. Therefore, the metal is very sensitive to any changes in resistor supply and demand in the global high tech economy. The signpost in the current market conditions should not be overlooked by precious metal market analysts.

Ruthenium has experienced a significant price increase, from USD$40 per Troy ounce to as high as USD$850 US dollars a troy ounce, corresponding with shortages of thick film chip resistors.

This price increase has caused customers to seek alternative resistor designs, also based upon thin film nickel. Unfortunately, the economies of scale in manufacturing thin film resistors are but a small fraction of that of thick film chips – one of the largest volume products produced in the world, measured in the trillions of pieces.

As Paumanok Publications, Inc. has pointed out, the thick film chip resistor market is one of the riskiest supply chains in the world. Because of its “rendered nature” and its large-scale reliance upon a rare precious metal that is the by-product of another industry (platinum), it is therefore subject to forces outside of its market control.

The overall price trend for ruthenium between April 2012 and May 2021 has been one of extreme instability and volatility in direct correlation to shortages of chip resistor products (see Figure 2), as reported in April 2021 MarketEYE article on resistor supply.

Nickel: Prime Alternative to Precious Metals

Nickel is the primary electrode material consumed in base metal electrode multilayered ceramic chip capacitors (BME MLCC). The fluctuations in nickel price are primarily the result of competition for the metal with the steel industry, where it is used as a metal hardener.

The supply of nickel is important for the production of X5R, X6S, Y5V and X7R MLCCs, which are the capacitors of choice for the operation of smartphones, computers and home entertainment equipment. The overall price trend for nickel between April 2012 and May 2021 has been remarkably and comparably stable (see Figure 3).

The historical stability of price for nickel is a great selling point for its use in MLCC electrodes to displace palladium/silver (Pd/Ag) designs. The reader should note that it is the rapid shift of materials pricing within existing contracts that has caused the most negative impact on profitability over time.

The most successful passive component manufacturers have a tendency to purchase raw materials when the prices are lowest and consume them when the materials price is at its highest – therefore, in effect, “manufacturing profitability” by converting the added value of the materials when they offer the greatest opportunity for profit from the vendor.

Copper: Nickel’s Passive Helper Metal

Copper engineered powders are consumed in the production of MLCCs as well, but as the termination material consumed in conjunction with the nickel-type electrode. As a base metal must be paired with another base metal in the MLCC design; therefore copper and nickel are an important type of base metal duo.

Copper is used in some MLCC electrode systems because unlike its counterpart, nickel, it is non-magnetic. The overall price trend for copper between April 2012 and April 2020 was historically stable; however, from May 2020 to May 2021 the price of copper skyrocketed to historic highs. This is because of its use as a conductor, specifically as a next-generation enabling metal for infrastructure and electric drives.

The price fluctuation of copper in 2021 should be of keen interest to researchers of high-capacitance MLCC operations as competition for copper between industries will drive up future MLCC termination costs. Due to the fact that base metal type MLCC are produced in the trillions of pieces and the termination pastes have high volumes of metal per MLCC body; the volume of copper consumption in MLCC is significant, and continues to grow over time in concert with MLCC demand.

Tantalum: No Stranger to Danger

Paumanok Publications, Inc., estimates that the primary raw materials consumed in the production of tantalum capacitors are capacitor grade tantalum metal powder and wire, which is engineered from high-purity tantalum ores and concentrates. Tantalum, a rare metal, represents a significant portion of the variable production costs for tantalum-type capacitors.

The tantalum ore used in the production of tantalum capacitors comes from Central Africa. Other known tantalite resources are located in Australia, Brazil and Canada. Tantalite’s primary use is as capacitor-grade tantalum metal powder for consumption in capacitor anodes. It is almost always mined in conjunction with other metals. Tantalum ore mining is most profitable when the parts per million of the producing mine is very high, and when the ore can be separated easily and cost-effectively from the other minerals it is mined with (through magnetic or gravity separation).

Tantalum ore is sold to intermediate producers of capacitor-grade tantalum metal powder and wire, who chemically separate the pure tantalum from the various other elements mined in conjunction with the metal. Capacitor-grade tantalum powder is produced by limiting the impurities (such as oxygen, potassium and nitrogen) in the mixture so that a high degree of purity is inherent in the final product.

The outlook for tantalum materials is positive because this special metal overlaps in its capacitance values with high-cap BME MLCCs, which are ripe for growth based simply on their known performance characteristics, their ultra-small case size and solid performance in digital electronics.

Tantalum capacitors are consumed in communications networking equipment, smartphones, automotive systems, medical devices and defense electronics. The overall price trend for tantalum ore between April 2012 and May 2021 has been down to stable, with prices plunging in 2019 to challenge recent five-year lows (see Figure 5). Tantalum ore materials show recent price fluctuations that correspond with increased consumption of tantalum capacitors to offset shortages of BME MLCC and for its use (as polymer tantalum) in battery electric vehicle propulsion systems.

Aluminum Foils for Electrolytic Capacitors

Aluminum capacitors require a variety of raw materials in their construction, including etched anode foil, etched cathode foil, separator paper and electrolytes. However, these raw materials have comparably lower pricing than most alternative dielectric materials on a pound-for-pound basis.

Etched anode foils represent the most expensive component involved in aluminum capacitor construction, followed closely by etched cathode foils. This fact explains why most of the larger aluminum capacitor manufacturers have in-house capabilities to produce their own etched anode and cathode foils, which ultimately helps the capacitor manufacturer to control costs.

Rolls of etched anode and cathode foil are rolled together with specialty paper, separating the two metal foils. The paper is soaked in the electrolyte, and the entire cell is placed in an aluminum can with lead wires attached and gaskets placed atop the can.

Aluminum comes from alumina, also known as bauxite; this material is also used as the primary substrate material for almost all thick film chip resistors, and in many axial and radial leaded resistors as well.

Aluminum remains in abundant supply and its price, while subject to variations, remains relatively stable over time. Aluminum consumption should remain at a steady state of growth as more of it is used in automotive bodies of the future.

Aluminum electrolytic capacitors are important components consumed in power supplies, television sets, computers and power electronics, including renewable energy systems. The overall price trend for aluminum between April 2012 and May 2021 has been stable; prices spiked in 2019, 2020 and 2021 due to trade tensions between the U.S. and China, but those prices have also quickly returned to normalcy (see Figure 6).

Summary and Materials Markets Outlook

The price of ruthenium is a serious concern, having gone from $44 per Troy ounce to $850 per Troy ounce in such a short time. This continues to place pressure on the resistor supply chain.

Palladium prices are also concerning and show new highs that will impact the costs to produce specialty MLCCs (high voltage, high frequency and high temperature).

Copper is also causing some concerns on price. The price of copper also can have an impact on the mass-produced BME MLCC markets worldwide.

Nickel, tantalum and aluminum prices are all trending upward in 2021, but certainly have been steady in price during the past decade in comparison to precious metals.

Join PCNS Passive Components Networking Symposium 7-10th September 2021 to attend Dennis Zogbi’s presentation Paumanok Market Seminar: Passive Components; Global Market Outlook with monthly updates of key data metrics for 2021