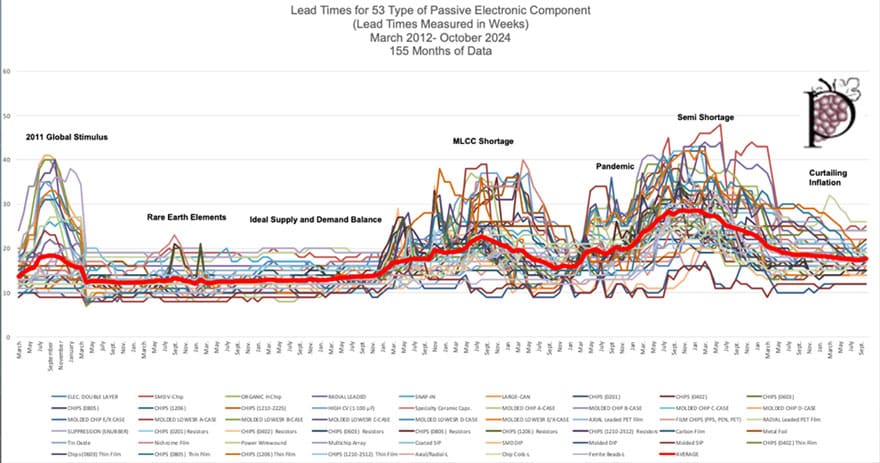

This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides an overview of year to date overview of lead time trends in passive electronic components – capacitors, resistors, inductors through October 2024.

Year-To-Date Market Report Highlights for Capacitors, Resistors and Inductors

- Capacitor, resistor and inductor lead times remained at comparably low levels compared to prior years, through October 2024.

- Declines in specific product groupings suggest weakness in portable electronics.

- Major positive market activity was noted in AI chipset decoupling and inductance.

- Minor positive activity in assisted driving for all vehicles and EVx propulsion.

- Prices for ruthenium increased sharply in October. This metal is consumed in thick film chip resistors. The ruthenium to TFC is a traditional economic indicator of renewed chip demand.

- We expect global improvement in the second half of the 2025 fiscal year.

- We forecast double digit growth for MLCCs and single digit growth for tantalum, aluminum, plastic film capacitors as well as thick film resistors and ferrite beads and chip coils and ferrite cores.

Capacitors

Capacitor lead times and demand declined sharply in July 2022. Weakness was noted in MLCCs, tantalum and plastic film, while aluminum electrolytic capacitors remained somewhat turbulent due to salient issues with materials supply, but a clear correction in the global capacitor markets for July 2022 (See Figure 1).

MLCCs

Ceramic capacitor markets showed continued signs of weakening in October 2024, but the markets continue to outperform other parts we cover in this report and the outlook for FY 2025 remains extremely positive for MLCCs in AI chipset decoupling and EVx propulsion. We forecast that MLCC revenues will increase to support recovering industries in FY 2025 and strong market performance for MLCCs in U.S. dollars for FY 2025, outpacing all other dielectrics.

Aluminum Capacitors

The aluminum electrolytic capacitor data suggest an increase in demand from electric vehicle propulsion – a net new market for aluminum capacitors and infrastructure, which impacted the sales of large can, snap-mount and polymer configurations. The market remains elevated. Directionally, the markets have been trending downward due to higher interest rates impacting many end-markets. Aluminum electrolytic capacitors for applications in EVx propulsion systems are impacting the V-chip and H-chip markets in October 2024.

Tantalum Capacitors

The tantalum electrolytic capacitor data suggest an increase in demand from AI chipsets for decoupling, SSD for storage and electric vehicle propulsion – a net new market for tantalum capacitors. Directionally, the markets have been trending downward due to higher interest rates impacting many end-consumer, end-product markets in handsets, tablets and cameras. Tantalum chip capacitors in both manganese and polymer configurations showed increased market activity in October 2024 after months of challenging headwinds. We noted increased demand for the “C” case size chip (EIA case measured in inches) in October 2024.

Plastic Film Capacitors

Lead times for plastic film capacitors are key use in renewable energy systems, PHEV and EVx propulsion, and demand has been elevated for some time. However, there was stagnancy in all product lines over the past three months.

This chart is a visual interpretation of the collective data for 44 types and configurations of capacitor monitored by Paumanok IMR and shows that the global capacitor markets have displayed stable lead times over the past 15 months, following years of turmoil marked by parts and materials disruption.

Resistors

In October 2023, resistor lead times levelled off, which is a key economic indicator because of the ubiquitous nature of thick and thin film chip resistors in the high-tech supply chain. The supply chain is extremely sensitive and the shift in demand, even slightly, is encouraging because it reflects the positive impact of actual demand from infrastructure and EVx propulsion.

Thick Film Chip Resistors

Thick film chip resistor lead times have stabilized in October 2024. The thick film resistor is ubiquitous in the high-tech economy and its technical signature is a key economic indicator for demand. The quantitative tightening in financial markets has resulted in an overall slowdown in demand. Thick film chips are an excellent indicator of the global high-tech economy. As previously stated, we noted a spike in the ruthenium price in October 2024 that has been an historical indictor of demand from the thick film resistor markets worldwide.

Thin Film Resistors

The market for thin film resistors began to stabilize in October 2024 following its sharp decline in demand due to global financial restrictions. The market had seen a relaxation in demand, but that soon showed an about face and demand has continued to grow again, stimulated by the vertical market needs to distance itself from choke point metals.

Resistor Networks

This product line was impacted in October 2024 by rising variable cost structure based upon alumina substrate, ruthenium content and large physical case sizes requiring large amounts of raw materials per unit. The reader should note that these resistor networks can be constructed and consumed at high voltage and are critical components for key electrical systems, especially for propulsion and defense electronics.

Axial and Radial Leaded Resistors

Demand for axial and radial leaded resistors, especially those consumed in mission critical applications, stabilized in October 2024 but remained slightly elevated after seeing increases in demand over the past 15 months.

This chart is a visual interpretation of the collective data for 14 types and configurations of resistor monitored by Paumanok IMR and shows the overall market weakening over the past 15 months as inventories crowded the supply chain in handsets and other portable electronics. Meanwhile, in October 2024 Paumanok noted a spike in the price of ruthenium, a key metal consumed in mass produced thick film chip resistors.

Inductors

Discrete Inductors

Discrete inductor demand showed steep declines due to slowdowns in consumption from the wireless handset business. However, like resistors, the magnetics markets are sensitive and there is a slight increase in parts for infrastructure and Evx propulsion, offset by lack of demand from portable electronics. We see increased demand in October 2024 for magnetic chip coils (SMD chip inductors) for applications in AI chip set decoupling and for electric vehicle propulsion.

This chart is a visual interpretation of the collective data for 3 types and configurations of discrete inductor monitored by Paumanok IMR and shows the overall market improvements over the past 15 months.

Strong Dollar

In October 2024, the currency exchange rates for the yen, won and NT dollar weakened as the U.S. dollar strengthened in value quite noticeably for the first time since 2018. The spike in yen, won and NT dollar has been noticed in the global financial press and will impact revenue forecasts for FY 2025.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Yen | 107 | 110 | 106 | 110 | 132 | 139 | 151 |

| Won | 1080 | 1165 | 1183 | 1149 | 1299 | 1308 | 1356 |

| NTS | 29 | 31 | 29 | 28 | 30 | 32 | 32 |