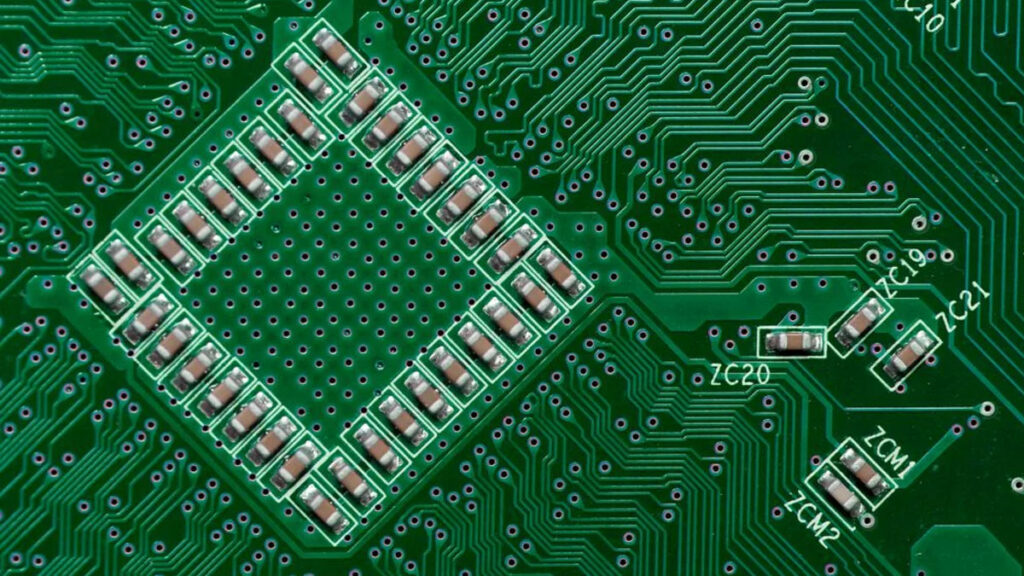

As AI technology continues to permeate various industries, the demand for AI servers is seeing steady growth. With Nvidia’s Blackwell GB200 set to begin mass production, a surge in demand for high-capacitance multilayer ceramic capacitors (MLCCs) is anticipated.

Leading passive component manufacturer Yageo has highlighted that the growing demand for AI servers is driving up production capacity utilization according to DigiTimes.

2Q24 AI demand surge

Industry insiders report that Yageo’s second-quarter performance met expectations, surpassing revenue projections. The increased momentum in orders from standard product distributors in Greater China, much of it driven by AI applications, contributed to this success.

The demand for AI servers, as well as for notebooks, PCs, and even mobile phones, remained strong in the second quarter. Looking ahead to the third quarter, Yageo expects a low single-digit growth in revenue, with margins and operating profit rates likely to improve further.

Over the past few years, the passive components supply chain benefited from heightened demand for ICT products during the pandemic. However, in the post-pandemic era, the global economy has been weighed down by war and inflation, leading to an inventory glut among major electronics manufacturers.

With inventories now returning to healthier levels, Yageo Chairman Pierre Chen expressed optimism about the future, noting that AI demand, unlike consumer products, lacks significant seasonal fluctuations and is expected to continue growing. The company’s capacity utilization is expected to see a significant boost in the third quarter.

The emerging passive component industry

According to reports, Murata Manufacturing Co has seen growing demand for MLCCs related to servers, with AI servers requiring five to ten times the amount of these components compared to traditional servers. Taiwanese manufacturers, including Foxconn and Quanta, who are part of Nvidia’s supply chain, are also key clients of Yageo.

Moreover, PSA Group previously noted that Taiwanese companies like Delta Electronics and Liteon, which are integrated into Nvidia’s GB200 supply chain, are expected to see solid growth in both automotive and AI server applications in the coming years. The gross margins for AI-related businesses are projected to reach 50-60%, with a significant expansion anticipated by 2025.

Industry experts point out that in the AI server market, Nvidia dominates with nearly 90% market share in AI chips, while AMD holds only about 8%. Including all AI chips used in AI servers, such as GPUs, ASICs, and FPGAs, Nvidia’s market share is expected to reach around 64% in 2024.

In June 2024, PSA Group reported that its finished product inventory had fallen to less than two months. Supply chain sources indicated that with the peak mobile phone season approaching, PSA’s third-quarter growth trajectory remains positive.

The ongoing US-China tech conflict continues to create uncertainty for global economic growth, affecting consumer electronics industry projections, where demand remains tepid. As a result, growth drivers in the passive component industry are gradually shifting from consumer electronics to emerging applications.

The AI boom is expected to boost the value of Taiwan’s passive component industry in 2024, with industry players optimistic about challenging 2022 levels and projecting the AI effect to grow year by year.

Source: DigiTimes