The ECIA survey results for October 2025 reports strong sales sentiment in October but weakens outlook for November according to industry pulse.

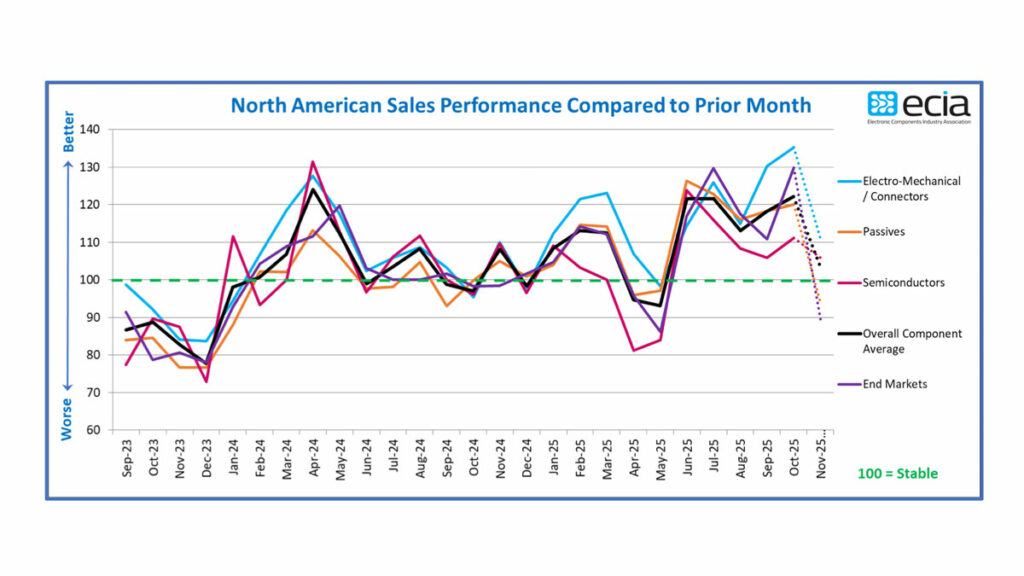

The October Industry Pulse survey results indicate that overall sales sentiment remained strong in October, with an index average of 122.2, a 4-point increase from September.

However, the sentiment for November plummeted by 18.7 points, dropping to 103.5.

While a slowdown in month-to-month sales growth expectations as the year ends is expected, the sharp decline in the index average is surprising. The decline in sales sentiment for Passive Components was particularly striking, with the index dropping by 26.3 points to 93.8.

Inductors and Capacitors were the main culprits in the decline in Passive Component sales sentiment for November. Fortunately, the Electro-Mechanical Components and Semiconductor survey results for November showed above-100-point expected sales growth.

The drop in sales sentiment for Electro-Mechanical components was as steep as for Passives, but the stronger October sentiment resulted in an index score above 100 for November despite the 24.5-point drop. Semiconductors, the most stable component category in the survey, saw a 5.2-point increase between September and October. However, the November outlook erased this improvement, with Semiconductor sentiment dropping back to the September level of 105.9. The Industry Pulse predicts a market slowdown as we approach the end of 2025.

The end-market index results for October and November are remarkable. The index surged by nearly 19 points between September and October, only to plummet like Icarus, flying too close to the sun. The November score plummeted by 40 points to 89.4. While all eight individual end-market segments achieved sales sentiment scores of 100 or above in October, only four managed to maintain sentiment above 100 in the November projections. Automotive and Medical Electronics suffered the most significant setbacks in the November forecast.

Since the April survey, ECIA has been measuring sales sentiment compared to the same month in the previous year. From this perspective, both product and end-market sentiment have shown impressive strength compared to the previous year throughout the survey period from April to October. Every segment has demonstrated exceptionally strong sales sentiment improvement year-over-year.

For several months, the Industry Pulse survey results for product lead times have reflected remarkable stability, with almost no reports of increasing or decreasing lead times. However, this stability was abruptly disrupted by the reported lead time trends for October. Reports of increasing lead times for Semiconductors jumped from 7% in September to 40% in October. There were no reports of decreasing lead times for Semiconductors in October. Passives also experienced a significant increase in lead times between September and October, with the number of survey participants reporting increases rising from 14% to 31%. Electro-Mechanical Components lead time reports remained relatively stable at around 16%. The lead time results for October align with the strong sales sentiment observed throughout October. It is possible that the decline in sales sentiment in November may also alleviate pressure on lead times.