OSAKA, Japan-Panasonic Corporation announced that it will transfer the semiconductor business mainly operated by Panasonic Semiconductor Solutions Co., Ltd., which is a 100% consolidated subsidiary company of Panasonic Equity Management Japan G.K. a 100% consolidated subsidiary company of the Company, to Nuvoton Technology Corporation, a Taiwan-based semiconductor company under the umbrella of Winbond Electronics Corporation group, and enter into the Stock and Asset Transfer Agreement with this company.

After 67 years Matsushita/Panasonic is quitting the chip industry. Between 1985 and 1990 the company was a top ten player. Now it is to be sold to Nuvoton Technology of Taiwan which is 61% owned by Winbond. Nuvoton is paying $250 million for the unit which designs power-management chips and sensors for smartphones, cars and security cameras. For its FY ending in March, Panasonic Semiconductor made a loss of $215 million on sales of $840 million. Earlier this year, in May, Panasonic sold its discretes business – which makes diodes and transistors – to Rohm. In 2015 the company put its SoC design business into a join venture with Fujitsu called Socionext.

Background and Purpose

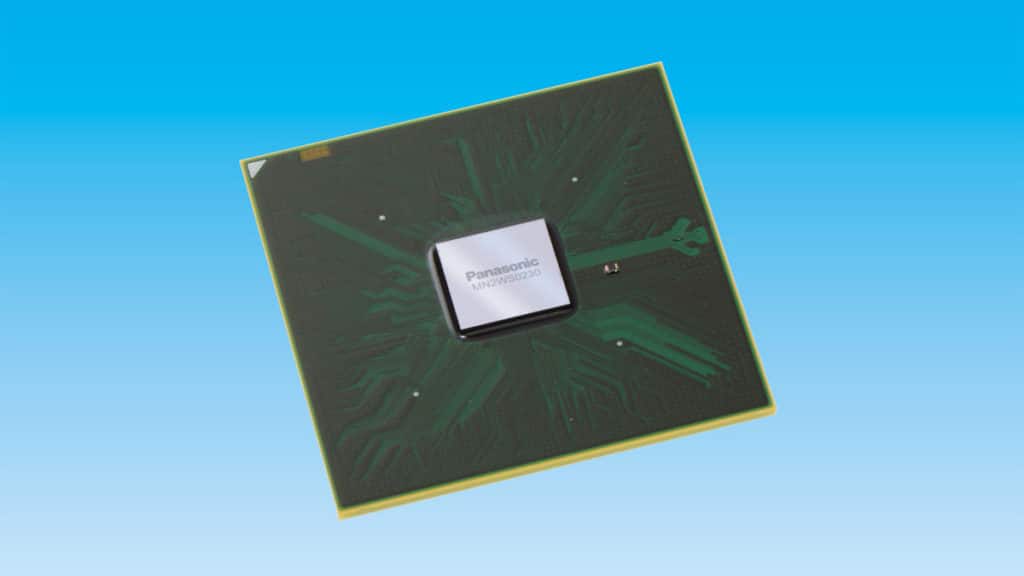

The semiconductor business of the company has shifted from the AV area to the automotive and industrial area over the last few years. The Company has positioned the “Sensing” technologies such as image sensors, and the “LiB Application” technologies such as IC for battery management and MOSFET for LiB battery circuits protection as the focus areas, and the Company has aimed to grow its business by consolidating resources in these areas.

In the meantime, in April 2014, the Company transferred the semiconductor wafer production process of the Hokuriku Plants (Uozu, Tonami, Arai) to the joint venture company formed with Tower Semiconductor Ltd., an Israel based foundry company. Furthermore, in June 2014, the Company transferred its semiconductor assembly plants in Singapore, Indonesia and Malaysia to UTAC Manufacturing Services Ltd. having its headquarter in Hong Kong.

The Company has been strengthening its competitiveness by becoming an asset light company, consolidating and eliminating its offices and production bases in both Japan and overseas for the mitigation of business risks. However, the competitive environment surrounding the semiconductor business has become extremely severe due to aggressive expansion of competitors, huge investments in the focused area, and industry reorganization through M&A.

In such an environment, the Company has come to believe that the even stronger business operation and the continuous investment is critical in order to achieve a sustained growth and expansion of the semiconductor business. Accordingly, it has concluded that the best option would be to transfer the business to Nuvoton, which highly appreciates the Company’s accumulated technical and product capabilities and therefore has a potential to lead stable growth by leveraging those capabilities.