Sales sentiment for electronics components seems to be mired in the doldrums with October sentiment as measured by the Electronics Components Sales Trend survey (ECST) struggling to remain essentially neutral at 97.1 compared to September.

While the November outlook calls for a small bump of 3.5 points to 100.6, to borrow a phrase from a song, “the thrill is gone.” Many of the conversations at ECIA’s recent Executive Conference expressed opinions very much in line with the results of the latest survey and perhaps even more glum. There is no indicator of improved expectations looking through the end of 2024 and beginning 2025.

In a bit of a surprise, the Electro-Mechanical/Connector segment continues to see a continued slide every month since its peak at 127.6 in April. This segment has typically delivered the strongest performance compared to other segments, but it has now dropped substantially below Passives and

Semiconductors.

The average score reported for Electro-Mechanical/Connectors for October is 95.3 and the outlook calls for a continued decline to 91.6 in November. Passive components saw a bump of 6.8 points up to 99.9 in the October results with continued expectations of improvement to 102.6 in November.

Semiconductors suffered a decline of 3.8 points to 96.2 in October. However, survey participants in this segment are ever the optimists and project and improvement to 107.7 in November. Unfortunately, their expectations have been dashed fairly regularly in recent actual survey results. The industry continues to face the dual challenge of resolving stubborn inventory issues along with responding to weak demand in almost all end markets.

The index score for the overall end-market for electronic components remains in neutral territory as it dipped below 101.6 in September down to 98.3 in October. The most encouraging results were delivered by the Computer, Medical, and Mobile Phone segments with strong improvements in their

scores that boosted them to 100 and above in the index. Industrial Electronics and Avionics/Military/Aerospace suffered substantial drops in their scores but still managed to maintain an overall score above 100 in October.

There is little to cheer about in the November outlook for end markets as almost all segments project a decline in their score and only Computers and

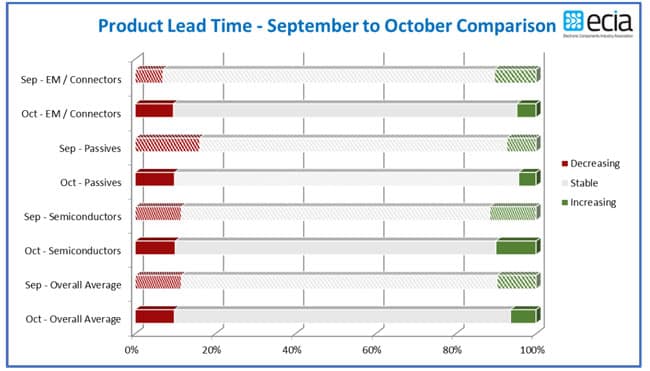

Avionics/Military/Aerospace forecast to reach 100 or above in the index. Lead time stability continues to dominate in the supply chain in the October results.